This article was written exclusively for Investing.com

Low rates and overly bullish expectations have driven the S&P 500 to record highs. But now rates are rising, and that means multiples will need to contract. Just how much those multiples need to fall is the concern, and it could be a lot.

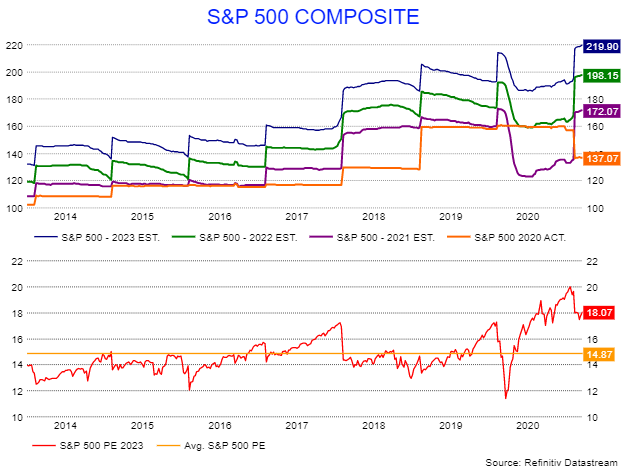

The S&P 500 trades at around 18 times 2023 earnings estimates of $219.90 per share, according to data from Refinitiv. That is well above the historical average of 14.9 since 2014 and indicates that future earnings growth expectations are very high. Should the PE return to that average over time, it would value the index at 3,256, 16% lower than its value of 3,915 on Mar. 18.

For the S&P 500 PE multiple to come down to 14.9, earnings by 2023 or 2024 would need to soar to $262.41 per share, nearly 19.3% higher than current estimates for 2023—that is unlikely to happen. In fact, the majority of earnings growth is expected to occur in 2021, climbing by 25.5% to $172.07. Forecasts call for earnings growth to slow in 2022 to 15.2% and 11% in 2023.

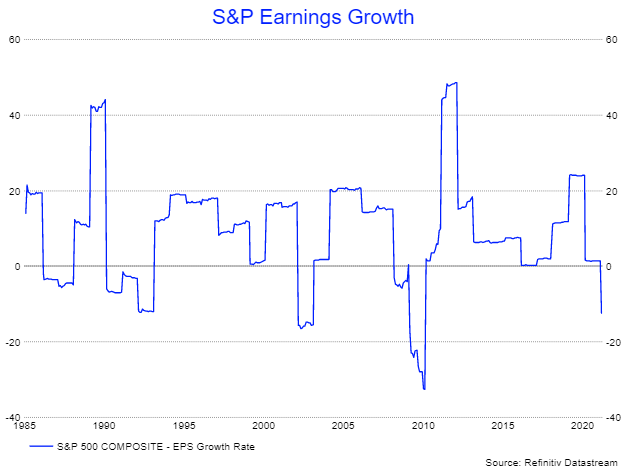

Earnings growth would need to rise by more than 32.4% in 2023. Since 1985 we have only had two periods where earnings grew by more than 30%, 1989 and 2011-2012. It seems unlikely that earnings in 2023 will increase by more than 30%. It would take a 19.2% increase in 2024 to reach $262.41. After two straight years of decelerating growth, it seems hard to accomplish.

It doesn't mean that the PE multiple for the S&P 500 has to slip all the way back to 14.9 times 2-year forward earnings estimates. But it does tell us how much earnings growth has been priced into the market. It also suggests that market expectations are much higher than consensus analysts' estimates, potentially by quite a lot.

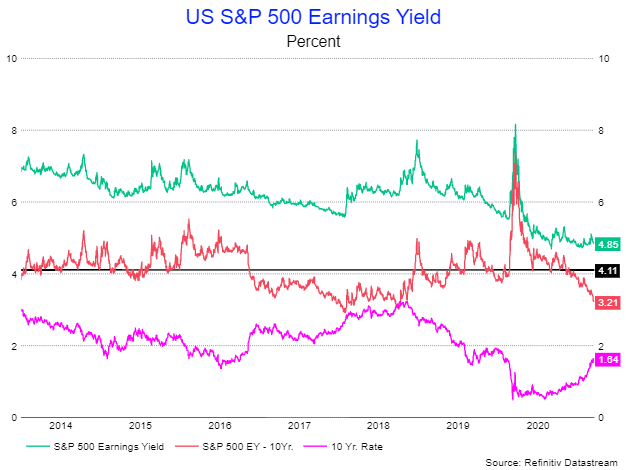

Low-interest rates play a heavy hand in the S&P 500 valuation too, which makes it even more challenging to quantify. But even when factoring low rates in, the S&P 500 is nearly just as overvalued.

Using 18-month forward estimates to assess the earnings yield of the S&P 500 is a way to measure the valuation against interest rates. The index currently has an earnings yield that trades with a 3.2% premium to the 10-year Treasury note, based on its 18-month forward earnings estimates. It has only seen levels this low or lower in 2018 in both January and October.

Now, as yields rise across the curve, it will begin to put pressure on the index, compressing multiples and driving the earnings yield higher. The last time the 10-year note traded with a yield of around 1.75%, the S&P 500 earnings yield was roughly 5.7%. That is nearly 85 bps higher than the S&P 500's current earnings yield of 4.85%. It would lower the S&P 500 PE ratio to 17.5, from 20.6, and value the index at 3,374 based on 18 months forward earnings estimates of $192.82.

It seems abundantly clear that expectations for future earnings growth in the S&P 500 are very high. Couple that with lower interest rates that have helped to expand the S&P 500 earnings multiple dramatically. It means that at this point, with rates rising and likely to continue to rise, it is reasonable to think that multiples need to compress, with lower prices to follow.