Despite the tumultuous impact of rate hikes in 2023, the real estate sector resurged - enabled by the ongoing retreat of Treasury yields – to end the week as one of the best performers with a gain of 4.64%, and demonstrating a positive year-to-date performance of 2.39%.

The consistent upbeat weekly performances through November have been creating a flutter in the market, raising speculation of a potential recovery for this hard-hit domain.

Dragged down initially by interest rate hikes, resilient underlying fundamentals have been instrumental in helping the sector claw back losses and land in positive territory. Underpinning this resurgence is September's steady home price growth in the U.S., which saw an upward revision from 5.8% to 6.1% year on year according to data from the Federal Housing Finance Agency.

This points to compelling evidence of an upswing within the housing market, which in turn is giving momentum to the broader real estate sector. And with Treasury yields also noting a downtrend - the U.S. 10-year yield falling by 44 basis points to 4.22% - it's not unreasonable to anticipate a possible turnaround for troubled sectors such as Real Estate given such accommodative conditions.

Still, it's important to put things in context. And there's no overlooking that its performance substantially trails the S&P 500 benchmark index by about 17.27% YTD. Recovery might well be on the horizon but bridging the performance gap will be a tall order and most critically hinge on continued positive trends both within and outside its ecosystem.

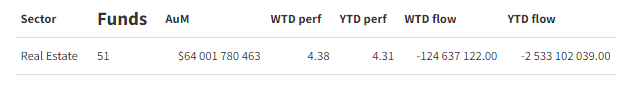

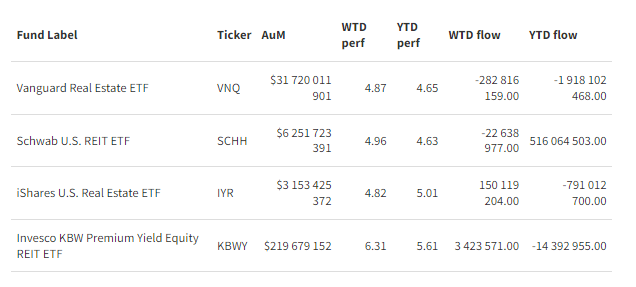

Group Data