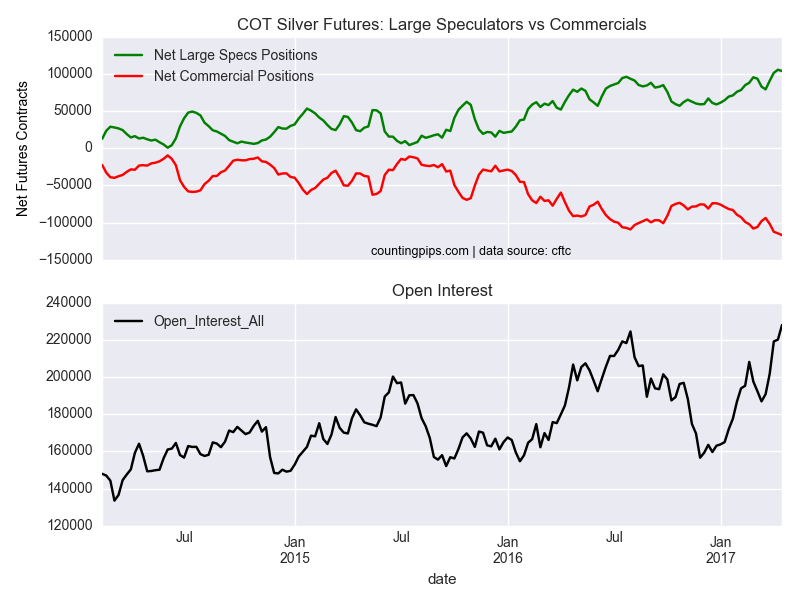

Silver Non-Commercial Positions:

Large speculators and traders slightly pulled back on their bullish net positions in the silver futures markets last week off of their record high levels, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex silver futures, traded by large speculators and hedge funds, totaled a net position of 103,887 contracts in the data reported through April 18th. This was a weekly decrease of -1,628 contracts from the previous week which had a total of 105,515 net contracts.

Silver speculative positions had made two consecutive record high levels before last week’s slight pullback. The net position remains above the +100,000 contract level for a third week.

Silver Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -116,832 contracts last week. This is a weekly change of -2,418 contracts from the total net of -114,414 contracts reported the previous week.

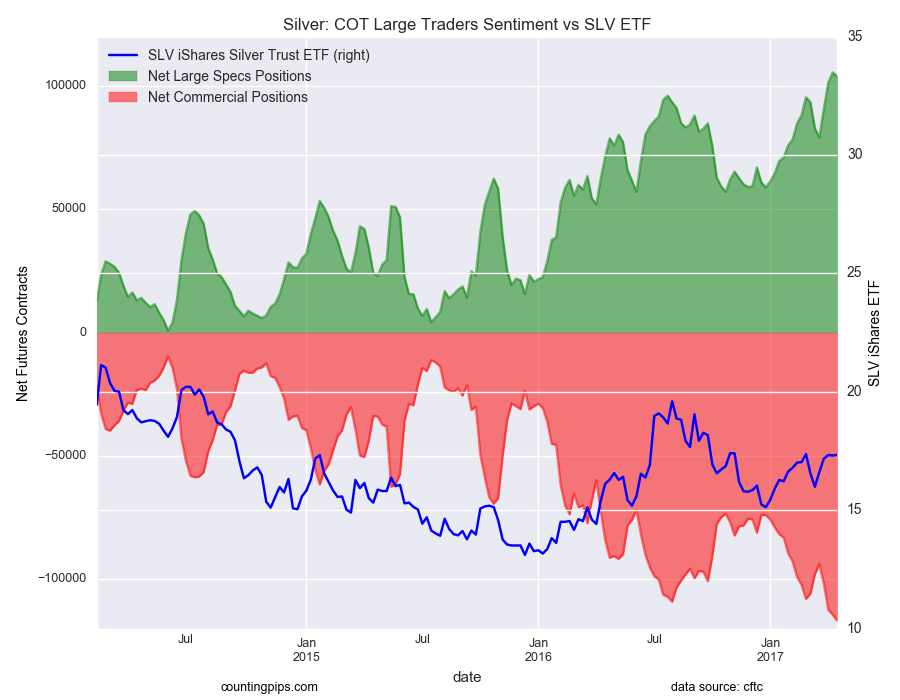

iShares Silver (NYSE:SLV) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SLV ishares ETF, which tracks the price of silver, closed at approximately $17.34 which was a edge higher of $0.03 from the previous close of $17.31, according to ETF financial market data.