Broadcom Inc. (NASDAQ: NASDAQ:AVGO) has established itself as a significant player in the semiconductor and infrastructure software sectors, capitalizing on the rapid adoption of artificial intelligence (AI) and the expansion of data centers. If you’re convinced that AI networking and cloud computing are the future, you might see Broadcom as a long-term option, especially since its AI-driven expansion has boosted both income and earnings.

Broadcom’s valuation is huge compared to a lot of its competitors. At one point, its P/E ratio hovered around an eye-popping 170, and that alone could scare off some folks who want a quick return. Sure, there’s a decent dividend and reliable cash flowwhich is a big plusbut if you’re just jumping in right now, you might want to wait and see if the price settles a bit. I’d personally keep an eye on it before committing new money.

You might also want to wait and see whether Broadcom can actually sustain its exceptional performance, or whether it’ll face more pressure from NVIDIA (NASDAQ:NVDA), AMD (NASDAQ:AMD), and Texas Instruments (NASDAQ:TXN) as the next earnings date of March 6, 2025 approaches.

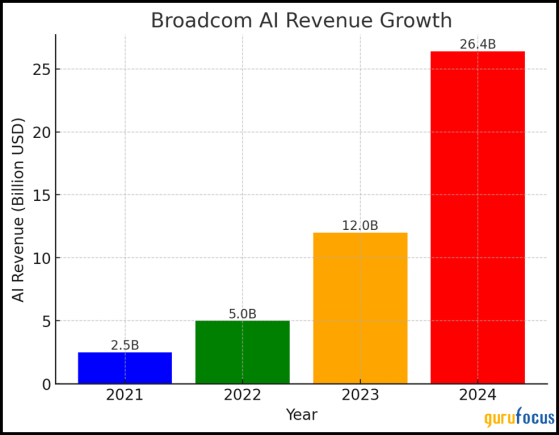

Financial Performance: Awaiting the March 6 Earnings Report With Broadcom’s Q1 2025 earnings report scheduled for March 6, a lot of eyes are on whether the company can keep up its impressive AI-driven growth. Last year, Broadcom’s AI revenue shot up by a whopping 220% year-over-year, which helped push total revenue to $51.6 billion. That’s huge, but here’s the real question: can Broadcom maintain that momentum?

Analysts are currently predicting an EPS of $1.51 for the quarter, with an expected range of $1.44 to $1.55slightly higher than last quarter’s $1.42. Broadcom has beaten EPS estimates 100% of the time over the past 12 months, whereas its peers have only managed it about 66.88% of the time. If Broadcom outperforms again, it might give investors more confidence in its lofty P/E of 172.87. But let’s face it: any slip-up could trigger a steep sell-off.

On the revenue side, forecasts for Q1 2025 come in at $14.62 billion, up from $14.05 billion last quarter, with projections ranging between $14.39 billion and $14.83 billion. Broadcom has beaten sales estimates 75% of the time, outperforming the industry average of 67.37%. Still, this quarter is a big testwill AI infrastructure and software revenues keep surging?

Beyond EPS and revenue, you’ll want to pay attention to free cash flow (FCF) and debt management. Broadcom’s FCF margin stood at 39% last quarter, which helped extend its 14-year dividend growth streak. However, with a debt-to-equity ratio of 97.94%, the company’s financial leverage is higher than that of its peers. If Broadcom can keep its cash flow stable and allocate capital efficientlyespecially given how capital-intensive AI can beit might keep investors happy.

Broadcom’s Valuation: A Deep Dive Into Its Pricing Broadcom’s valuation is one of the most contentious aspects of its stock, mainly because it’s priced so much higher than its competitors. So, let’s talk about the numbers and figure out if this premium really makes sense.

Right now, Broadcom’s P/E ratio sits around 172.87, which is downright massive compared to NVIDIA (47.46) or Texas Instruments (39.22). That tells me investors are betting big on Broadcom’s ability to keep growing quickly and maintain those AI-driven earnings. But let’s be honestwhen a stock is this pricey, even a small earnings miss can trigger a pretty steep sell-off.

You’ve also got a P/S ratio of 12.54, which suggests people are willing to pay over 12 times Broadcom’s revenue. That’s no small premium, especially when AMD’s ratio is just 3.39. If Broadcom can’t keep boosting its revenue at a blistering pace, there’s a real chance that lofty multiple could come crashing down.

And then there’s the EV/EBITDA figure of 45.87, which is even higher than NVIDIA’s 38.90 or AMD’s 34.30. Essentially, investors are expecting Broadcom to churn out strong profits for quite a while. That’s fine if AI demand keeps roaring ahead. But what if it cools or if competitors ramp up their pricing pressure? Broadcom might struggle to justify its valuation if any of those scenarios play out.

Competitive Analysis: NVIDIA, AMD, and Texas InstrumentsBroadcom goes head-to-head with three major players: NVIDIA, AMD, and Texas Instruments. Each one poses a different kind of challenge.

NVIDIA dominates the AI market with around 79% of the AI GPU space and is rapidly expanding its data center and AI software ecosystem. That dominance makes it Broadcom’s toughest rival. If NVIDIA keeps innovating at its current pace, it might be tough for Broadcom to hold onto its valuation premium.

AMD, on the other hand, is pushing aggressively into AI chips with competitive pricing strategies that could nibble away at Broadcom’s market share. AMD’s data center growth soared by 250.27% year-over-year, proving it’s a serious contender in AI-driven networking solutions.

Texas Instruments is more of a conservative competitor, focusing on analog and embedded processing rather than AI hype. It’s all about capital efficiency and strong returns on investment, which can appeal to investors who’d rather have steadier, lower-risk semiconductor plays.

If Broadcom can’t differentiate itself beyond AI networking and software, it might lose groundespecially with NVIDIA and AMD constantly pushing new boundaries in AI chip development.

Conclusion:Broadcom’s AI-driven growth and strong cash flow make it an attractive long-term investment, but its high valuation creates near-term risks. Investors looking to enter may want to wait until after the earnings report for a clearer picture.

Broadcom is a solid long-term hold. Yet with a P/E of 172.87, a P/S of 12.54, and high debt levels, the stock has limited upside unless earnings surprise significantly. Investors should monitor earnings growth and AI market share trends closely.

This content was originally published on Gurufocus.com