Key Points:

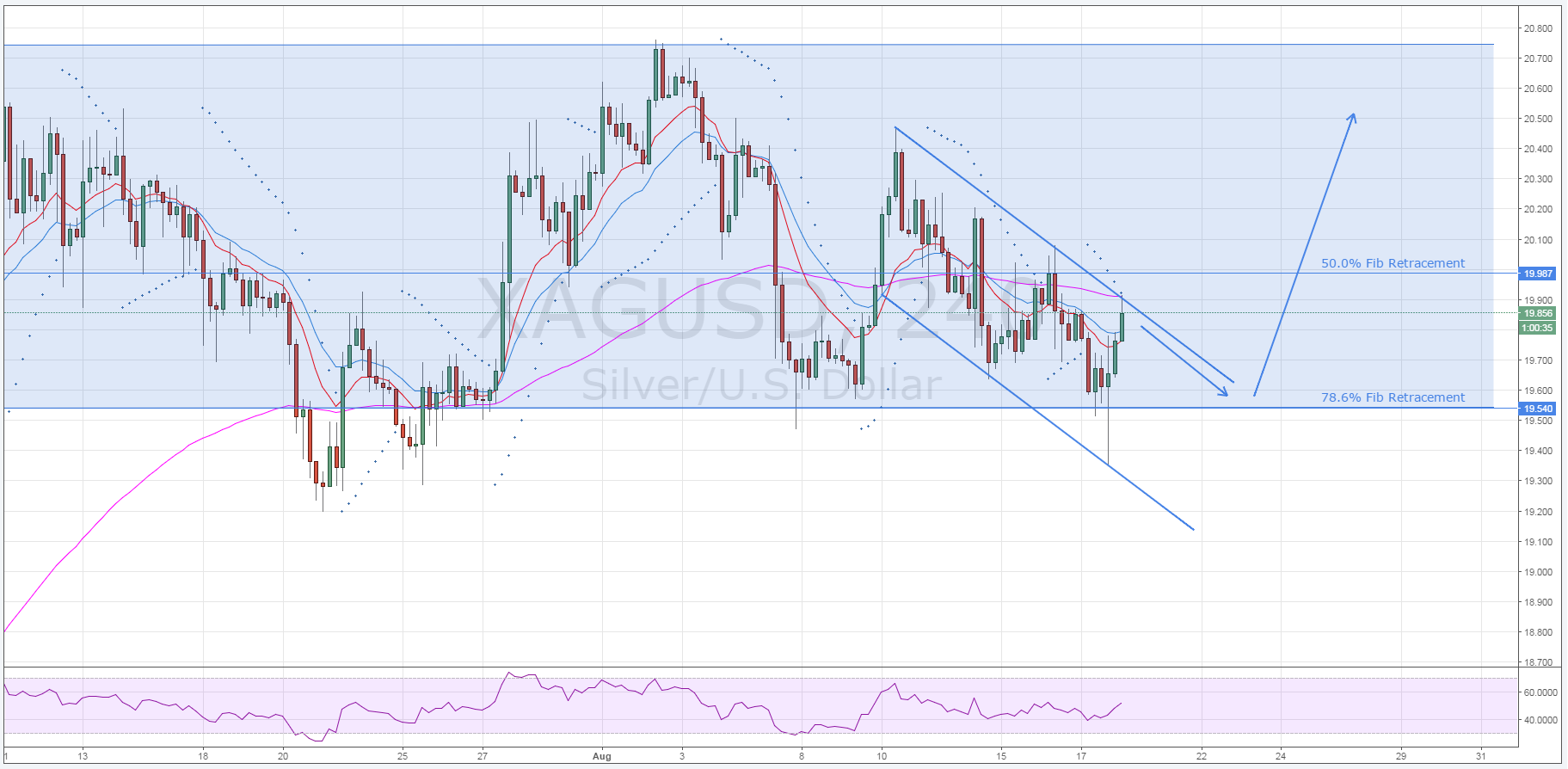

- Silver is reaching the lower constraint of the ranging phase.

- Short-term bearish channel in place.

- Reversal likely at the 19.540 price.

The relatively range-bound silver is nearing the downside of its confining channel which means another reversal is likely over the next few sessions. Consequently, eyes will be fixed on the metal as it reaches the 19.540 level as this should prove to once again be a point of inflection. However, any proceeding upside could be capped somewhat by a rather robust zone of resistance around the 19.987 level. As a result, this level will also be in focus as the pair begins to ascend once again.

As shown below, silver is currently following a short-term descending channel lower which should bring the metal back to the downside constraint of the long-term ranging phase. However, recent bullishness has cast some doubt on silver’s short term forecasts as it could have already reversed. Fortunately, a number of other technicals are presently signalling that the metal is set to move back to the 78.6% Fibonacci level at least once more prior to moving upwards again.

Firstly, the EMA activity on the H4 chart remains highly bearish which should see buying pressure build during the coming session. Furthermore, the 100 period moving average will be providing some dynamic resistance which will cap silver’s ability to surge higher. In addition to the moving averages, the Parabolic SAR reading retains its bearish bias and this will likewise be exerting some downward pressure.

After moving back to support at the bottom of the sideways channel, the metal is expected to regain some buoyancy and move higher once again. Whilst silver could very well reach the 20.700 mark as a result of this recovery, it will encounter some fairly heavy resistance around the 50.0% Fibonacci level at the 19.987 price. This zone has already proven to be a formidable opponent to any recovery to the upside and, as a result, will need to be broken before there is a high probability of 20.700 being challenged again.

Ultimately, silver’s recent ranging phase has proven to be fairly consistent and the metal usually corrects itself quickly if it strays below the downside boundary of the channel. Consequently, there is relatively little downside risk once the metal reaches this key support and, even if resistance at 19.987 holds, there is significant upside potential going forward. However, keep an eye on silver as it approaches these key points as fundamentals could come into play and upset the long-term sideways trend.