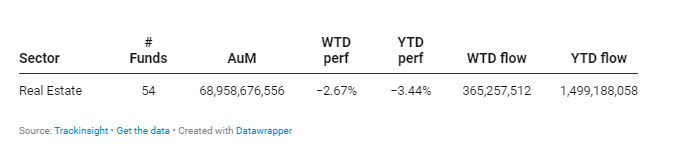

Following a week in which the U.S. 10-year Treasury yield rose sharply from 4.08% to 4.31%, marking a notable increase of 22 basis points, driven by inflation rates surpassing expectations. This financial movement predominantly impacts sectors sensitive to interest rate adjustments, such as real estate. The S&P Real Estate sector was down 3.12% for the week – worst performer within the S&P 500 index. Real Estate ETFs felt the brunt, losing 2.67% week-over-week.

Treasury Yields' Surge and Inflation Data

The inflation narrative was amplified with the Producer Price Index. Data released earlier Thursday showed that headline PPI inflation rose 0.6% month-on-month in February, twice the expected increase. Persistent inflation could provide a stronger reason for the Federal Reserve to maintain higher interest rates for an extended period - a trend that might put pressure on the stock markets in the short term.

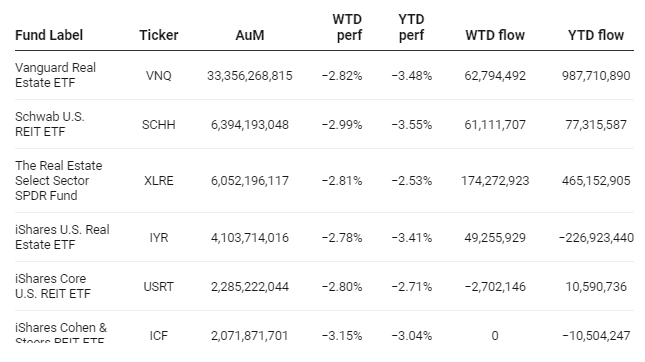

Real Estate ETFs Under Pressure

The noteworthy rise in interest rates led to a downturn in Real Estate ETF performance. For instance, the Vanguard Real Estate ETF (VNQ), boasting assets under management (AUM) of $33 billion, saw a decline of 2.82% over the week. Similarly, the Schwab U.S. REIT ETF (SCHH) was not spared, experiencing a 2.99% loss.

A Chilling Trend in Property Values

The real estate market is not just wrestling with fluctuating ETF valuations. A profound shift in property values across major U.S. cities paints a gloomy picture: significant depreciation stemming from the pandemic-induced adoption of hybrid and remote work models has left urban centers deserted, contributing to declining property values.

Case in point, transactions from San Francisco to Washington showcase properties selling at dramatic discounts compared to their values from just a few years ago, signaling a distressing trend for commercial real estate investors and municipal budgets alike. Such markdowns underline the broader economic implications of changing work habits and the resulting dip in commercial property valuations.

Group Data:

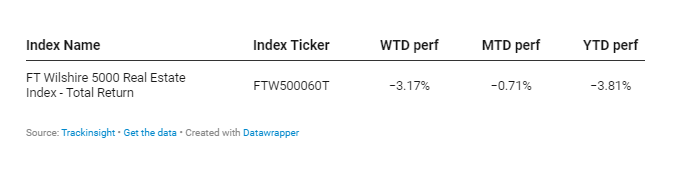

Index Data: