An introduction to rare-earth elements

Rare-earth elements (REE) are a group of 17 chemical elements known for their conductive and magnetic properties. They are cerium, dysprosium, erbium, europium, gadolinium, holmium, lanthanum, lutetium, neodymium, praseodymium, promethium, samarium, scandium, terbium, thulium, ytterbium and yttrium.

The elemental forms of rare earths are iron-grey and silvery lustrous metals that are generally soft, malleable, ductile and typically reactive, especially at elevated temperatures or when finely divided for use in a wide variety of applications. These have atypical fluorescent, conductive and magnetic properties, making them extremely useful when alloyed or mixed in small quantities with common metals like iron.

They are called “rare earths” because it used to be difficult to technologically extract them from their oxide forms. Deposits of these metals can be found around the world. Some of them are found in abundance in the Earth’s crust, just like copper or tin. Still, they are not found in very high concentrations and are mostly found mixed together with each other or with radioactive elements such as uranium and thorium. Their chemical properties make it challenging to separate them from surrounding materials or from each other. These features also make them difficult to purify. Current production methods require significant amounts of ore and generate a lot of harmful waste just to extract a small quantity of REE. Waste from the processing methods includes toxic fluorine, radioactive water and acids.

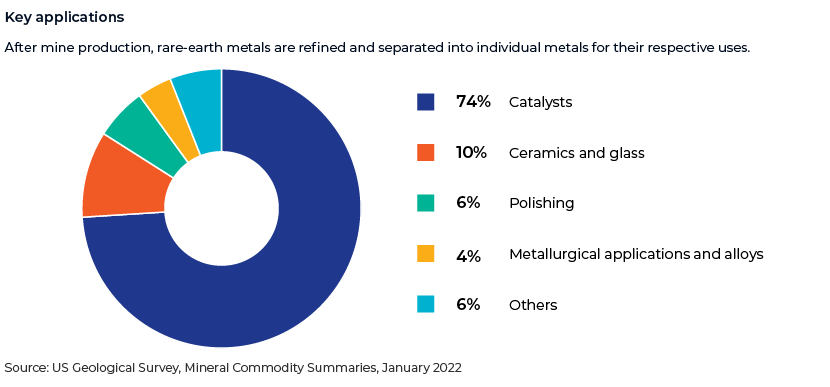

REE are critical components for 200+ products and applications, including but not limited to the following:

Computer hard drives, smartphones, hybrid and electric vehicles (EVs), wind turbines, solar panels and flat-screen monitors and televisions

Key defence applications such as electronic displays, lasers, guidance systems and radar and sonar systems

Several of these metals are critical for the energy sector – oil refining, nuclear power and wind turbines

These REE are basic to commonly used technologies such as LED lights, smartphones and hybrid cars – sectors worth trillions of dollars.

Current market scenario

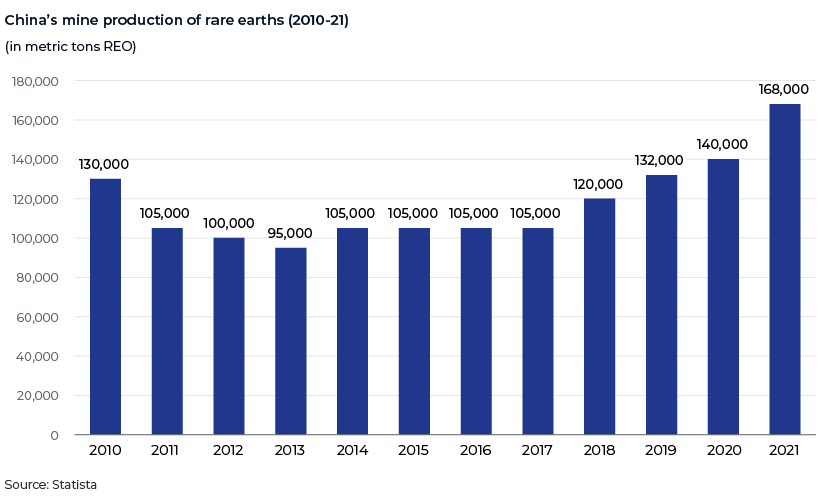

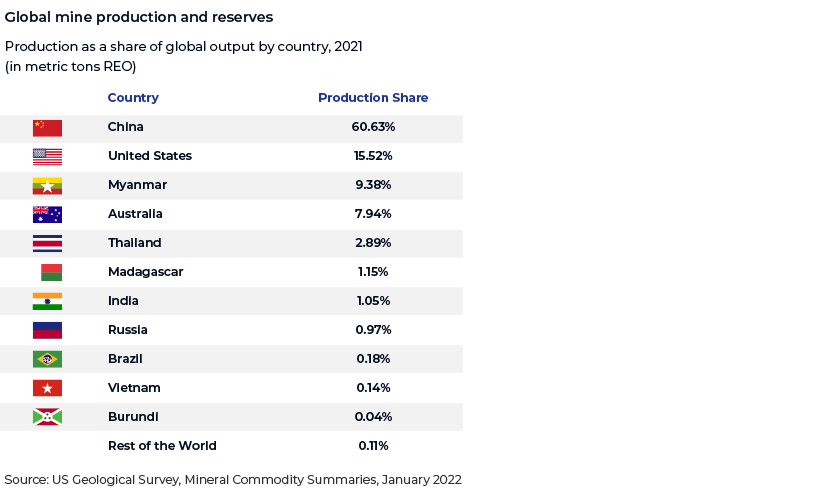

China has always flourished in the REE market, since it has the highest resource concentration in the world. In 2019, it held a c.90% share of global REE production, leading to supply concerns among global economies. China’s market power has resulted in a very competitive global supply chain. As a result, Australia, India, Japan and the US (the Quad countries) amped up production to reduce China’s market share to 60% in 2021.

