Shopify (NYSE:SHOP) is a Canadian e-commerce web development platform that serves clients of all sizes. It also offers complementary services such as payment processing, shipments, marketing, and financing solutions. In 2024, the websites that used Shopify as a provider had an estimated market share of over 12% in US e-commerce.

In the market sell-off of 2022, Shopify’s stock suffered significantly, dropping approximately -86%. The company overestimated growth prospects during the pandemic and increased operating expenses from 47.97% of revenue to 63.86%, resulting in an FY 2022 net income loss of $3.447 billion.

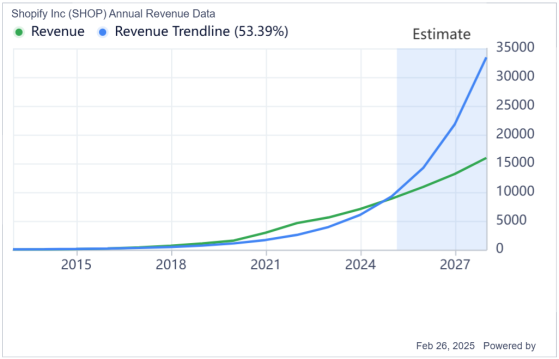

Despite these headwinds, the stock price has recovered significantly, from $25.67 to $110.95, thanks to a strong recovery in revenue growth and margins. Simultaneously, the top line is expected to continue accelerating in the following years as the company cross-sells new solutions and increases its total addressable market.

How Does the Company Generate Revenue?

Shopify generates revenue through two methods. One is through Subscription solutions, which are the least volatile and include recurrent revenue from POS terminals, websites, apps, and domain subscriptions. In Q4 2024, Shopify achieved a record $666 million in this category, rising 26.8% YoY.The second is through Merchant solutions, which provide customers with a centralized e-commerce platform to run their online business entirely. Here, Shopify earns from payment processing fees, currency conversion, and working capital lending. Recently, the company obtained $2.146 billion in quarterly revenue, growing 32.5% YoY. Finally, based on what the company has described, the sales volume is affected by seasonality, making Q4 the strongest quarter due to holiday demand, while Q1 is typically the weakest.

Outlook and Challenges

Source: SHOP IR

Shopify has been successful in incorporating every type of client, from solo entrepreneurs who want to build an online store to large enterprises with billions of sales. Simultaneously, the company has been cross-selling other solutions necessary to run an online business, which has allowed the company’s financials to grow at double digits and increase its total addressable market.

These integrated solutions have increased customers’ switching costs, especially on the web development front, as many apps are built exclusively for Shopify. At the same time, accepting Shopify Payments on a website tends to be cheaper than accepting Stripe or PayPal (NASDAQ:PYPL), as Shopify charges an extra fee per transaction, making customers more inclined to use Shopify Payments.

Risks to Shopify’s Business

Although Shopify Payments (part of Merchant solutions) is driving most of the growth, it certainly has lower gross profits than Subscription solutions due to associated third-party costs and lower take rates. For example, in FY 2024, Subscription solutions had a high gross margin of 81.5% vs. 39.1% from Merchant solutions. As the company has commented, this change in revenue mix is likely to decrease overall gross margins going forward.At the same time, operating expenses continue to weigh heavily on overall revenue due to significant marketing and R&D costs. In FY 2024, OPEX represented 76% of the gross profit. Nonetheless, as the company grows, it is expected for these high expenses to decline as a percentage of revenue, potentially improving bottom-line items.

Finally, Shopify has benefited from higher interest rates, where they can earn interest from three solutions

Over the past two years, interest income has multiplied by 4.1x to $308 million. Yet, due to lower interest rates, this line item will likely decline or experience slower growth in 2025.

Valuation

Source: Author’s calculations | 3Y Estimates: GuruFocus

Inputting revenue and net income consensus estimates for the next three years, with a cost of equity of 12.6% based on CAPM, provides an intrinsic valuation of $38.4, which makes the actual price of $110.95 extremely overvalued. However, Shopify’s valuation has always been expensive on an absolute basis. For example, the price-to-sales ratio and the forward PE are absurd at 16.2x and 76.8x, respectively. Still, the market has soared in enthusiasm, with the company growing revenues for the past two years at an average of 25.9%, even when considering a massive drop in growth rates compared to pre-pandemic levels.

WIX Data by GuruFocus

At the same time, there is a valuation discrepancy between its closest peer, Wix.com (WIX), which is also a web development platform targeted towards e-commerce. Clearly, Shopify has been more effective in growing its market share, as displayed below, justifying a higher multiple. Yet, the forward PE of 76.8x is too high vs. the 26.9x of Wix, concluding a strong overvaluation of the stock.

WIX Data by GuruFocus

Takeaway

Overall, Shopify is a great business with a moat and is likely to obtain a higher return on equity than its costs of capital for many years. The company is becoming diversified in many different ways, and the integrated solutions bring high switching costs to merchants. As the company increases its TAM, the opportunity to grow at high growth rates would likely persist for many years. Nonetheless, the valuation is hard to justify, and in a bearish backdrop, the stock would likely result in large drawdowns, as happened during 2022. At the same time, as most of the gross profits come from financial solutions, the company becomes more economically sensitive, bringing a poor hedge in an inflationary period. Therefore, investors may consider entering the stock with a cautionary approach.This content was originally published on Gurufocus.com