“Investments are subject to market risk” is a mandatory statement a fund house makes in an Investment Policy Statement (IPS) when offering investment opportunities to investors. Investors take risks, hoping for a return on investment (ROI). A higher ROI is expected from assets/investment with higher risk, and only high risk takers, skilled in managing risk efficiently, generally take that risk. Investment avenues are always evolving and investors look for new opportunities to invest. Investment products have evolved from, for example, gold, bonds, stocks and derivatives to digital money called cryptocurrency.

Environmental, social and governance (ESG) factors are now gaining prominence, making companies more socially aware of how they earn revenue. These factors direct a company’s performance in relation to the environment, its employees, suppliers and customers, and its governance. For example, “At MSCI, we define ESG Investing as the consideration of environmental, social and governance factors alongside financial factors in the investment decision-making process”, says Remy Briand, Managing Director at MSCI ESG Research.

ESG considerations have provided investors with better returns at lower risk than have traditional investment products”, according to Morningstar/Citywire Discovery. Awareness of the environment, climate change, the greenhouse impact and zero carbon emissions have brought products based on ESG criteria into the spotlight in recent years.

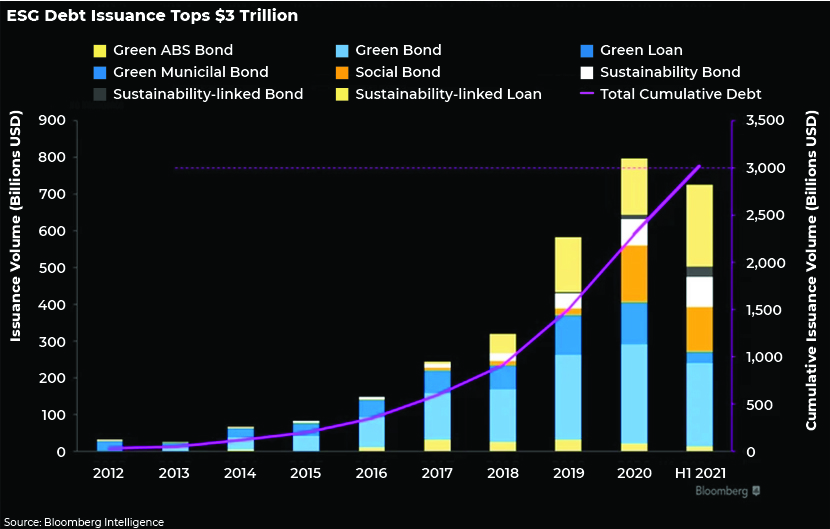

Investment in ESG funds is trending. Bloomberg forecasts that ESG AUM could grow to USD53tn by end-2025, after reaching the target USD30.6tn by end-2021. On the debt-issuance front, ESG-themed issuance is set to surpass USD3tn in the year 2021. It took almost 12 years (2007-19) to reach USD1tn but just one year (2020) to reach USD2tn. In just the first six months of 2021, it crossed another USD1tn. ESG-themed debt issuance may surpass USD11tn by end-2025.

Key factors driving demand for ESG products:

-

Paris Agreement: The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 parties at the Conference of the Parties (COP) 21 in Paris, on 12 December 2015 and came into force on 4 November 2016. Following the agreement, a number of governments defined nationally determined contributions (NDCs) to achieve the targets. They also encourage and offer more benefits to those investing in sustainable or environmentally friendly businesses, creating a niche opportunity for investing in ESG. This has been driving significant demand for ESG products in recent years.

-

Pandemic: In November 2019, the world became aware of the end of the Bull Run and panicked due to the outbreak of the pandemic that resulted in the biggest market crash in March 2020 as global indices fell c.40%. The Dow Jones Industrial Average fell nearly 3,000 points on 16 March 2020, the largest single-day drop in US stock-market history to date, when the pandemic was declared a national emergency in the US. People are now more conscious about their health and the environment, driving growth of ESG investment products, which is likely to continue post-pandemic.

-

Sustainable returns: Increasing awareness of the environment and the need for sustainable investment in environmentally friendly businesses are also driving the trend in ESG investment.

-

Sustainable Finance Disclosure Regulation (SFDR) is an EU regulation that came into effect on 10 March 2021 to govern the provision of financial products and services in the EU and banks’, insurers’ and fund managers’ commitment to sustainability. The SFDR aims to inject EUR1tn into green investments over the next decade to address data inconsistency in the climate-related information provided by financial-market participants. The SFDR also focuses on preventing greenwashing (financial firms publishing inaccurate data on environmental commitments, saying an investment is fulfilling its environmental, social and governance commitments while being closely aligned with companies emitting substantial amounts of carbon. Implementation of the SFDR would provide an accurate picture of ESG investment.

-

In the US, President Biden is working closely with departments/legislative bodies to implement regulation of sustainable investment to limit climate change and enhance carbon neutrality. Asian countries are also aggressively setting targets in line with the Paris Agreement, implementing new ESG-/sustainability-related regulation. The MSCI 2021 Global Institutional Investor Survey showed that 79% of the investors surveyed have increased their ESG investments in Asia Pacific.

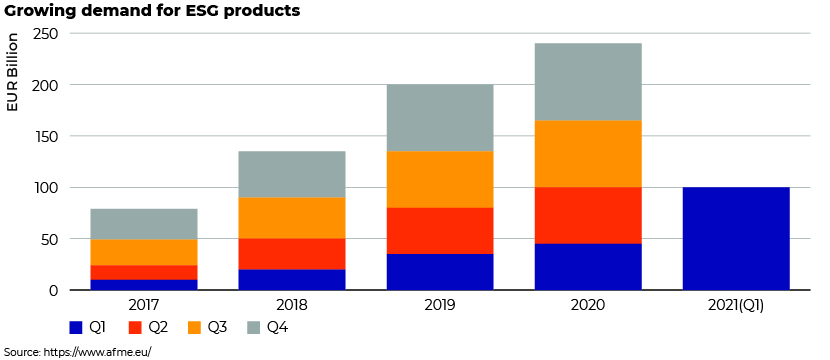

The graph above shows increasing demand for ESG products on a quarterly basis from 2017 to 1Q 2021. Companies first started focusing on ESG products in 2017. By mid- or end-2018, they had significant stakes in their portfolios, although not as much as equity or debt. ESG products accounted for 57.14% more of their portfolios in 1Q 2019 versus 1Q 2018. For the full-year 2019, they had more ESG products than in 2017 and 2018 combined. Although 2020 was devastating for most companies, sectors and economies, demand for ESG products jumped 303.80% from 2017. Asset management companies changed the historical 60/40 portfolio in equities and bonds, with ESG funds also forecast to generate more returns than equity or debt. As a result of high demand for ESG product, investment in 2021 for Q1 were amazingly high which was 2 times of 2020 Q1.

Trend in ESG debt issuance:

ESG an evolving trend:

ESG has been attracting the attention of investment banks, Asset Management Companies (AMCs’), PMS’s and private equity funds recently, pushing governments to implement regulation to govern the momentum in new investment products/avenues of investment. ESG-related regulation is still in its early stages, and we are likely to see far more development on this front. We shall cover more on this topic in future blogs.