Today’s retail sales report could be critical, especially if it comes in weak, as the market is currently uncertain about the number of rate cuts expected tomorrow.

Currently, Fed Fund Futures show about a 70% chance of a cut, while swaps indicate a 50% chance. I can’t recall when the market was this undecided about what the Fed would do. Whatever decision they make could have a significant impact.

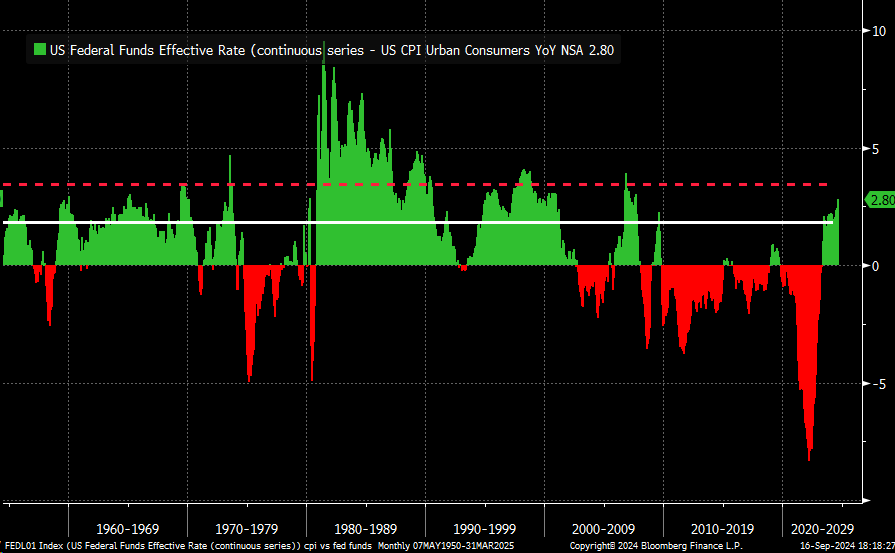

From my perspective, a 25-basis-point cut probably isn’t enough, given where the real Fed Funds rate is. A 50-basis-point cut seems more appropriate.

A 25 bps cut would bring the real Fed Funds rate down to 2.55%, still higher than the 2.45% level in July. The Fed would likely need to cut at least 50 bps to get the rate moving back to neutral.

This could explain why the market is so divided—on the one hand, we know Powell tends to be conservative, but on the other hand, a 25 bps cut might not provide much help.

Stocks Finish Little Changed as Technology Sector Slides

Meanwhile, stocks ended the day lower on the Nasdaq, down around 50 basis points, while the S&P 500 closed primarily flat.

The bulk of the losses came from technology heavyweights, led by semiconductors. The SMH finished the day down more than 1%, with Nvidia dropping about 2%.

Nvidia (NASDAQ:NVDA) remains a key player, and if it doesn’t move, the broader stock market likely won’t either—this dynamic hasn’t changed.

The big gamma level at $120 continues to be the dominant force for Nvidia, and until it breaks through that level, the stock, along with the S&P 500 and Nasdaq, will remain stuck.

Currently, Nvidia is facing resistance at the 61.8% retracement level and the 20-day moving average near $120, highlighting the importance of this price level. For now, the 10-day exponential moving average is acting as support.

