It has been almost one year since Reddit’s (NYSE:RDDT) stock went public after more than 18 years since its foundation. Looking back, and considering that the company now has a market cap of approximately $35.53 billion, it was one of the most successful IPOs in 2024.

In March 2024, the social media platform was listed on the New York Stock Exchange, raising $519 million directly and allowing existing shareholders to sell $229 million more for $34 per share. Since then, the stock has considerably appreciated to $196.38, or over 476%, for investors who could invest at the IPO price before it started trading at $47 on the day of the listing.

One of the main drivers of this stunning price appreciation has been the rapid evolution towards profitability. For the first time, Reddit achieved GAAP profitability in a non-fourth quarter. Due to seasonality patterns, Reddit has had GAAP profitability three times in the past, but only in the fourth quarters of 2020, 2021, and 2023. However, the Q4 2024 figure of $71 million massively outperformed the past profitable fourth quarters, boosting the stock’s positive sentiment.

Source: RDDT IR

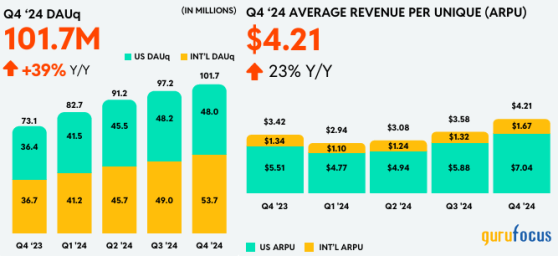

At the same time, core KPIs such as daily active users ("DAU") and average revenue per user ("ARPU") have exhibited massive growth, with the first one growing to 100 million users globally and the second one to $4.21. This implies YoY growth rates of 39% in active users and 23% in revenue per user, with a key distinction of the revenue contributions mainly coming from the United States.

Finally, Reddit has also benefited from a partnership with Open AI since May, when it was agreed that it would integrate Reddit’s real-time content on ChatGPT, providing its source and increasing ChatGPT users’ awareness of Reddit.

Conference Call

During the latest conference call, the company announced the beta introduction of Reddit Answers in the United States. This tool is an AI-powered search product integrated into the platform that provides summaries of community discussions. So, for example, if someone is searching for the best coffee maker under the subreddit r/buyitforlife, the user receives a summary of what past participants have shared about coffee machines.At the same time, Reddit provided optimistic guidance of $360-$370 million in revenue in Q1 2025, which implies a YoY growth of approximately 50.2% and an adjusted EBITDA of $80-$90 million, expanding roughly 750% from the mid-point.

Valuation

The main concern with Reddit is definitely its valuation. During the IPO, many said that the stock was overvalued, and a year later, it still is, but the stock is significantly up from the IPO price. As exhibited in the image above, almost all of the multiples of Reddit imply overvaluation with a price to sales of over 20x, a price to book above 16x, and an absurdly forward PE ratio higher than 176x. Simultaneously, most of the ratios that matter, especially price to sales, are in the higher percentile of its history.

Nonetheless, as the company continues growing at accelerated levels and obtaining higher nominal profitability, multiples are likely to drop and consolidate at more reasonable levels that are impossible to observe today. In addition, most of the sell-side analysts have considered these, and based on their price targets, they aren’t giving too much importance to the current multiples.

For example, based on ten analysts updating their ratings on Reddit after earnings, they all increased their price targets, and 70% had bullish ratings on the stock. Yet, the average price target from all these analysts is $204.5, which implies a slight upside potential of just 4.34%, indicating that, based on analysts, the stock of Reddit is fairly valued.

Risks

One of Reddit’s main risks is its ability to retain users. For example, the global split between logged-in users and logged-out users is 45% logged-in and 55% logged-out. One year ago, it was 50-50, so the split has deteriorated since then. Also, their ability to grow in terms of weekly active users comes predominantly from international markets, where, overall, Reddit is not as popular as it is in the United States. The problem is that the average revenue per international user is approximately 4.2x lower than in the USA. This implies that in the future, the average revenue per user in the mix between the US and the international will likely drop.Another risk is the fact that the stock has appreciated in triple digits and, since the release of Q3 earnings, has demonstrated a massive momentum with a prolonged parabolic movement on the stock price. Large corrections with these aggressive movements occur more than likely.

Takeaway

Although Reddit is experiencing massive growth in core KPIs and profitability, the valuation is not attractive for a prudent investor to invest in the stock. At the same time, its positive sentiment has increased the shares substantially, and an entry point at $196 is not attractive. However, based on the strong growth that the company has exhibited and the guidance provided, this is a company that could easily experience large volatility in its shares, and if expected results are achieved, appealing returns are likely. Therefore, a stronger price correction to $140-$150 could be a great entry point for me to be bullish on the stock. The mid-point of that implies a 15.4x price-to-sales ratio vs. the actual 20.9x.This content was originally published on Gurufocus.com