- Silver could break $35 and move toward $38.

- A potential supply-demand deficit could fuel the breakout.

- Fed meeting may influence silver’s trend in the near term.

- Looking for more actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to ProPicks AI winners

Silver, like Gold, has continued to rise in recent weeks, reaching long-term highs of around $35 per ounce. Demand is driven by geopolitical and economic tensions, such as the tariff war, as well as a weaker US Dollar, which typically benefits precious metals.

From a fundamental perspective, another supply-demand deficit is expected this year, supporting the potential for further price increases. Investors in silver should also consider companies involved in its extraction. One major player is Pan American (TSX:PAAS) Silver (NYSE:PAAS), a Canada-based company operating primarily in Latin America, which has seen gains in recent quarters as silver prices have moved upward.

Strong Chance of Surpassing $35 per Ounce

During yesterday's session, silver nearly tested the long-term high set last October. With strong factors supporting further gains, a breakout above this level appears likely.

Figure 1 Technical analysis of silver

A clear breakout above this level could push prices toward the February 2012 highs, just below $38 per ounce. Conversely, if resistance holds, a short-term pullback below local support around $34 per ounce could signal another test of buyers’ strength. In that case, the key level for sellers would be the long-term upward trend line, which has repeatedly prevented a deeper correction.

For better entry points in a potential continued uptrend, investors should watch demand zones at $32.50 and $31.50 per ounce. However, a pullback to these levels remains less likely unless market fundamentals shift significantly.

Pan American Silver’s Uptrend Gathers Momentum

Investing in precious metals is not limited to products tied directly to commodity prices. Investors can also consider companies involved in metal extraction. In silver mining, Pan American Silver Corporation stands out as a major player, particularly in Latin America.

The company’s stock has been trending upward for over a year, largely driven by rising silver prices. Recently, this uptrend has gained momentum, increasing the likelihood of a move toward the key resistance zone near $30 per share.

Figure 2: Technical analysis of Pan American Silver

If this resistance is broken, it would signal a strong long-term continuation of the upward trend. In the event of a pullback, the main support remains the upward trend line.

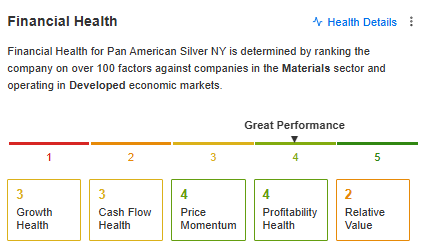

Additionally, the company's financial health rating stands at 4 out of 5, reinforcing its solid position.

Figure 3: Pan American Silver's financial health index

If macroeconomic and geopolitical conditions continue to support silver’s growth, this scenario has a strong chance of playing out. In this context, today’s Federal Reserve meeting will be important, as it could provide more insight into U.S. monetary policy.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belong to the investor. We also do not provide any investment advisory services.