With the first rate cut on the horizon, investors are increasingly looking toward sectors that could benefit the most from lower interest rates. Real estate investment trusts are a prime example as their operations are typically heavily leveraged and highly dependent on the current cost of money. In this analysis, we will examine Realty Income Corp. (NYSE:O), a company so renowned for its monthly dividends that it has trademarked its nickname The Monthly Dividend Company. I believe the stock presents an attractive buying opportunity.

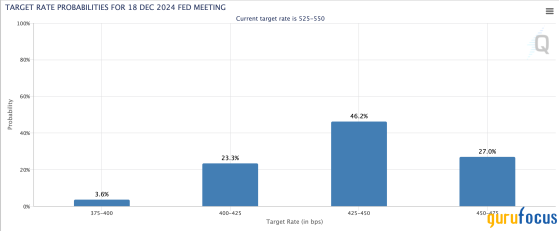

Why lower rates will benefit REITsTo combat stubborn inflation, the Federal Reserve has maintained interest rates at their highest level since the burst of the dot-com bubble. However, after the economy began showing cracks late last week, recession fears spiked and officials are now expected to cut rates by up to 125 basis points by the end of the year.

Let's explore how lower interest rates will benefit REITs, focusing on two main factors: the cost of borrowing and the relative attractiveness of dividend stocks.

First, lower interest rates will decrease the cost of borrowing, which is highly beneficial for companies operating with high leverage, such as REITs. With reduced interest rates, REITs can borrow more money to expand their operations. Realty Income, for instance, invests at an approximate 8% cash yield, while its weighted average cost of capital is around 6.50%, according to its second-quarter earnings report. Lower interest rates should lower its cost of capital, enabling the company to pursue more acquisition opportunities, such as its recent acquisition of Spirit Realty Capital.

Second, as rates decrease, bond yields fall, making dividend stocks relatively more attractive compared to fixed-income securities. The current 10-year U.S. Treasury rate is at 3.96%, over 1% below Realty Income's dividend yield of 5.21%. As rates decline, the demand for dividend stocks among income investors is likely to increase due to their negative correlation with interest rates.

Breaking down the businessRealty Income operates under a triple-net lease model, where tenants are responsible for all taxes, fees and maintenance costs in addition to rent. Although its tenants include a wide variety of retailers, its portfolio primarily focuses on small, inflation-resistant retail stores, such as grocery stores, convenience stores, dollar stores and drugstores.

In addition to renting properties to small stores, Realty Income is actively pursuing accretive acquisitions, orchestrating sale-leaseback transactions with its tenants and expanding into other business areas, as evidenced by its investment in the Bellagio in Las Vegas last year.

Realty Income's tenants are generally non-cyclical, and the triple-net lease model further protects the company from property expenses. Its successful re-leasing activity demonstrates skilled management of underperforming tenants. Overall, the beauty of the business lies in the simplicity and reliability of the triple-net lease REIT model.

Crown jewel: A massive real estate portfolioRealty Income owns a massive and attractive portfolio of real estate, consisting of over 15,450 properties across the U.S., U.K. and six European countries. These properties are leased to over 1,500 tenants in more than 90 industries. This diversified portfolio offers unique safety, as no single tenant can pose a significant risk to the company.

The company manages this portfolio well, maintaining an occupancy rate of 98.80% and achieving same-store rent growth of approximately 1.50% per annum. This growth is made possible by rent escalators built into its leases, which typically increase by 1.50% to 3% annually or are pegged to the consumer price index.

The portfolio focuses on inflation-resistant retailers, which constitute 79.80% of the properties. Another 14.70% consists of industrial real estate, with other types of properties, including a large stake in The Bellagio, making up the remaining percentage.

Realty Income's largest tenant groups include grocery stores, convenience stores, dollar stores, home improvement stores and drugstores. This mix enhances the portfolio's resilience during economic downturns as these tenants typically perform well under various economic conditions.

Additionally, the portfolio is well insulated from economic shifts in the short term with a weighted average lease term of 9.60 years.

