In a surprising turn of events, the real estate sector witnessed an unexpected bullish trend this week. A major contributing factor to this outcome appears to have been Fed Chair Jerome Powell’s speech following the latest policy-setting meeting. The Federal Reserve held steady on rates, keeping the federal funds' target rate at 5.25% to 5.5% - a decision that has instilled new hope among investors. The fact that the central bank has elected to maintain its benchmark interest rate for the second consecutive time suggests it may remain unchanged in the forthcoming months.

Standing at their highest point in 22 years, a semblance of concern surrounding this interest rate level still looms over financial markets. Yet surprisingly enough, the aggressive hawkish policy from the Fed has been unable to rattle the US Economy. Since late Q1 2022, interest rates have risen 11 times under Powell's watch. However, the S&P500 benchmark index has shrugged off this threat thus far, with gains of 13.51% year-to-date.

That said, not all S&P sectors have weathered these rate hikes as well. The poor performance of real estate this year - a sector critically linked to interest rates due to its dependence on borrowed money for operations - stands testament to this fact. Despite a significant rebound over the first week of November (+8.55%), the sector emerged battered and bruised with a year-to-date performance of -5.27%.

Investors hope that the start of November will confirm a shift in paradigm in the wake of Powell’s dovish comments and job growth slowing down more than expected in October. The US economy added 150,000 jobs over the past month, falling short of the economists’ forecasts and paving the way for a soft landing.

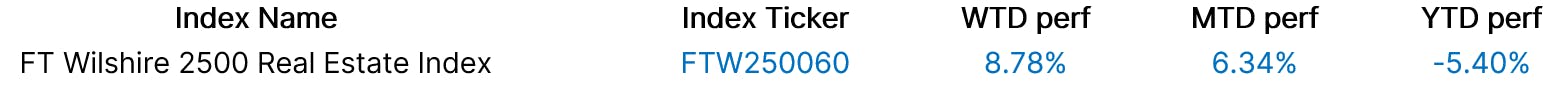

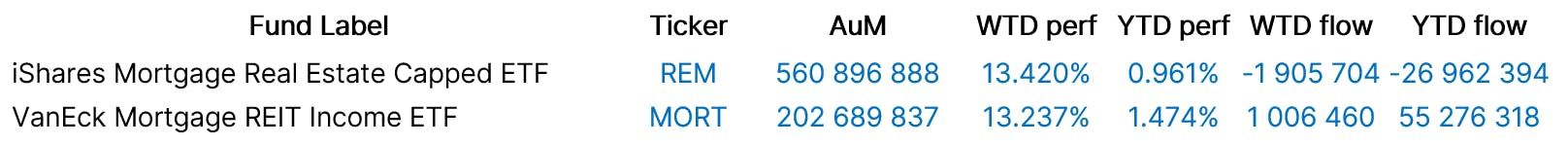

As if on cue with these numbers and capitalizing on this newfound momentum were behemoth entities iShares Mortgage Real Estate Capped ETF (REM), boasting an impressive weekly performance jump by 13.42%, and VanEck Mortgage REIT Income ETF (MORT) posting returns of 13.24%. Meanwhile, the FT Wilshire 2500 Real Estate Index (FTW250060) gained +8.78% over the week.

Group Data: Real Estate ETFs

Index Data

Funds Specific Data: REM, MORT

This content was originally published by our partners at ETF Central.