Against the backdrop of an uncertain market environment, the instinctual nature of most investors is to pivot towards liquidity (i.e., Cash) or safety in the form of assets or businesses that have a track record of being steadfast in the midst of change. In the case of the latter, companies with a stable cash flow and a more mature business model – a characterization associated with value stocks – tend to be the safe haven for many investors.

In this article, we will take a closer look at value investing, examine its current performance in the marketplace, and discuss a solution that provides pure-play exposure to the investment strategy.

Value Investing in the Large Cap Space

Value investing is an investment strategy that involves searching for stocks or other securities that are considered undervalued based on their intrinsic value. In the context of large market capitalization (large-cap) equities, value investing focuses on identifying, and investing in, well-established companies with substantial market capitalizations that are trading at prices below their perceived intrinsic value.

Large-cap companies are typically well-known and have a significant market presence; this is reflected in the Russell 1000 Value Index’s fact sheet, as the average market capitalization of companies considered to be ‘Value, Large Cap’ is $166.293 Billion. In the context of large-cap equities, value investors may focus on companies that have temporarily fallen out of favor with the market due to factors such as a poor earnings report, industry-specific challenges, or general market pessimism. These investors believe that such companies can rebound and offer attractive long-term returns when the market eventually recognizes their true value.

Simply put, the investment strategy seeks to acquire valuable assets when they are momentarily undervalued and hold them until they reflect their fully realized potential.

A look at the current performance of US large-cap value stocks

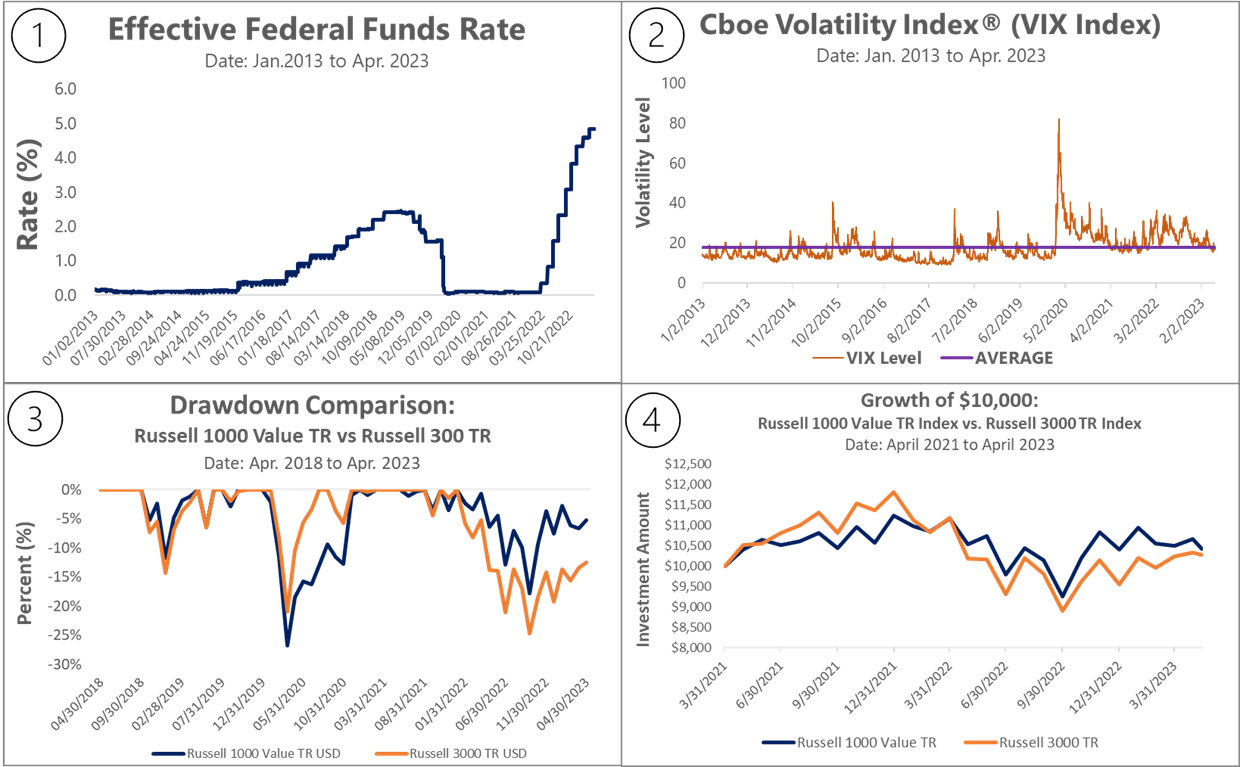

In the current market environment of elevated interest rates (panel 1) and above-average market volatility (panel 2), the performance of value, large-cap equities has been comparatively better than that of the broader equity market. As illustrated in panels 3 and 4 of the following chart, the recent drawdown performance of the Russell 1000 Value Index has been less than that of the broader market, as reflected by the Russell 3000 TR Index.

With growing uncertainty regarding the strength of the banking sector and the belief that the interest rates will remain higher for longer – investors are gravitating towards equities that are representative of established companies capable of navigating a precarious market landscape. A clear example of this is the acquisition of First Republic Bank by JP Morgan Chase (NYSE:JPM), due to depositors withdrawing their monies from the banking institution, resulting in them entering Federal Deposit Insurance Corporation receivership. JP Morgan Chase, a top ten index constituent of the Russell 1000 Value Index, is reflective of the surety and stability value investing provides during varying economic cycles.

A value-style focused investment solution

The JP Morgan Active Value ETF (Ticker: JAVA) is a pure value equity portfolio that utilizes a fundamental, bottom-up approach to identify attractively valued companies within each sector. As noted in the fund’s prospectus, securities held by the fund will predominantly be of companies with market capitalizations similar to those within the universe of the Russell 1000 Value Index.

The underlying strategy for the ETF utilizes the firm’s U.S. Value strategy and its Large Cap Value strategy, combining them to construct the portfolio. In executing the ETF’s investment objective, the manager will integrate financially material Environmental, Social and Governance (ESG) factors in both the investment analysis and decision-making processes, with the goal of enhancing long-term, risk-adjusted financial returns.

For investors seeking a value-style focused investment solution, JAVA offers a single-ticket solution to a mandate solely focused on companies that are stable and have showcased their resiliency over varying market cycles.

This content was originally published by our partners at ETF Central.