Silver is down 10 days in the row since we recommended shorting it

Source: Bar Chart (edited by Short Side of Long)

At the end of October we highlighted the risks on Precious Metals assets. From the technical perspective, Gold and Silver failed to break above their respective 200 day moving averages, reversing sharply on the FOMC announcement. Furthermore, investor sentiment and positioning by hedge funds was very bullish, indicating an above average possibility of a shake out. We were recommending a contrarian bet by shorting the metals. In particular, our focus was Silver, where Managed Money COT reached record bullish bets.

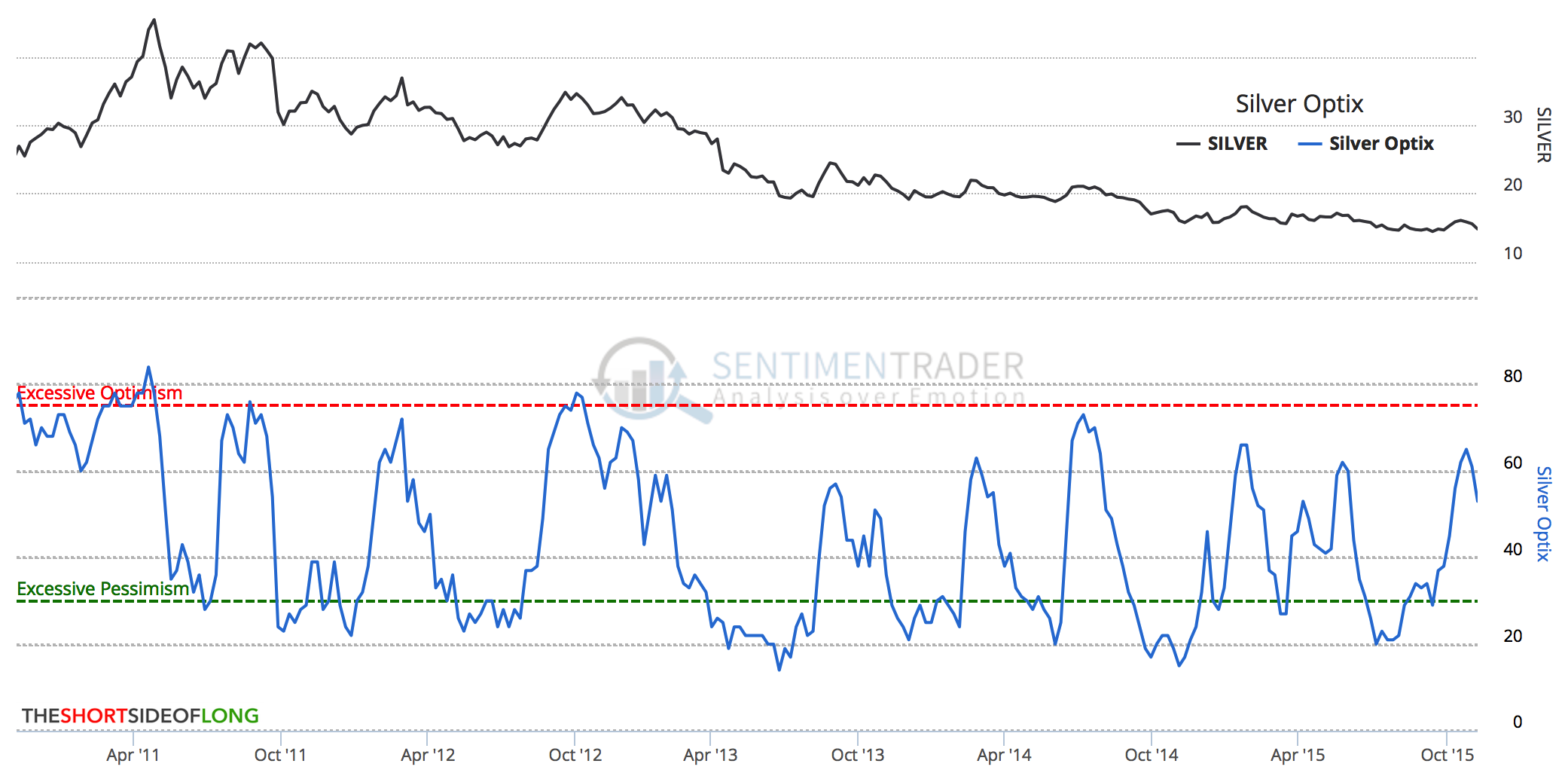

Unsurprisingly, the metal did go down. Selling pressure has been remarkably strong and Silver price is currently down for the 10th day in the row. However, what is even more interesting is how sentiment is behaving right now. A couple of months ago, a slight Silver rally pushed SentimentTrader’s Optix from 20% to above 60%. On the other hand, a complete reversal of this rally towards 52 week lows has not pushed Optix back to 20%. We are presently surprised to see that bulls still outnumber bears, holding onto hope, with today’s sentiment readings coming in at 53%.

They say that bear markets slide a slope of hope, so the question now is, how low will Silver have to go before sentiment turns so bad, that it's actually good? While we don’t expect a straight line down, as near-term oversold levels should see somewhat of a rebound, we are predicting that prices could move towards fresh 52 week lows.