SentinelOne Inc. (NYNYSE:SE:S) is one of the less established advanced cybersecurity companies working with artificial intelligence. The industry is positioned to have extremely high growth over the next few decades as AI, robotics and automation platforms scale.

As a result, many investments in the field are richly valued, but SentinelOne is much more favorable in this regard with a much lower price-sales ratio compared to competitors. In addition, the company is close to free cash flow positivity, which has been improving since its initial public offering. As this is an earlier-stage investment compared to the also attractive Zscaler (NASDAQ:ZS), the potential for outsized returns is more pronounced.

Operational analysisSentinelOne focuses on providing advanced cybersecurity solutions using AI and machine learnings. Its platform is designed to protect endpoints, cloud workloads, containers and internet of things devices through AI-powered autonomy. The company has developed a unified platform for its security offerings and has made multiple acquisitions since its IPO in 2021, including Attivo Networks for identity detection and response (purchased for $616.50 million in 2022).

SentinelOne has been named as a leader in Gartner's Magic Quadrant for Endpoint Protection Platforms. In addition, it has received 100% prevention in its latest MITRE ATT&CK Evaluation, demonstrating industry-leading analytic coverage and zero detection delays. Some of its core customers include Hitachi (HTHIY), Lyft (NASDAQ:LYFT), Electronic Arts (NASDAQ:EA), Aston Martin (LSE:AML), Samsung (KS:005930) (SSNLF) and Canva.

From my research, the top three publicly traded competitors to SentinelOne are likely CrowdStrike (NASDAQ:CRWD), Palo Alto Networks (NASDAQ:PANW (NASDAQ:PANW)) and Okta (NASDAQ:OKTA). CrowdStrike ($94 billion market cap) and Palo Alto Networks ($110.50 billion market cap) are both much larger than SentinelOne ($6.30 billion market cap). Okta has a market cap of around $15.80 billion.

Over the next 10 years, multiple sources estimate a compound annual growth rate of around 20% will take place in the AI cybersecurity market size. I believe this to be conservatively accurate. However, I also think there is some likelihood for the CAGR to increase as developed economies become more reliant on digital tools, AI and automation for deflationary economic factors by driving down the cost of production and cost of goods. I think there will be high demand from developed nations like the United States for automation to help in efforts to decrease the federal debt. As such, platforms like those offered by SentinelOne protecting the security of digital interfaces have the potential to see outsized growth beyond current leading research estimates, in my opinion.

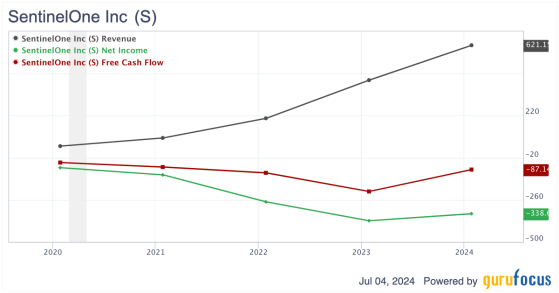

Financial analysisAs I mentioned in my introduction, SentinelOne has been growing its revenue rapidly with a three-year growth rate of 69.60%. However, its three-year earnings per share without nonrecurring items growth rate has been -23.60%. That being said, its three-year free cash flow growth rate is much more promising at 4.50%.

A large part of why the FCF is much more promising than the net income growth is the company has been utilizing a lot of stock-based compensation to date to pay its workforce. This is not necessarily a bad thing because it has helped to incentivize the team to drive growth in the top line, but now management arguably needs to focus on net income positivity to generate the price returns necessary to make the SBC worthwhile for stakeholders.

I believe that once the company begins to generate net income positivity, it will attract a whole new field of investors, driving the stock price up reliably if it can maintain this momentum. At this time, early investors would be wise to focus on the FCF growth the company has achieved and the fact it is much closer to FCF positivity than net income positivity, which shows a strong fundamental business despite factors like stock-based compensation impacting the bottom line.

In addition to the future outlook for SentinelOne that I deem positive related to its FCF and potential net income positivity, the company also has no long-term debt on its balance sheet. Its minor-impact lease obligations make its debt-to-equity ratio just 0.01. In addition, its equity-to-asset ratio is 0.70. For comparison, CrowdStrike has an equity-to-asset ratio of 0.37 and a debt-to-equity ratio of 0.31. Palo Alto Networks has an equity-to-asset ratio of 0.25 and a debt-to-equity ratio of 0.34. Therefore, SentinelOne is in a very favorable position for mergers and acquisitions compared to its peers on some level, but we have to remember how large these two companies are compared to SentinelOnethis means that even though they are more leveraged, they have the capacity to acquire larger emerging competitors.

Valuation analysisAt the time of writing, SentinelOne has a price-sales ratio of almost 9, which is significantly lower than its total historical median of almost 13. In addition, CrowdStrike has a price-sales ratio of 29.49 and Palo Alto Networks has a multiple of 15.48. Okta has a price-sales ratio of 6.56. Therefore, SentinelOne is undoubtedly significantly undervalued compared to some of its leading peers and its historical valuation multiples.

In my opinion, it is reasonable to expect the company's price-sales ratio may expand somewhat as it grows in profitability, but in the near term, I think it will contract further. Therefore, for my estimate, I have predicted the company may have a price-sales ratio of 8 by July 2025. Considering the company's revenue is forecasted to grow at approximately 30% by Wall Street analysts on consensus over the next year, this suggests a potential one-year price target of $23.40, implying a CAGR of 16% as the current revenue per share is $2.25 and the stock price is $20.15.

However, over the long term, once the company begins to report GAAP profitability, I think the growth has the potential to compound more. It is not unreasonable for the price-sales ratio to have expanded to 10 by 2034, considering Palo Alto had its IPO in 2012 and has a price-sales ratio of 15.48. I believe this expansion would be primarily driven by investor sentiment rising as a result of profitability growth. If SentinelOne manages a 15% revenue CAGR over the next decade, it would make its share price $91, implying a CAGR of 15.50%.

Risk analysisWhile my estimates here are optimistic, there is the possibility that management struggles with profitability more than I anticipate, which could reduce investor sentiment, contracting the price-sales ratio over 10 years. The company expects to achieve positive free cash flow and non-GAAP operating income by the end of fiscal 2025, but GAAP profitability could take longer. Factors that could influence this include high levels of competition and the advent of new AI-led cyber threats, which require more advanced systems to combat. It is likely larger players that have the capability to acquire more technologies will be able to stay ahead of newer entrants like SentinelOne.

There are also risks related to the fact SentinelOne's offerings are highly dependent on AI and ML capabilities. Like all uses of these technologies at this early stage of development, AI-led cybersecurity systems can give false positives and also run the risk of missing crucial breaches and security risks, which good human intervention may not mistake in the same way. There are also likely to be growing regulatory pressures as the AI systems become more advanced, especially as the company grows its contracts with more sensitive, larger enterprises where data protection is crucial to public security.

ConclusionIn my opinion, SentinelOne could be a very high-growth investment over the next decade. In particular, I think it has the potential for significant near-term alpha as a result of high revenue growth rates and a price-sales ratio which I think will not contract much further. The company faces risks from growing threat intensity from AI-lead malware, but its lack of long-term debt and strong balance sheet indicates it is relatively well-positioned for M&A to strengthen itself accordingly. Free cash flow positivity is near, so once the company reduces its stock-based compensation and begins to buy back shares, I think it is highly likely the stock will gain a lot of positive sentiment in the market. There are challenges to management achieving this, but I think the company's success is probable.

This content was originally published on Gurufocus.com