As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q2. Today we are looking at the semiconductors stocks, starting with Western Digital (NASDAQ:WDC).

This article was originally published on Stock Story

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.27%, while on average next quarter revenue guidance was 2.45% under consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021 and while some of the semiconductors stocks have fared somewhat better than others, they have not been spared, with share prices declining 8.06% since the previous earnings results, on average.

Western Digital (NASDAQ:WDC)

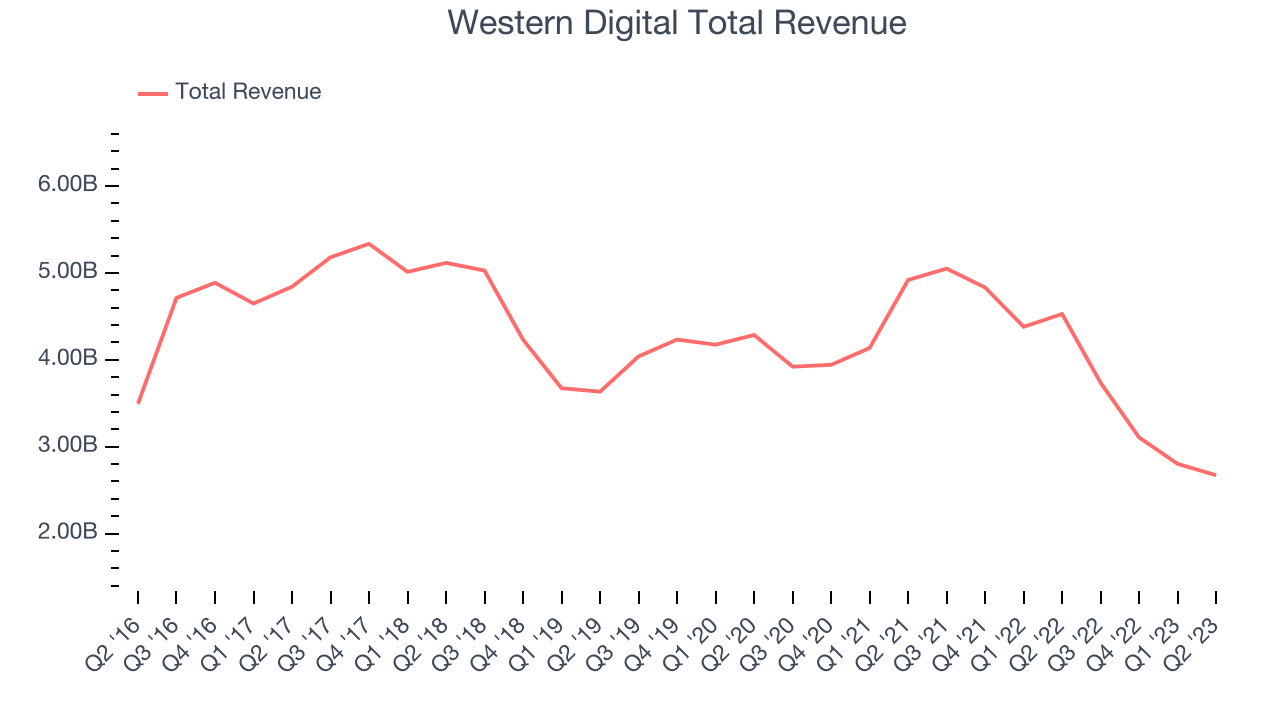

Founded in 1970 by a Motorola (NYSE:MSI) employee, Western Digital is a leading producer of hard disk drives, SSDs and flash memory.

Western Digital reported revenues of $2.67 billion, down 41% year on year, beating analyst expectations by 5.97%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

“Throughout the fiscal fourth quarter and fiscal year, Western Digital continued to optimize our operations and successfully execute our innovative product roadmap, priming ourselves for greater profitability when demand rebounds across hard drives and flash. As a result of these efforts, we delivered revenue above our expectation and delivered a range of industry-leading products to our customers,” said David Goeckeler, Western Digital CEO.

The stock is up 8.36% since the results and currently trades at $46.13.

Best Q2: Nvidia (NASDAQ:NVDA)

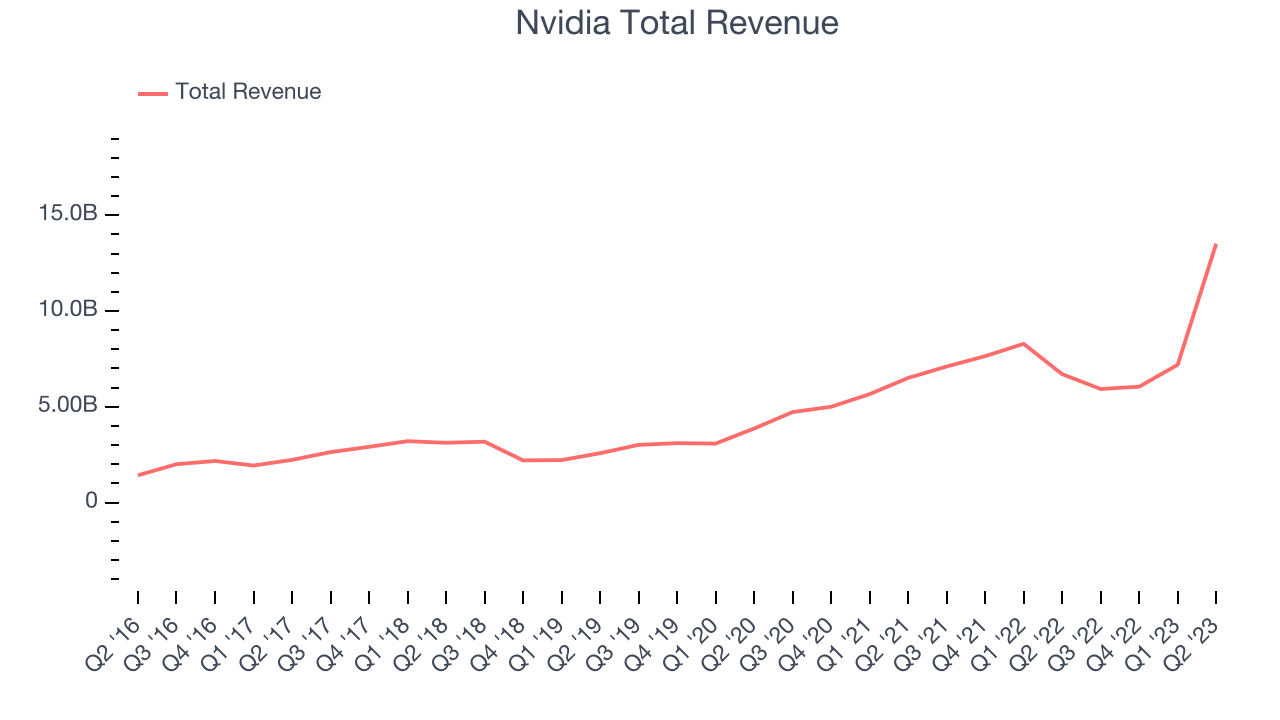

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $13.5 billion, up 101% year on year, beating analyst expectations by 21.9%. It was an incredible quarter for the company, with beats across nearly every key metric. Nvidia's revenue guidance for the next quarter also blew past analysts' expectations.

Nvidia achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is down 1.42% since the results and currently trades at $464.53.

Weakest Q2: IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of most of its products, IPG Photonics is a provider of high-performance fiber lasers that are used for cutting, welding and processing raw materials.

IPG Photonics (NASDAQ:IPGP) reported revenues of $340 million, down 9.83% year on year, missing analyst expectations by 1.79%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

The stock is down 29% since the results and currently trades at $93.41.

Magnachip (NYSE:MX)

With its technology found in common consumer electronics such as TVs and smartphones, MagnaChip Semiconductor (NYSE:MX) is a provider of analog and mixed-signal semiconductors.

Magnachip reported revenues of $61 million, down 39.8% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a significant improvement in its gross margin but underwhelming revenue guidance for the next quarter.

The stock is down 11.8% since the results and currently trades at $8.05.

Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology (NASDAQ:STX) reported revenues of $1.6 billion, down 39% year on year, missing analyst expectations by 5.01%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

The stock is up 19.4% since the results and currently trades at $69.22.