S&P 500 member SLB is nearly 100 years old, founded in 1926. Schlumberger Limited (NYSE:SLB) is the New York Stock Exchange listed parent of the SLB group of companies. In 2022 the company changed its brand name to SLB, but the legal name of the listed parent company remains Schlumberger Limited. SLB is the largest of the Big Three oilfield services companies, the other two being Baker Hughes (NASDAQ:BKR) and Halliburton (NYSE:HAL).

2024 results

SLB's pre-tax income grew 7.4% in 2024 to $5.67 billion, following pre-tax income growth of 23.7% in 2023. Diluted earnings per share grew 6.9% in 2024 to $3.11, following 2023's growth in diluted EPS 21.8%.

2024 segment results

Digital & Integration pre-tax income grew 12% to $1.4 billion and achieved a pre-tax operating margin of 33.1%. Reservoir Performance pre-tax income grew 15% to $1.5 billion and achieved a pre-tax operating margin of 20.2%. Well Construction pre-tax income fell 4% to $2.8 billion and achieved a pre-tax operating margin of 21.2%. Production Systems pre-tax income grew 52% to $1.9 billion and achieved a pre-tax operating margin of 15.6%. Total Pretax Operating Margin expanded by 0.5% percentage points to 20.2% in 2024.

SLB has anAltman Z Score of about 3.3 giving it a safe financial profile. It's also worth noting that SLB has a cool Interactive Analyst Center on the investor relations section of its website. There you can view financial and operational data, build charts and download data into Excel.

Why do I like this stock

There are several reasons, more than just Donald Trump's Drill, baby, drill! plans which should provide tailwinds for US oilfield services companies.

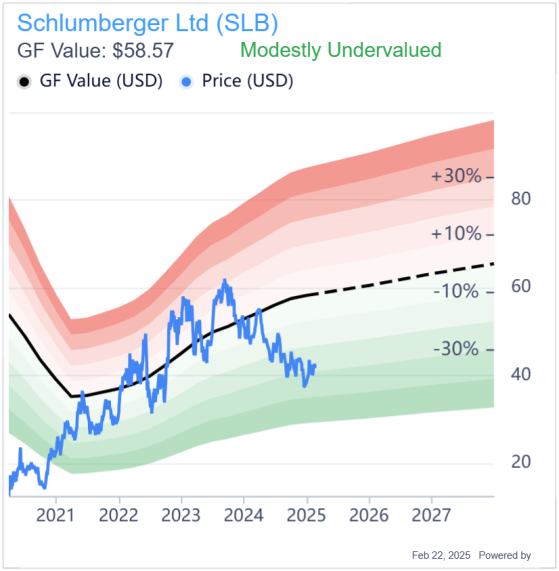

First, GF Value rates the stock as Modestly Undervalued and I agree given the earnings growth I can foresee in this company.

SLB is a large player in the Middle East, which is probably the most resilient market in oil and gas. This gives SLB a lot of visibility on earnings, given the Middle East will almost certainly be the last man standing when it comes to oil and gas production given its low cost of production and vast reserves. The Middle East can even be seen as a growth area as countries like Saudi Arabia and the United Arab Emirates look to increase natural gas production.

SLB's acquisition of ChampionX (NASDAQ:CHX) adds value through increasing its exposure to specialty chemicals solutions and artificial lift in oilfield services, especially as ChampionX is a leader in the important Permian basin market. Additionally, the deal brings $400 million of annualized pre-tax synergies.

The addition of ChampionX will augment our exposure to the production and recovery market, which is an increasing priority for our customers Production chemicals presents an exciting opportunity as an asset-light business that will remain resilient to industry cycles, with nearly every liquid produced globally requiring an element of production chemicals that increases with the age of the asset.Source: Olivier Le Peuch, SLB CEO, at the J.P. Morgan Energy, Power & Renewables Conference, June 2024

SLB is also one of the leaders in subsea and its new business OneSubsea according to SLB's 2024 10-K will drive innovation and efficiency in subsea production by helping customers unlock reserves and reduce cycle time. OneSubsea comprises of an extensive complementary subsea production and processing technology portfolio, world-class manufacturing scale and capacity, access to industry-leading reservoir and digital domain expertise, unique pore-to-process integration capabilities, and strengthened research and development capabilities. SLB owns 70% of this joint venture with Norwegian partners Aker Solutions and Subsea7 owning 20% and 10% respectively.

OneSubsea has peer leading margins and is being utilised deeply by major players including an alliance with BP plc (LON:BP) and a strategic collaboration with Equinor ASA (EQNR), ensuring revenue quality.

Source: SLB presentation at the J.P. Morgan Energy, Power & Renewables Conference, June 2024

Technology leader

SLB calls itself a global technology company which is fair given its Digital business driven by Cloud, AI and Edge revenue growth. SLB's Digital & Integration segment gives the group substantial margin uplift. The core businesses of Reservoir Performance, Well Construction and Production Systems have generally produced pre-tax operating margins of between 10% and 20% over the last four years. Over the same period Digital & Integration has produced an average pre-tax operating margin of 34.2%. While this segment's Asset Performance Solutions is expected to stay roughly flat in terms of revenues in 2025, the digital element offers a lot of growth.

