Despite mounting evidence supporting recession forecasts, the stock market remains at odds with that outlook. This leaves investors in a predicament of avoiding a further drawdown in the equity markets but not wanting to miss out on a potential recovery.

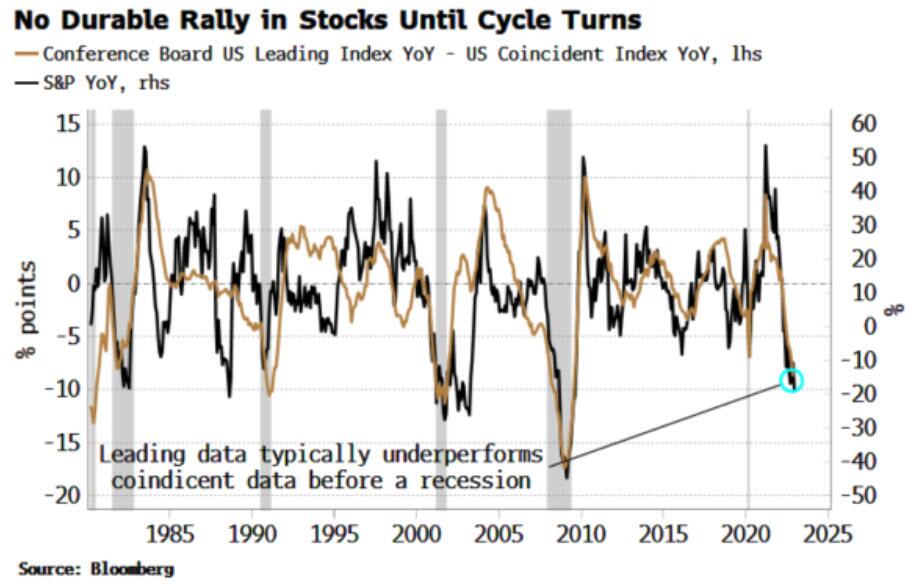

It is hard to argue with the recession forecasts that currently proliferate the headlines. For example, Simon White from Bloomberg makes an important observation:

“Stocks will be unable to post a durable rally and exit their bear market until the cycle turns. As the chart below shows, it’s not until leading data start to outperform coincident data once more that stocks turn up.

Unfortunately, when leading data are as depressed as they are today relative to coincident data, the cycle does not turn without there being a recession. Based on the historical data, stocks have another 15% or so downside if the US has a recession.”

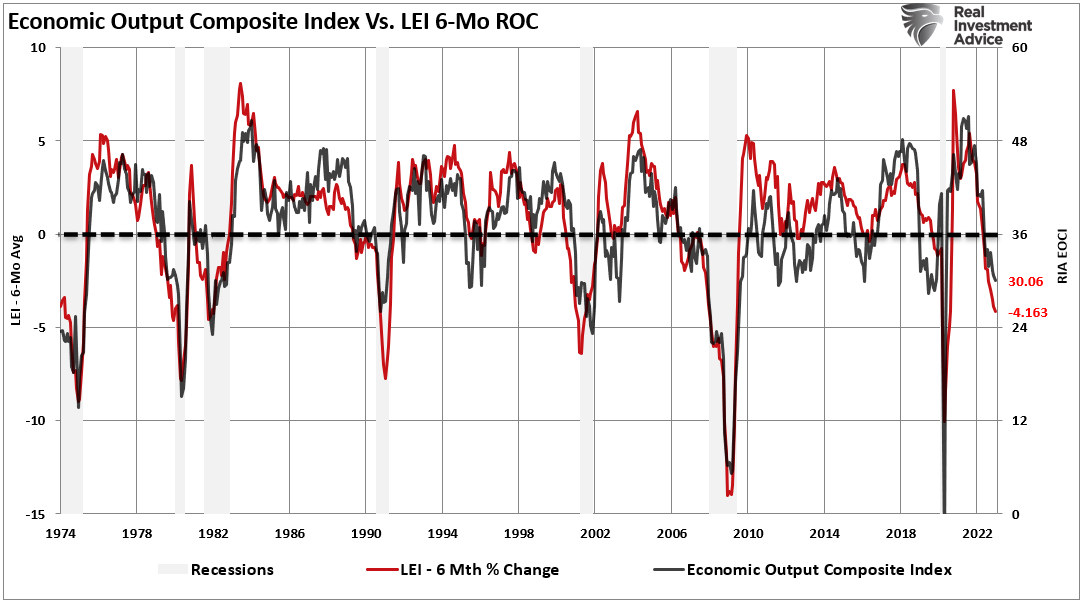

The Leading Economic Index is a significant indicator. In particular, we monitor the 6-month ROC in the Index as it highly correlates to corporate earnings and has a perfect track record in forecasting recessions. Both the 6-month ROC in the LEI and our broad Economic Composite Index (more than 100 individual data points) suggest a recession is imminent.

In the most recent report, the Conference Board issued its recession forecast regarding the sharp drop in the Leading Index.