Portfolio growthRealty Income has consistently grown its adjusted funds from operations per share by approximately 5% annually. For this year, the company is projecting 5.40% growth. This growth is achieved through expanding the portfolio with AFFO-accretive transactions, rent escalations and an impressive rent recapture rate of 105.70% as of the second quarter.

The company has identified attractive sale-leaseback opportunities in the current high-interest rate environment, such as the 527 million euro ($578.83 million) sale-leaseback transaction with Decathlon completed earlier this year. These strategies enable the company to continuously increase its dividends every month, providing a reliable stream of income for its shareholders.

What about the balance sheet?When evaluating financial health, it is essential to consider debt as REITs are typically highly leveraged. Realty Income has a debt-to-equity ratio of 0.67, slightly below the industry median of 0.69, indicating a healthy level of leverage.

Its debt is also well-structured, with an average term to maturity of 6.30 years, shielding it from having to refinance at high rates. Additionally, 99% of Realty Income's debt is unsecured and 94% is fixed-rate, providing further assurance to investors regarding its financial stability.

The company also boasts one of the best credit ratings among public real estate companies, with an A- rating from Standard & Poor's and an A3 rating from Moody's. This strong credit rating allows Realty Income to borrow at more favorable rates compared to its peers.

A prime income pickThe title of "Dividend Aristocrat" is not easy to earn. A company must consistently pay and increase its dividends for over 25 years, which signifies stability and reliability. It is no accident that Realty Income is known as The Monthly Dividend Company. It has been paying and increasing its dividends for over 26 years. That's a good track record if you ask me.

Realty Income rewards its investors with a fat dividend yield of 5.70%, which has grown by 3% annually over the past five years. However, this growth rate is below its long-term average of 4.30%. Locking in the dividend at the current price will provide an attractive income stream in addition to the growth opportunities outlined above.

Regarding dividend safety, there is little reason for concern. The company has paid its dividends every month for 26 years while continuously improving its business. This consistency suggests there is no need to doubt its ability to maintain its dividend payments, as evidenced by its AFFO payout ratio of 74.60% and an FFO interest coverage ratio of 3.70.

Is Realty Income undervalued?Now to the big question: Is the stock fairly valued, undervalued or overvalued?

Realty Income's price-book value is 1.37, indicating the stock is trading at a 37% premium to the book value of its assets. This looks quite cheap compared to its five-year average of 1.75 and the sector median of 1.51.

When we look at the price-to-adjusted funds from operations, an alternative to the price-earnings ratio, Realty Income's forward price-to-AFFO of 14.50 is also significantly below its five-year average of 18.73 and the sector median of 16.24, cementing its undervaluation.

These metrics suggest Realty Income shares are undervalued from both an asset and earnings perspective. GuruFocus assigns the stock a fair value of $68.94, indicating an upside potential of over 12% from the current price, even after the recent run-up.

Risks to my thesisDespite Realty Income being a stable and predictable business, the feared economic slowdown could shuffle the cards. While I expect the business to perform well under any market conditions, tenant issues caused by a recession, coupled with an inevitable stock market decline, pose a significant risk to my bullish thesis. However, we are not currently in a recession and it would take considerably more negative data to reliably suggest that we are headed for one.

A second risk to the thesis is that with over 15,000 properties, Realty Income's AFFO growth will require larger acquisitions, adding to management costs and possibly limiting its growth potential. While this does not appear to be a significant issue at the moment, it is clear a larger company is harder to maneuver, and Realty Income will eventually need to acquire hundreds of properties each year to move the needle. On the other hand, a vast portfolio provides it with stable and reliable cash flows and expertise in different areas of the real estate industry.

ConclusionIn conclusion, Realty Income is a time-tested, reliable business that has delivered solid income and market-beating returns to its shareholders for many years. Given the current macroeconomic environment and expected rate cuts, I anticipate the stock will perform well and recover toward its long-term valuation. With a large dividend yield and enticing valuation, Realty Income presents an attractive investment opportunity.

This content was originally published on Gurufocus.com