Why Buy Canadian ETFs?

Buying Canadian ETFs is an obvious choice. Because U.S. stocks trade in USD and Canadians generally get paid in CAD, there is an additional hurdle to jump through before buying U.S. ETFs as a Canadian investor.

Investing in USD-denominated ETFs necessitates exchanging CAD for USD, leaving investors at the mercy of the current exchange rate and any markups their brokerage charges. For many, this cost can substantially eat into long-term returns.

Fortunately, many fund managers have released CAD denominated ETFs that hold a basket of USD stocks or USD ETFs in a "wrapper" structure. Canadians looking for their U.S. equity exposure can buy these ETFs and pay in CAD without worrying about converting currency. A list of these potential ETFs can be found via the Trackinsight ETF screener by filtering for Canadian equity ETFs.

There is a catch, though – Some of these ETFs come in both currency hedged and unhedged forms. What's the difference? And which one should average investors pick? Let's find out.

What are Unhedged ETFs?

For example, let's use the famous S&P 500 Index (SPX). The underlying stocks of the S&P 500 trade in USD - Canadian ETF that holds the S&P 500 trades in CAD.

Because of this, the fluctuation between the CAD-USD pair can affect the value of the Canadian ETF beyond the price movement of the underlying stocks:

- If the U.S. dollar appreciates, the CAD S&P 500 ETF will gain additional value beyond the movements of its underlying U.S. stocks.

- If the Canadian dollar appreciates, the CAD S&P 500 ETF will lose additional value beyond the movements of its underlying U.S. stocks.

ETFs that are unhedged accept this phenomenon. That is, their share price is also affected by currency volatility. This can alter their daily and long-term returns and result in different performance versus their underlying index, whether good or bad.

What are Hedged ETFs?

ETFs that are currency hedged mitigate this volatility by buying a derivative called a future to lock in a set CAD-USD exchange rate every month. With a currency hedged fund, the changes between the CAD-USD pair will not affect the value of the ETF. You only get the movements of the underlying stocks net of a management fee — nothing more.

Currency hedging, therefore, ensures that the performance of the CAD ETF is solely based on the performance of its underlying USD stocks. While you lose out on potential gains if the USD appreciates, you also mitigate potential losses if the CAD appreciates. This makes currency hedged ETFs less volatile than their unhedged counterpart.

Which One is Better: Unhedged or Hedged ETF?

The answer to this question depends on an investor's risk tolerance and time horizon. Unhedged is generally better for young investors who don't mind additional volatility. Let's illustrate by comparing the Vanguard S&P 500 Index ETF (VFV) against the Vanguard S&P 500 Index ETF (CAD-Hedged) (VSP).