“There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead. Meanwhile, the coincident economic index (CEI) has not weakened in the same fashion as the LEI because labor market-related indicators (employment and personal income) remain robust. Nonetheless, industrial production— also a component of the CEI—fell for the third straight month. Overall economic activity will likely turn negative in the coming quarters before picking up again in the final quarter of 2023.”

Yet, despite the data supporting the recession forecasts, the market continues to disregard those warnings.

Bullish Formations

The market has continued to trade higher despite falling earnings and weaker outlooks. Notably, several bullish formations are occurring that historically denote higher prices over the short- to intermediate-term. For example, the compression of prices between the downtrend line from the January 2022 peak and the rising lows since October was an important focal point for investors. Such is shown in the chart below. That compression acts as a “spring,” and when prices break out, the subsequent move tends to be pretty powerful.

As you will note, since January’s market peak, each attempt to break above the falling downtrend line was a head fake, leading to lower prices. The break above that downtrend line suggests that a pathway higher for prices is now occurring. While we do NOT have evidence of a clear sustained break above that downtrend, the risk of a head fake remains elevated.

But, as shown below, several other technical improvements to the broad market are worth watching, which also defy the recession forecasts.

Since the October lows, the market has been building a rather substantial price base. The inverse head-and-shoulder pattern already suggests a market bottom has formed. A solid break above the downtrend line (with a successful retest) would confirm the completion of that pattern.

Furthermore, the 50-DMA is rapidly closing in on a cross above the declining 200-DMA. This is known as the “golden cross” and historically signifies a more bullish setup for markets moving forward.

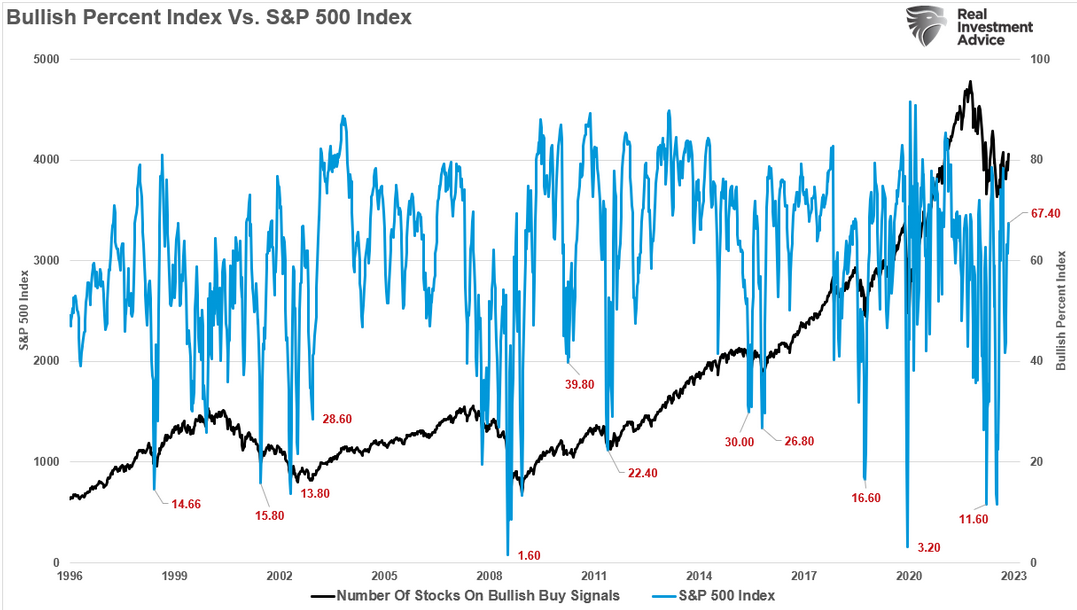

Lastly, overall bullish sentiment is also improving markedly, with the number of stocks on bullish buy signals rising to the highest since March 2022.

Should we ignore the recession forecasts?