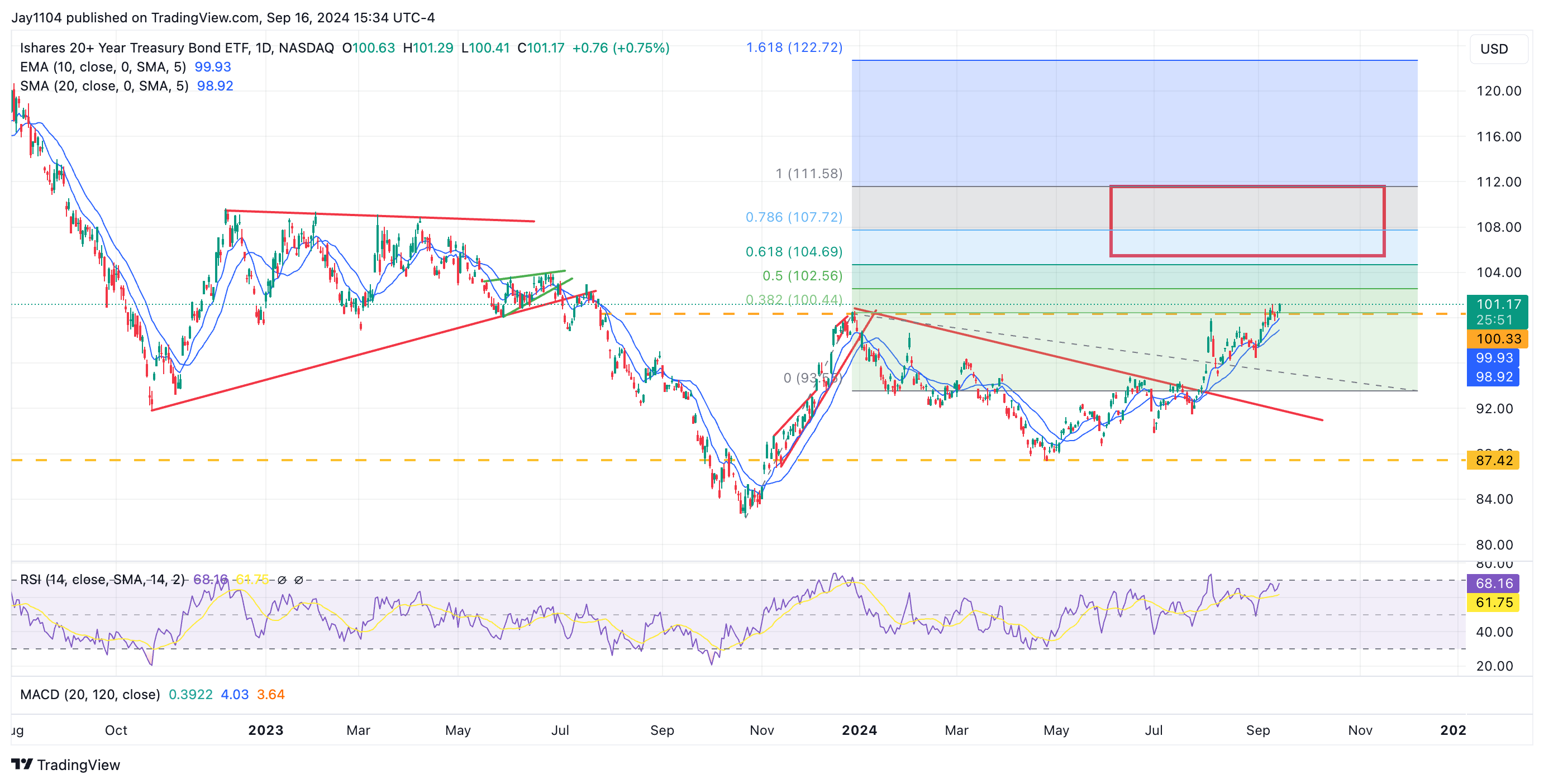

Another issue is that TLT appears to have more room to climb. It has broken through resistance at $100, which now acts as support. Depending on how you measure it, TLT could be heading towards a range of $105 to $112 soon.

The ratio of Nvidia to TLT doesn’t look encouraging at the moment. With the ratio sitting at a clear support level, if TLT continues to rise while Nvidia remains stagnant, TLT could become more appealing relative to Nvidia.

Given Nvidia’s previous trading levels relative to TLT, the ratio could have significantly more room to fall.

If you think the QQQ to TLT ratio looks similar to the USD/JPY, you’re right—it does.

The exact reason isn’t entirely apparent. It could be related to the carry trade, or maybe it’s something else, but the similarity is there, and it’s something to keep an eye on.

S&P 500: Correction Ahead?

Finally, the S&P 500 is likely to move lower from here. The sharp drawdown in the first week of September, followed by last week’s retracement, seems to be a temporary bounce. We’re already seeing Bitcoin rollover, and the liquidity situation in the market isn’t looking great. I expect it to worsen significantly as reserve balances decline.

It could open the floodgates if the S&P 500 cash breaks below 5,600. If volume picks up, it would signal the sellers’ return, and I wouldn’t be surprised to see S&P 500 cash drop below 5,500 by the end of the week.