US regional bank stocks went through another roller-coaster ride last week, experiencing a significant dip after financial regulators announced plans for new rules aimed at insulating the general public from future bank failures. The regulations underpinning these announcements will apply to all US banks that have assets equating to at least $100 billion.

These actions from regulators come on the heels of the aftermath of the Silicon Valley Bank upheaval noted in Q1 2023. This dramatic episode has triggered renewed efforts by regulatory bodies to improve regional financial stability and mitigate systemic risk.

Analysts, Arnold Kakuda and Nicholas Beckwith, have surmised that up to 18 regional banks might need to offload an estimated $63 billion worth of debt collectively in order to step up to the plate and meet these newly imposed regulatory requirements. The implications with respect to capital management are potentially profound given such substantial debt needs.

Interestingly, these proposed norms were not as severe as initially expected by market participants. The quality and strength of Q1 earning reports generated by leading regional banks appear to have somewhat alleviated regulatory concerns, thereby diluting some immediate risks pertaining to initial punitive measures.

The outline from the Federal Deposit Insurance Corporation (FDIC) along with the Federal Reserve (FED) and the Office of the Comptroller of the Currency (OCC) hammered out this revised regulatory framework as a protective regulation strategy. Although less punishing than anticipated, it was enough of a shockwave element that contributed heavily to sending regional bank holdings southward.

These are crucial times as regulators try to maintain a delicate balance; it remains to be seen whether these recent moves will shore up stability in this complex financial ecosystem or create further market inefficiencies over time.

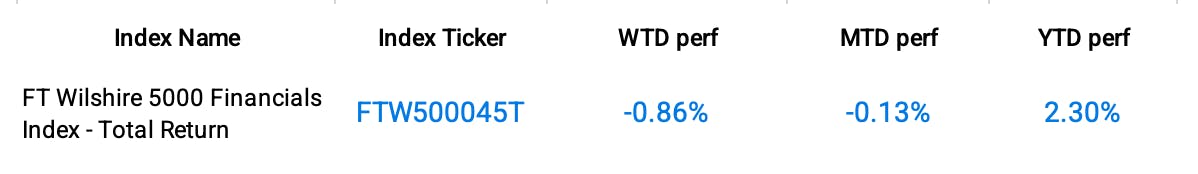

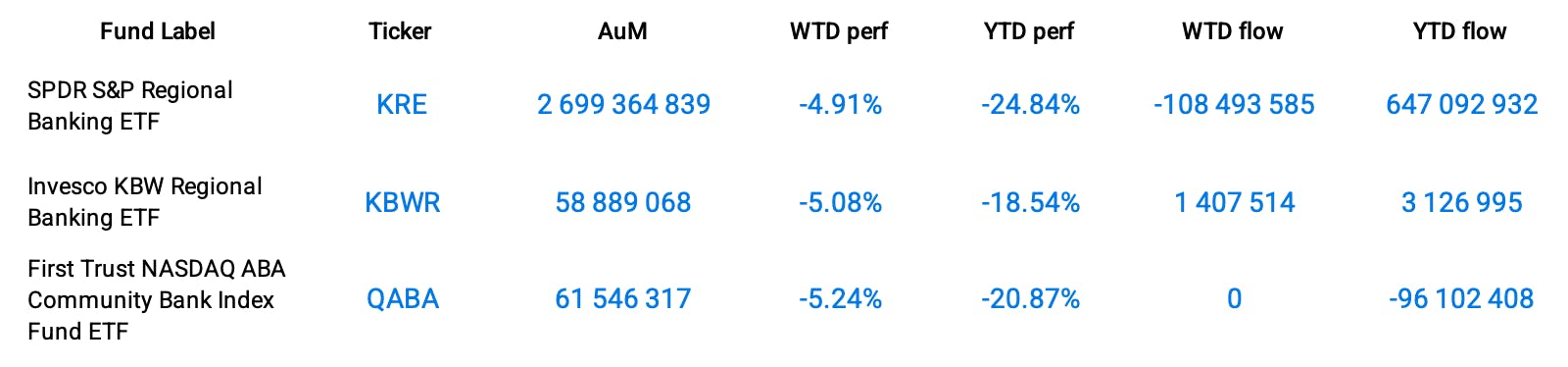

Group Data: Financials

Index Data

Funds Specific Data: KRE, KBWR, QABA

This content was originally published by our partners at ETF Central.