There are at best 11 major mines and 7 preeminent processing plants worldwide currently; 6 of these are in China, 1 in Malaysia and a small-scale plant in Estonia. New mines and processing plants are currently under development in Australia, Norway, Canada, South Africa, the US and some African countries.

China’s dominance

The REE mine with the world’s largest deposits is the Bayan Obo deposit in Inner Mongolia, north of China; it contains 40m tons of rare-earth reserves.

https://www.statista.com/statistics/1294380/rare-earths-mine-production-in-china/

In December 2021, China established a rare-earths behemoth by merging three major producers to bolster its control of the global REE sector that it has controlled for decades.

The merger comprised government-owned entities – China Minmetals Corp., Aluminum Corp. of China and Ganzhou Rare Earth Group Co. – and formed a new organisation – China Rare Earth Group Co. Ltd – to accelerate the development of mines in the south of China. China Rare Earth Group is expected to account for c.62% of heavy rare-earth supplies nationally, 52,719 metric tons of mining quota (31% of China’s national total) and 47,129 metric tons of smelting quota (29% of the national total).

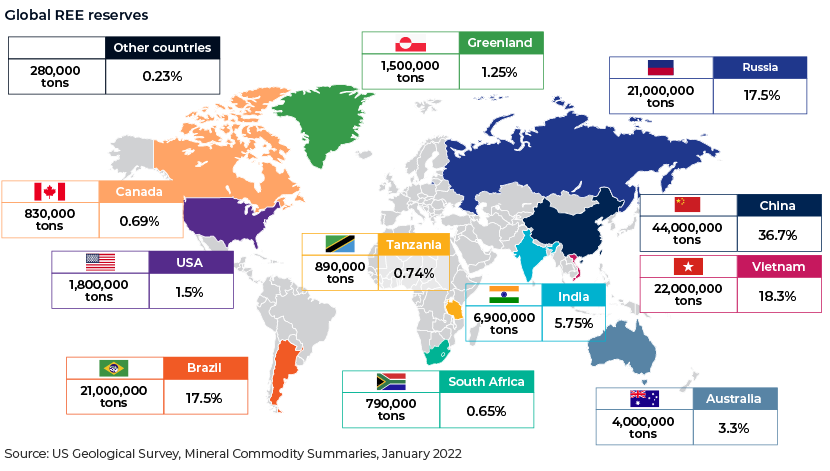

China has the largest reserves and is the largest mine producer of REE. The US has just 1.5% of REE reserves and depends heavily on China for refined rare earths.

Vietnam and Brazil have the second- and third-largest reserves in the world, respectively, but their mine production is among the lowest, each producing just c.1,000 tons every year.

Alternative materials could be used for the different applications, but they are generally less effective.

Heavy rare earths are often more difficult to source. These are metals such as dysprosium and terbium that are essential for defence applications, technology and EVs. Neodymium and praseodymium are two of the most suitable light REE critical for products such as turbines, motors and medical devices. Demand for these metals has spiked due to growth in technology and is expected to increase further due to the competitive EV market.

The Quad countries have formed a rare-earth procurement chain to reduce China’s supply to makers of smartphones, high-performance motors and EV batteries.

Strategies devised by the Quad nations

India holds the world’s fifth-largest reserves of REE, almost twice that of Australia’s, but still imports most of its rare-earth requirements in finished form from China

Exploration in India is regulated by the Bureau of Mines and the Department of Atomic Energy

Indian government corporation IREL (India) Limited (IREL) has the monopoly over monazite beach sand – the key mineral that contains REE and is found in coastal states

IREL produces rare-earth oxides through low-cost, low-reward upstream processes and sells these to global companies that extract the metals and manufacture final products through high-cost, high-reward downstream processes

IREL’s primary focus is on supplying thorium (extracted from monazite) to the Department of Atomic Energy

In 2019, the US imported 80% of its rare-earth requirements from China

President Joe Biden signed an executive order in February 2021 to review gaps in the domestic supply chain of rare earths, medical devices, chips and other key resources

In March 2021, the Department of Energy announced a USD30m initiative to tap into the US’s domestic supply chain for rare earths and other battery-making minerals like cobalt and lithium

Australia is the fourth-largest producer of rare earths

Prime Minister Scott Morrison announced USD360m in funding to counter China’s dominance

Projects to be funded include a rare-earth separation plant, a battery material refinery and a vanadium processing plant in Western Australia

Japan’s rare-earth procurement is managed by Japan Oil, Gas and Metals National Corporation (JOGMEC), a state-owned company governed by the Ministry of Economy, Trade and Industry

Japan is further set to increase funding for the exploration and mining of rare earths. One important aspect is lifting the current 50% cap on state funding for resource exploration projects, to ease the private sector’s financial burden from intrinsically high-risk mining projects

Conclusion

Companies such as Lynas Rare Earths (Australia), Energy Fuels (US) and MP Materials (US) are keen to boost the domestic supply chain, but extracting rare earths remains an arduous process, restricted because of environmental, technical and political factors. Countries other than China have vast rare-earth resources but lack the necessary expertise, unlike China, for processing and producing rare-earth metals.

Rare-earth producers have seen their share prices at all-time highs in 2022. Increasing demand due to the energy transition and strategic concerns intensified by Russia’s invasion of Ukraine have prompted investors to target this crucial sector. Western economies should cooperate to boost the REE supply chain, failing which China would maintain dominance.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.