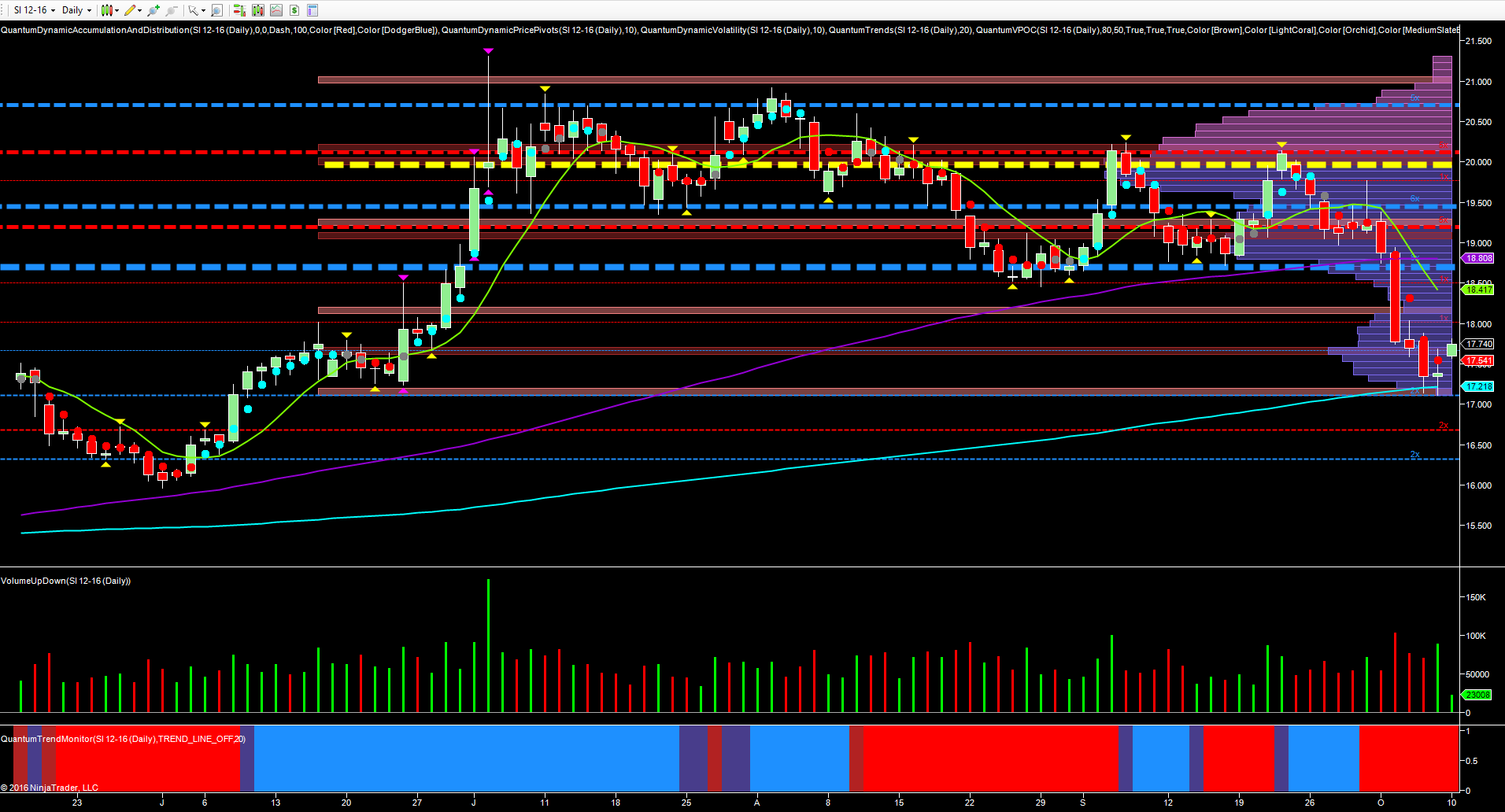

Last week was a torrid time for the precious metals, with both gold and silver breaking through key support levels above, and as a consequence turning heavily bearish. The two charts are almost identical with volume profiles to match.

For silver, it was Tuesday’s price action which delivered the knockout blow, driving through the potential support area at $18.71 per ounce and moving swiftly through the low volume node at $18.20 per ounce, before closing on the day at $17.77 per ounce.

Thursday’s price action then delivered further bearish momentum, before Friday’s doji candle brought some respite, with the $17.11 per ounce area coming to the rescue.

In early trading, silver has regained some of last week’s losses, opening gapped up at $17.60 per ounce, but remaining in a very fragile state. Given the weight of technical resistance now layered overhead, the longer term outlook looks increasingly bearish.

Should the minor support at $17.11 per ounce fail to hold, then the price of silver looks set to decline further, with a move to test the $16.600 per ounce area first, followed by $16,375 per ounce. Thereafter silver will move to June's low at $15.96 per ounce.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI