PayPal (NASDAQ:PYPL)'s Q2 2024 results signal a significant turnaround, marked by an 8% year-over-year revenue growth and an 11% rise in total payment volume (TPV), showcasing strong user engagement and expanding market share. As we head into Q3, PayPal's ability to sustain this momentum in transaction volume, margin improvement, and user activity will be critical for a continued recovery. With new product initiatives rolling out and a strategic focus on optimizing Branded Checkout and Venmo, PayPal is well-positioned for another quarter of robust revenue growth and enhanced profitability.

Strong Revenue Growth, Boosted Margins, and Signs of a Long-Term TurnaroundPayPal's Q2 2024 results suggest that its financial performance has finally turned a corner, with wholesome revenue growth fueled by improved operational efficiency. The financial services firm reported an 8% year-over-year rise in net revenues to $7.9 billion on a currency-neutral basis, while TPV jumped 11% to $416.8 billion.

Notably, transaction margin dollars have surged by 8% to $3.6 billion, the best performance since 2021. This shows that the company is well on its way to successfully monetizing its transaction volume with its efforts to optimize transaction loss performance and reduce expenses.

Meanwhile, Braintree and Branded Checkout have significantly contributed to the growth of transaction margin. The company also said its GAAP operating income had increased 17%, while non-GAAP operating income leaped 24%. This serves to show, in fact, that PayPal has been averaging out the cost and augmenting efficiency. Also, a 126-bps expansion of its GAAP operating margin to 16.8% and its non-GAAP operating margin by 231 bps to 18.5% suggests that the underlying operational structure will be more profitable.

The quarter's standout moment was PayPal's profitability, with GAAP EPS growing by 17% to $1.08 and non-GAAP EPS jumping by 36% to $1.19. From a cash flow perspective, the company has generated $1.5 billion from operations, with free cash amounting to $1.4 billion, underscoring its robust cash-generative capability. Additionally, the adjusted free cash flow for PayPal was $1.1 billion, excluding the net timing impact from European BNPL consumer receivables and their subsequent sale.

These offset a meager 0.4% decline in active accounts to 429 million, while engagement on PayPal remains high. Payment transactions per active account grew 11% to 60.9, indicating increased user activity and loyalty toward the ecosystem that PayPal provides. Moreover, the volume growth for the company's Branded Checkout and Venmo's TPV is a testament to the strengthening product adoption and increasing user engagement.

Lastly, new initiatives like push provisioning of the Venmo debit cards also join growing monthly active accounts, which indicates that strategic moves by PayPal seem to spur a forward trend and may point toward a possible long-term turnaround for the company.

Steady Growth in Transactions and User Engagement Amid Competitive PressuresIn Q2 2024, PayPal demonstrated resilience in its operational performance, achieving steady growth across key metrics. Active accounts remained relatively stable at 429 million, a slight 0.4% increase sequentially. While YoY growth was flat, this stabilization was driven by a decrease in churn and growth in both merchant and consumer accounts. More importantly, monthly active accounts (MAA) increased by 3% YoY to 222 million, largely propelled by the engagement on Venmo and PayPal consumer accounts.

The total number of payment transactions grew by 8% YoY to 6.58 billion, signaling increased user activity within PayPal's ecosystem. This surge was further reflected in the 11% YoY growth in transactions per active account (TPA), now at 60.9, underscoring enhanced engagement. Excluding unbranded card processing (PSP), TPA also saw a 6% YoY growth, highlighting improved transaction growth in branded checkout and Venmo.

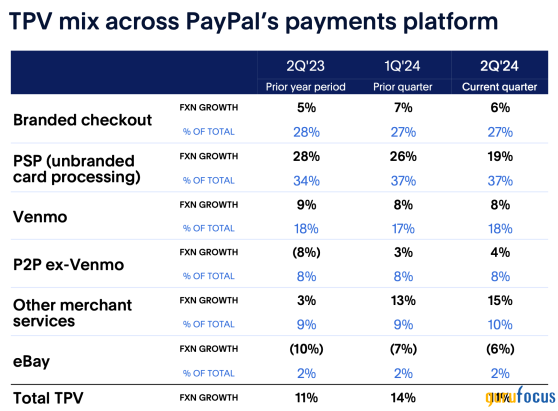

A breakdown of PayPal's TPV mix reveals that Branded Checkout TPV grew 6%, supported by PayPal's focus on large enterprises and international markets. Venmo's TPV showed consistent growth, rising 8% YoY, coupled with a 5% increase in monthly active accounts, indicating ongoing traction in peer-to-peer transactions and product adoption. Meanwhile, the TPV of other merchant services accelerated, primarily driven by the success of Hyperwallet payouts.

However, PSP TPV decelerated from 28% in Q2 2023 to 19% in Q2 2024, aligning with PayPal's price-to-value strategy and improving Braintree's contribution to overall margin growth. Despite a decline in eBay (NASDAQ:EBAY)'s TPV, total TPV growth remained at a healthy 11%, reflecting PayPal's diversified revenue streams and expanding ecosystem. This balanced operational performance signals PayPal's ongoing efforts to strengthen its platform amidst competitive pressures.

Source: PayPal Q2 Presentation

Undervalued Shares Signal a Potential Buy Opportunity with a Margin of SafetyValuation metrics for PayPal provide a compelling opportunity with a margin of safety. The forward P/E is 16, significantly below the 10-year median of 46, indicating a consistent undervaluation. Similarly, the TTM P/E is 19, a substantial decrease from a high over the past 10 years of 108, suggesting a stable and conservative investor sentiment in a post-pandemic world. Historically, the company has traded at a premium due to its strong growth prospects, but with revenue growth now slowing to 8% YoY, this elevated P/E ratio signals market expectations that may be difficult to meet. This could serve as a warning sign, suggesting the stock might be vulnerable if future growth fails to meet investor expectations.

Other valuation measures indicate that the TTM EV/EBITDA of 11 is significantly below its 10-year median of 26, suggesting that it is undervalued per its historical EBITDA performance. Moreover, TTM P/S stands at 2.68, which is at the lower end of its historical range, with a 10-year low of 1.94, indicating that the stock is undervalued on a sales basis.

Finally, analyst sentiment is cautiously optimistic, with an average price target of $81.45, slightly above current trading levels for the stock. These stable analyst ratings support a case for a value investor buy opportunity and a promising potential for profit with a margin of safety in PayPal's market price today, instilling a sense of hope into potential investors.

Navigating Fintech Competition and Uncertain Turnaround for Future GrowthPayPal continues to face intense competition in the fintech space. Established players like Apple (NASDAQ:AAPL) Pay, Visa (NYSE:NYSE:V) Checkout, Mastercard's (NYSE:NYSE:MA) Masterpass, American Express's (NYSE:NYSE:AXP) Later Pay, and digital services from Meta (NASDAQ:META) and Google (NASDAQ:GOOGL) are pressuring PayPal's growth. With customers now having multiple in-store payment options, PayPal must compete on both convenience and pricing. PayPal also has to be agile to meet the customer needs that are increasingly shifting towards mobile phone-based payments. These pressures on the market have capped PayPal's ability to grow its user base and expand transaction volumes.

According to the engineer Tom Haylock, a key risk to PayPal's outlook is the uncertainty around its current management's turnaround strategy. This uncertainty has led some banks and research agencies to be cautious, affecting investor confidence. Although market sentiment toward PayPal has improved recently, continued above-consensus EPS growth is essential to justify higher valuation multiples. Without consistently exceeding market expectations, PayPal's upside potential could remain limited, resulting in its valuation staying below optimistic scenarios. Lastly, inconsistency in free cash flow generation and regulatory challenges add to the risk profile, requiring careful consideration for long-term investors.

Company Cautiously Optimistic While Analysts Eye Bigger GainsPayPal's guidance for 2024 differs from analyst estimates, leading to some conflicting signals. PayPal raised its FY 2024 GAAP EPS guidance to $3.88 to $3.98, reflecting its confidence in strategic initiatives and operational strengthan increase from the prior estimate of $3.65, signaling optimism about future performance.

However, analysts are even more bullish, projecting a higher EPS of $4.45. for 2024. Looking ahead, analysts also expect an EPS recovery starting in 2025. Overall, the consensus reflects optimism for PayPal's mid-to-long-term outlook.

Source: Yahoo Finance

TakeawayLooking ahead to Q3, the focus will be on sustaining transaction growth, enhancing product offerings like Venmo and Branded Checkout, and navigating competitive pressures to solidify its recovery and drive future profitability.

This content was originally published on Gurufocus.com