How Did Semiconductors Become the Week's MVP in the S&P 500?

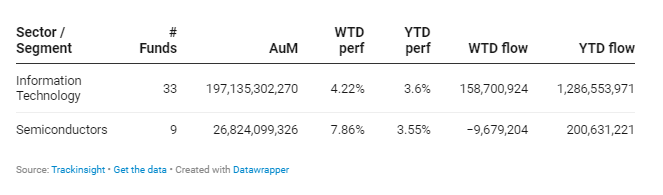

The spotlight was firmly on the information technology sector over the week, thanks to remarkable performance of semiconductor stocks. Fueled by strong spending trends in the field of artificial intelligence (AI), the sector, as represented by the S&P 500 Information Technology Index, experienced a remarkable surge, closing the week at an all-time high of 3,565.21 and reflecting an impressive increase of 4.31%.

TSMC: The Catalyst Behind the Surge

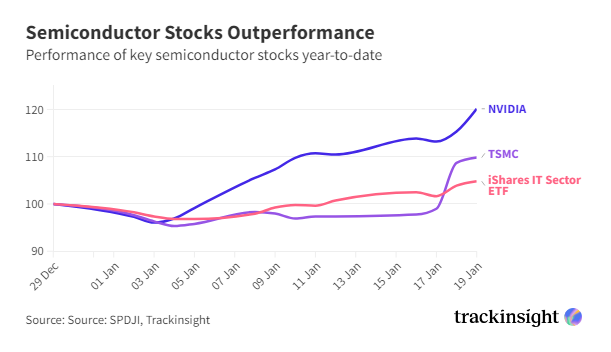

At the forefront of the week's market rally was Taiwan Semiconductor Manufacturing Company (TSMC), the globe's premier contract manufacturer of semiconductor chips and a key supplier to tech giants like Apple Inc (NASDAQ:AAPL) and Nvidia. TSMC's shares surged by 12.80%, sparking a bullish trend across the semiconductor industry, with the uptick attributed to the company's announcement of a projected 20% increase in year-over-year revenue - a testament to the soaring demand for advanced chips in AI technologies.

Impact on Leading Chipmakers and ETFs

Following TSMC's lead, Nvidia and Advanced Micro Devices (NASDAQ:AMD) also enjoyed significant gains, with their respective stocks climbing 8.74% and 18.88% over the week. Super Micro Computer Inc (SMCI) wasn't far behind, reaching a new peak after uplifting its annual forecast in response to escalating demand for AI capabilities, with a weekly stock increase of 24.68%.

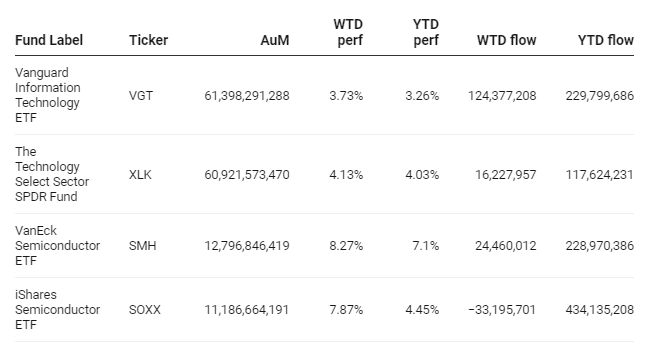

And this wave of optimism wasn't limited to individual stocks. Exchange-traded funds (ETFs) heavily invested in the semiconductor giants, such as the VanEck Semiconductor ETF (SMH) and the iShares Semiconductor ETF (SOXX), also saw considerable gains, up 8.27% and 7.87% respectively, again highlighting the market’s growing confidence in the semiconductor sector’s AI-driven future.

Bottom Line

The surge in semiconductor stocks not only shines a spotlight on the sector's critical role in the current technological revolution but also underscores the growing interest in AI applications. As companies continue to innovate and expand their AI capabilities, the semiconductor industry's growth trajectory seems poised for even greater heights.

Group Data

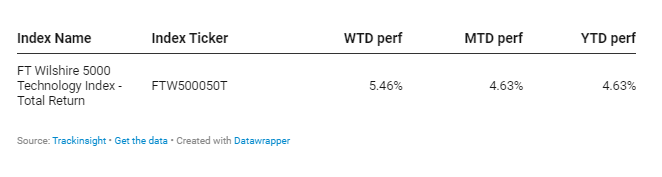

Index Data