Rentokil Initial PLC (NYSE:LON:RTO) (LSE:RTO) is a UK based global service company specializing in pest control, hygiene, and workplace solutions. Their business model centers on providing comprehensive professional services to commercial and institutional clients across multiple sectors. The company generates revenue through recurring service contracts and product sales, with a strategic focus on protecting people and enhancing workplace environments.

The core of Rentokil Initial's approach involves delivering specialized pest management, hygiene, and workwear services through a network of professional technicians and extensive geographical coverage. They target diverse industries including food production, healthcare, hospitality, and commercial enterprises, offering tailored solutions that address specific client needs. Their revenue model relies on establishing long-term service relationships, developing innovative technological solutions, and maintaining a robust operational infrastructure across Europe, the Americas, and Asia Pacific.

By continuously investing in research and development, digital technologies, and professional training, Rentokil Initial differentiates itself through high-quality, technologically advanced service delivery. Their business strategy emphasizes predictable, recurring revenue streams, scalable service models, and a commitment to solving complex environmental and workplace challenges for their clients. This approach has enabled them to become a market leader in pest control and related professional services, with a significant global presence and a market capitalization exceeding $12.5 billion.

A solid compounder

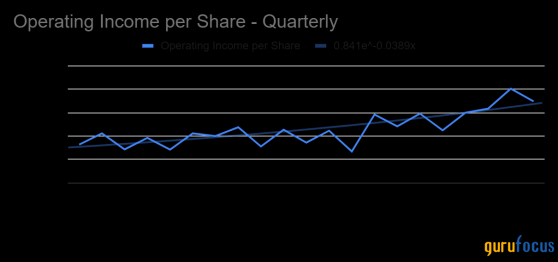

Rentokil Initial's stock has done quite well over the last decade compounding at around 12% annually. The recent softness in stock price is a good opportunity for new investors to take a posiiton in this well managed business in a solid and growing industry.Operating income per share 5 year CAGR is 14%. All four of the most recent quarters are showing growth. This bodes well for stock price recovery.

Terminix Acquisition

In a significant move that reshaped the global pest control industry, Rentokil Initial PLC acquired Terminix Global Holdings Inc. in a deal valued at approximately USD6.7 billion, which was finalized on October 12, 2022. This strategic acquisition combined two industry leaders with rich cultural heritages and a shared commitment to people, customers, and ESG principles. The transaction, involving both stock and cash components, resulted in Terminix stockholders receiving about USD 1.34 billion in cash and 129.1 million new Rentokil American depositary shares, giving them approximately 26% ownership of the combined entity. This merger established Rentokil as the preeminent global pest control company, substantially expanding its footprint in North America, the world's largest pest control market. Rentokil's CEO, Andy Ransom, hailed the acquisition as a pivotal moment, emphasizing the enhanced scale, capabilities, and talent it brought to the company. The integration process began immediately upon completion, with Rentokil also listing American Depositary Receipts (ADRs) on the New York Stock Exchange as part of the combination. This landmark deal aimed to create a powerhouse in pest control and hygiene services, leveraging the strengths of both companies to drive industry growth and value creation. Both businesses are route based and densification of routes should lead to greater efficiencies. However this will take a few years to play out.BusinessAbout 70% of Rentokil Initials business comes from the US, its largest market. Revenue distribution from its various markets are shown below. It is interesting that the company has a small beachhead in India, potentially a very large market.

80% of revenue some from its pest control business.

Growth Rates

| Growth Rates per share | CAGR | ||

| Fiscal Period | 10-Year | 5-Year | 1-Year |

| Revenue | 8.10% | 9.20% | 4.50% |

| EPS without NRI | 12.60% | 12.80% | 0.40% |

| EBIT | 8.20% | 13.60% | 19.40% |

| EBITDA | 6.30% | 28.70% | 11.20% |

| Free Cash Flow | 26.50% | 13.00% | -0.50% |

| Dividends | - | - | 14.50% |

| Book Value | - | 32.50% | 5.00% |

Valuation

The following table gives various price ratios for Rentokil and compares then to the corresponding 10 year median ratios. The company is trading at a steep discount to the 10 year median ratios.| Ratio's | 10 yr median ratio's | Discount for 10 yr median | ||

| PE Ratio without NRI | 16.99 | PE Ratio (10y Median) | 31.71 | 46.42% |

| PS Ratio | 1.85 | PS Ratio (10y Median) | 2.61 | 29.12% |

| PB Ratio | 2.39 | PB Ratio (10y Median) | 8.48 | 71.82% |

| Price-to-Operating-Cash-Flow | 14.09 | Price-to-Operating-Cash-Flow (10y Median) | 16.18 | 12.92% |

| EV-to-Forward-EBITDA | 10.83 | EV-to-EBITDA (10y Median) | 13.73 | 21.12% |

Discounted Cash Flow Valuation

DCF valuation indicates a margin of safety for Rentokil stock at the present time.Rentokil valuation ratios compare favorably with other route based business services companies. Rentokil's operating margins are currently depressed as it digests the acquisition but I expect them to recover in due course.

| Ticker | Company | Current Price | Market Cap | EV-to- | PS Ratio | PE Ratio | FCF Yield % | Dividend | Operating | EBITDA Margin |

| ($M) | EBITDA | Yield % | Margin % | % | ||||||

| RTO | Rentokil Initial PLC | 25.08 | 12,597.93 | 11 | 1.83 | 25.49 | 5.01 | 2.33 | 13.81 | 21.89 |

| ECL | Ecolab Inc (NYSE:ECL) | 231.98 | 65,687.88 | 18.84 | 4.22 | 32.54 | 3.05 | 1.01 | 16.25 | 24.63 |

| ROL | Rollins Inc (NYSE:ROL) | 45.8 | 22,181.17 | 29.96 | 6.7 | 47.71 | 2.42 | 1.33 | 19.5 | 23.3 |

| CTAS | Cintas Corp (NASDAQ:CTAS) | 185.55 | 74,868.68 | 28.76 | 7.69 | 44.73 | 2.48 | 0.78 | 22.34 | 27.15 |

ConclusionRentokil Initial, a global leader in pest control and hygiene services, acquired Terminix in 2022, significantly expanding its presence in the North American market. Despite facing integration challenges that have impacted organic revenue growth, the company is expected to overcome these hurdles by 2025/26. The stock price has come down substantially and valuation is attractive. The pest control industry outlook remains robust, with strong projected growth and increasing market demand. Rentokil's expansion in the US, coupled with its currently discounted valuation due to integration issues, presents a compelling growth opportunity in a fragmented market. The company has also established a beach head in Asia which promises a large opportunity for its pest control business. As the company works through its integration challenges, it is well-positioned to capitalize on the increasing demand for pest management solutions and eco-friendly practices in the coming years.

This content was originally published on Gurufocus.com