Stocks ripped higher following the Fed meeting on May 4, but that didn't last long. The move higher seems to have been premature, reversing gains on May 5. Investors seemed to have refocused their attention on the critical pieces of the meeting: the Fed would be raising rates and, more importantly, as a result tightening financial conditions.

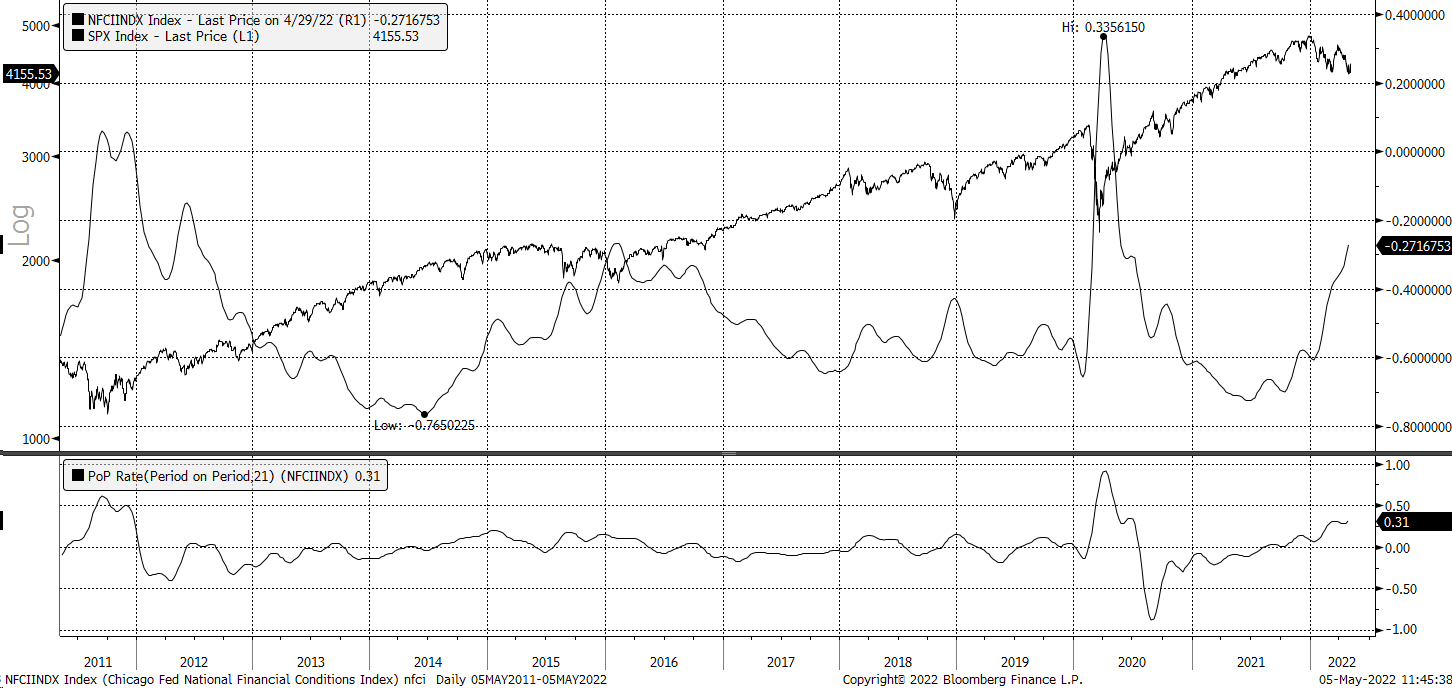

Financial conditions have already tightened as measured by the Chicago Fed National Financial Condition Index. Since the beginning of this year, those conditions have tightened materially, rising to -27 bps as of Apr. 28, up from roughly -60 bps. Over the same time, the S&P 500 has dropped almost 14%.

Conditions Are Still Easy

However, financial conditions will probably need to tighten even more and head towards neutral for the Fed to succeed. The Chicago Fed notes that when the index is below 0, it is historically associated with looser-than-average financial conditions. In contrast, positive values are traditionally related to tighter-than-average financial conditions.

Despite the current rise in the index, financial conditions are at least historically easy and suggest there will need to be even more tightening to come. We can see the damage that has been caused in the market with the current move higher in financial conditions, which has been around a 32-basis point increase. The pain could be massive, given that we have nearly the same amount of tightening ahead of us.

Tighter Conditions Create Pain for Stocks

Historically the data shows that when financial conditions tighten, they tend to be associated with volatility in the S&P 500, which is not different from what we have experienced recently. For example, in 2018, financial conditions tightened dramatically as the Fed raised rates, which sent the S&P 500 plunging by almost 20%.

Similarly, during the rate hiking cycle that started in late 2015, financial conditions increased dramatically in 2014. That period of tightening led to a long period of instability in the S&P 500, and it wasn't until conditions began to ease that stocks finally started to move higher again.

This would indicate that a meaningful equity market rally seems unlikely as long as financial conditions remain tight. Even worse than that, if they tighten further, it will likely lead to more pain for stocks.

How Far Will The Fed Go?

When the Fed talks about tightening financial conditions, it can only mean bad news for stock prices. Given the amount of tightening that is still ahead of us, the problem for stocks can only grow worse. If the Fed intends to tighten conditions beyond the neutral level, making financial conditions restrictive, things could worsen.

This could become particularly painful for stocks with high multiples and little earnings to show for it. The tightening financial conditions will further decline key valuation ratios like the price-to-earnings or price-to-sales. As these valuations compress, their future earnings become worth less, and when a company has no earnings, it makes valuing those stocks even riskier since there may be an uncertain path forward.

Of course, another question is how far will the Fed ultimately go in this process. Still, unless something changes quickly on the inflation front, it seems very hard to imagine financial conditions easing anytime soon.

When these financial conditions peak and begin to turn lower, that will be a clue that perhaps the worst of the equity market selloff is over.