Source: SLB presentation at the J.P. Morgan Energy, Power & Renewables Conference, June 2024

That digital element is growing thanks to SLB's proprietary Delfi offering.

The Delfi digital platform brings you the world's best apps, AI, data management, and physics-based science for oil and gas exploration, development, drilling, production, midstreamand energy transition solutions. Developed by domain experts for domain experts, it is an open, scalable, and secure, cloud-based software environment with 24/7 operational support.Source: Introduction to Delfi, SLB website

The oil and gas industry has long used supercomputers for data analysis, for instance in seismic imaging in exploration. But the industry is ripe to use cloud, AI and edge given the vast amount of data generated across the upstream, midstream and downstream sectors of industry, to squeeze out efficiency gains in operations, maintenance and environmental performance. In the recent Q4 earnings call, SLB announced it had formed strategic partnerships with industry leaders including NVIDIA (NASDAQ:NVDA), Amazon (NASDAQ:AMZN) Web Services, and Palo Alto Networks.

Finally, and perhaps most importantly, I believe that the company has sustainable competitive advantages in each of its four segments, giving SLB an important moat around its business.

Moats

The best way to understand SLB's value proposition in Digital is to read its 2022 Investor Day presentation which can be found here.

One good example described at the 2022 presentation of Delfi being deployed was the following at Chevron (NYSE:CVX), we are working closely with Microsoft (NASDAQ:MSFT) to completely transform their work processes across upstream. One very interesting statistic about Delfi at the same presentation was Our monthly customer retention rate has been above 95 percent for each of the last 12 months.

A September 2020 report on digital in energy from Bank of America (NYSE:BAC) Global Research noted that SLB's Delfi had a significant first-mover advantage and that software adoption tends to be sticky as switching costs are high.

In Reservoir Performance, I came across a recent press release about an Integrated Services Contract award to SLB from Petrobras (PBR), which mentioned a product called Ora, an intelligent wireline formation testing platform. On further research I found that this product won a World Oil Award in 2021 for Best Exploration Technology, saying Ora platform reduces the CO2 footprint by up to 96% by minimizing or eliminating flaring, in addition to decreasing energy consumption by at least 50% on average. These are big numbers to help customers reduce costs. This is a good example of a tool that adds value for customers that appears to be quite unique.

In Well Construction, where SLB is the market leader, SLB invented the rotary steerable system, and its autonomous directional drilling is transformative for the industry according to the 2022 Investor Day presentation. SLB's products and services touch more than one-third of the rigs in the US again according to the 2022 Investor Day presentation. By being able to drill more productive wells, SLB can share in the value creation for customers through better pricing.

SLB's Production Systems segment helps customers increase oil recovery and minimize the number of wells

needed. The OneSubsea joint venture sits in this segment and although it competes fiercely with TechnipFMC (FTI) in the subsea business, OneSubsea boasts the largest installed base of subsea trees and last year was awarded a groundbreaking All-Electric Subsea Project contract by Norwegian oil major Equinor which demonstrates OneSubsea's expertise in the important offshore oil and gas trend of electrification of operations. Partnering with Aker Solutions and Subsea7 gives OneSubsea powerful engineering, procurement, construction and installation capabilities.

Risks

SLB has been in the news a lot in the last year as the Financial Times has written several articles about SLB's continued involvement in Russia. Baker Hughes and Halliburton both exited Russia but SLB has said it had no plans to leave. It was criticised by several campaigners for this but SLB has insisted it is not in breach of sanctions. The stock market is probably amoral, but for me this does highlight a higher risk appetite of the board of SLB, given that this could have possibly annoyed various governments.

While my medium to long term outlook for global oil production is for peak and slow decline, and this is certainly a risk for SLB, this is offset somewhat by the probably long-term growing demand for natural gas. The fact that SLB's biggest geographic region is Middle East and Africa, accounting for 36% of revenues in 2024 shows that SLB is less exposed to long-term trends than many other oilfield service providers with lower or no Middle East positions.

Governance

Given the decision to stay in Russia, I looked into SLB's board of directors. The board is stacked with experienced executives, including former senior employees of the supermajors ExxonMobil (XOM) and TotalEnergies (EPA:TTEF) (TTE), and people with vast experience in the energy (including renewables), technology and finance industries, and markets including Russia, India and Argentina. The board has the normal committees plus the New Energy and Innovation Committee, which shows it does have an eye on future markets.

Conclusion

SLB is a great growth at a reasonable price opportunity. Although the stock has been trending down over the last year and a half, it seems to have found a floor at $40 over the last six months. Its trailing 12 months EV/EBITDA is 8.4x which is nearly 30% below its five year average trailing EV/EBITDA of 11.7x. This discount is odd, given that as the leading oilfield services provider, it is now set to benefit from what ConocoPhillips (NYSE:COP) board member and respected energy analyst Arjun Murti calls The Rise of The Energy Pragmatism Era. That is to say, energy policy and energy producers are now realizing oil and gas has a bigger role to play compared to the recent ambitions to move as quickly as possible to a fully renewable energy future, or the energy transition era.

SLB is modestly undervalued, has financial strength, has a resilient core business and a fast-growing and higher margin digital business. SLB obviously doesn't deserve a technology valuation, but it does deserve a higher valuation that it currently has.

This content was originally published on Gurufocus.com