US bank stocks experienced a palpable surge over the week following hints from the Federal Reserve of potential rate cuts in 2024, offering some respite to the financial market. The rally was particularly pronounced in regional banks marking a significant moment in the financial sector’s recovery from recent adversities.

The S&P Banks Select Industry Index offers a clear window into these changes. Prior to the abrupt bankruptcy of Silicon Valley Bank, the index fluctuated above the 1,000 threshold but found itself plummeting as low as 704.65 on May 4th. The SVB bankruptcy sent shockwaves through the financial market, triggering huge losses for regional bank stocks and leading the Federal Reserve to temporarily increase the size of its balance sheet by $400 billion to inject liquidity into the financial market.

The S&P Banks Select Industry Index has really started to climb back up since the end of October, an observation confirmed by robust performance this week (up 7.44%), which saw it recover its pre-crisis level.

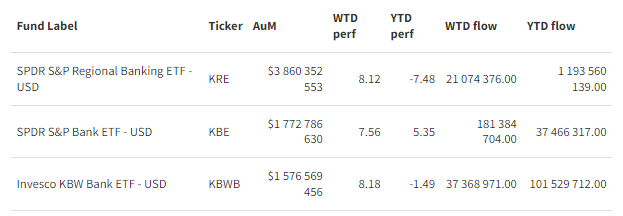

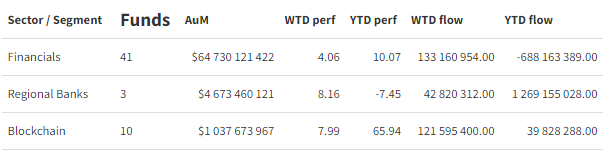

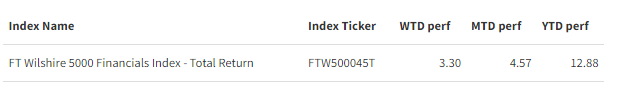

Reflective of the recovery were ETFs tracking the financial sector, with an impressive gain of 4.06% over the week—boosting year-to-date gains to 10.07%. Regional bank ETFs—particularly those that bore the brunt of the fallout from Silicon Valley Bank's collapse—recorded a sturdier upsurge of approximately 8.16% for the week.

However, it is worth remembering that despite such encouraging weekly performance figures, US regional bank ETFs are still lagging by around 7.45% in terms of year-to-date returns, reflecting the impact of new regulatory pressures in place to prevent further failures following SVB’s collapse.

Group Data

Index Data

Funds Specific Data