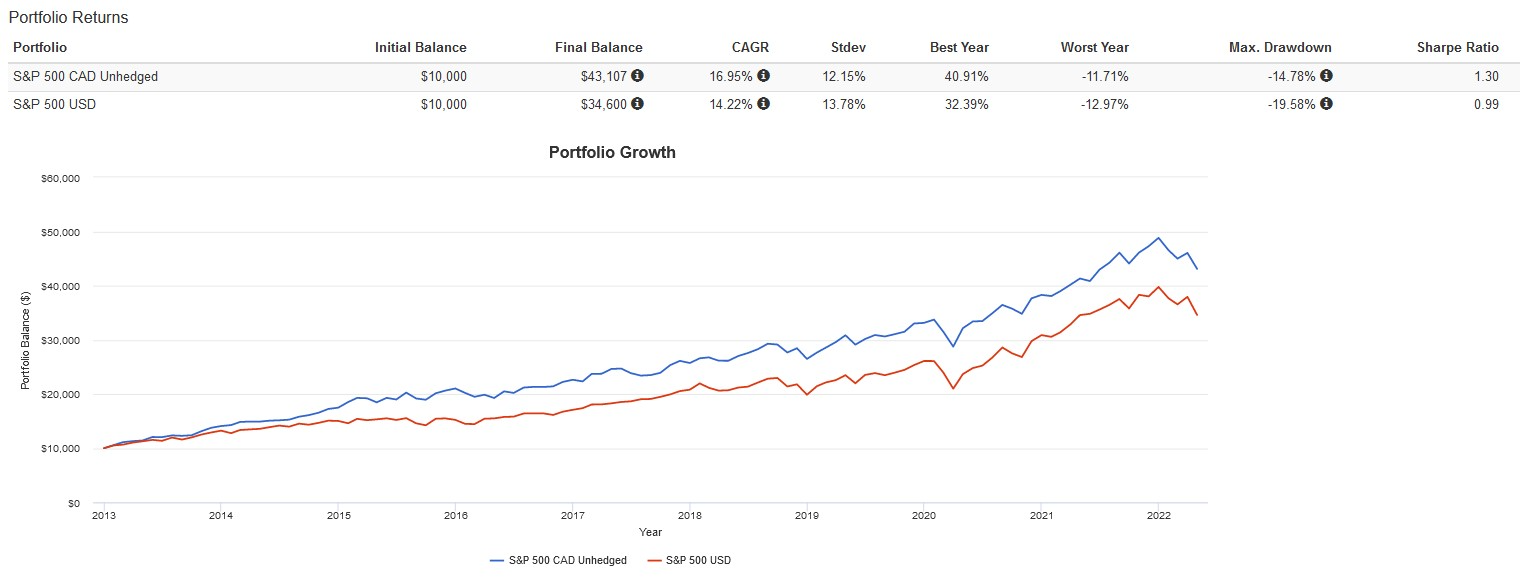

Over long periods, currency fluctuations between the CAD-USD pair generally revert to the mean. Over the last decade, the appreciation of the U.S. vs CAD (and recently) gave unhedged ETFs like VFV a substantial edge in performance over their U.S. counterparts, as seen in this chart below.

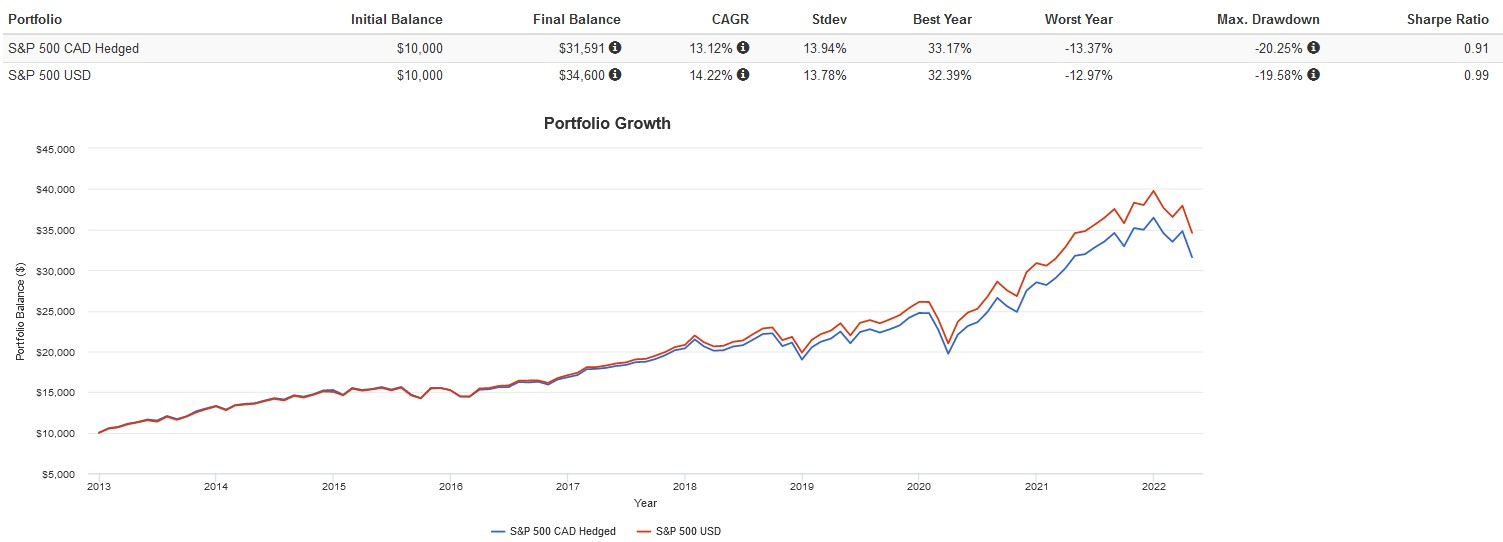

The biggest reason young investors pick an unhedged ETF is tracking error, which is defined as the percentage in the ETF’s performance that differs from the performance of the index it replicates. Currency hedging costs money – fund managers must continually sell and buy futures contracts (rolling) as they expire monthly. This adds trading expenses, which eat into the ETF returns and causes underperformance. VSP has underperformed its USD counterpart by 1% annually since inception.

The verdict? Avoid currency hedged ETFs unless you're an older investor with a shorter time horizon until retirement. In that case, the additional volatility from currency exchange rate fluctuations might not be desirable for your risk tolerance, making hedged ETFs a more conservative investment.

The following article was originally published by our partners at the Canadian ETF Market.