History Still Suggests Caution

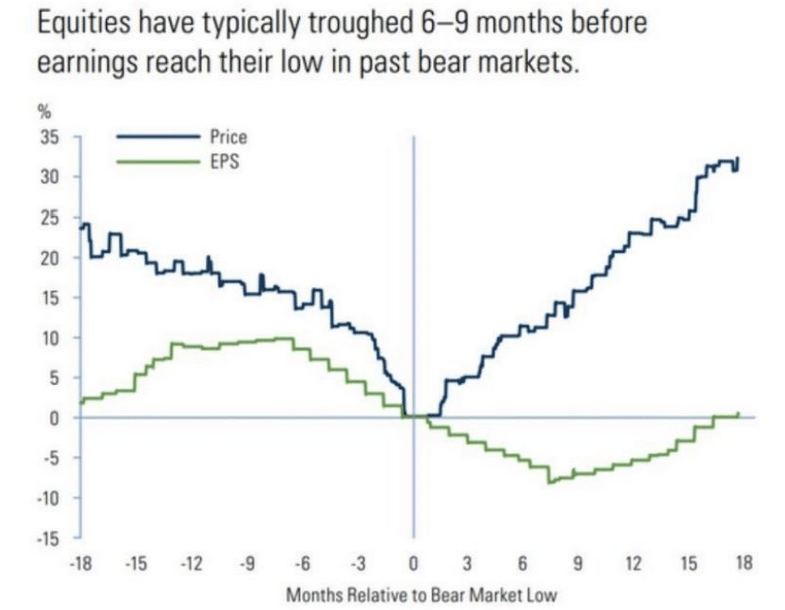

While it is possible that some bad news, or an overly aggressive Fed, could cause a reversal to these bullish formations, for now, they continue to support higher prices. This seems odd given the negative flow of recession forecasts and deteriorating earnings data. However, historically, market prices tend to trough 6-9 months before earnings bottom. This is because the market anticipates outcomes and was the subject of this week’s post on “Contrarianism.”

“As a contrarian investor, excesses get built when everyone is on the same side of the trade. Everyone is so bearish the markets could respond in a manner no one expects. This is why equities have historically bottomed between 6-to-9 months before the earnings trough.”

There are plenty of reasons to be very concerned about the market over the next few months. Given the market leads the economy, we must respect the market’s action today for potentially what it is telling us about tomorrow.

However, while we should not discount the improving technicals, we can not entirely dismiss the recession forecasts either.

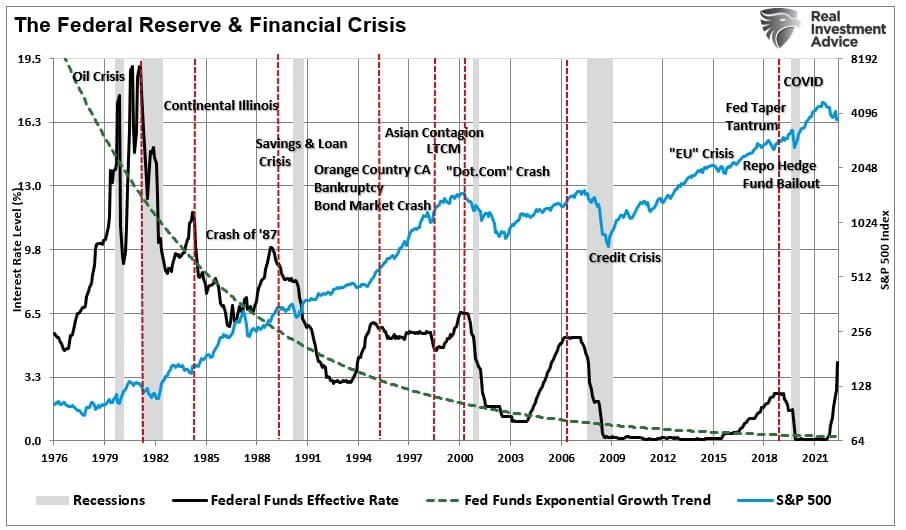

History is exceptionally clear about the impact of higher interest rates on economic growth, employment, and personal incomes. As we discussed in the “Fed Myth,” there has never been such a thing as a “soft landing.”

“There were three periods where the Federal Reserve hiked rates and achieved a ‘soft landing,’ economically speaking. However, the reality was that those periods were not ‘pain-free’ events for the financial markets. The chart below adds the ‘crisis events’ that occurred as the Fed hiked rates.”

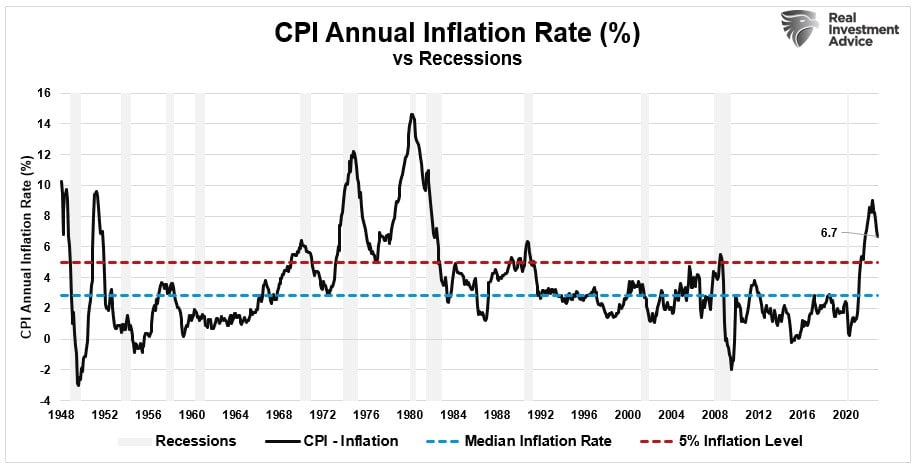

Crucially, a recession, or hard landing, followed the last five instances when inflation peaked above 5%. Those periods were 1948, 1951, 1970, 1974, 1980, 1990, and 2008. Currently, inflation is well above 5% throughout 2022.

Could this time be different? Absolutely,

The bullish formations in the market indeed show investors are hopeful of such an outcome.

Unfortunately, there is a lot of history that suggests otherwise.