The much awaited Jackson Hole speech by the Fed Chair Janet Yellen and the subsequent nonfarm payrolls data, failed to ignite the prospects of a rate hike this September of 2016. The market now forecasts only a 21% probability of a rate hike in this month. The probability of a rate hike in December of 2016 stands at just above 50%.

Time and again, I have explained why the Fed cannot hike rates in 2016. According to my research, the chances of a rate hike in December of 2016 are also very bleak. Nonetheless, Fed speakers will continue to “jawbone” the dollar, much the way they have been doing this whole year.

The coming week features a number of Central Banks competing with each other to unleash their monetary easing plans as if that is the only solution to all the economic problems plaguing the world. Even the failures of the past seven years have not deterred them from printing more money from thin air.

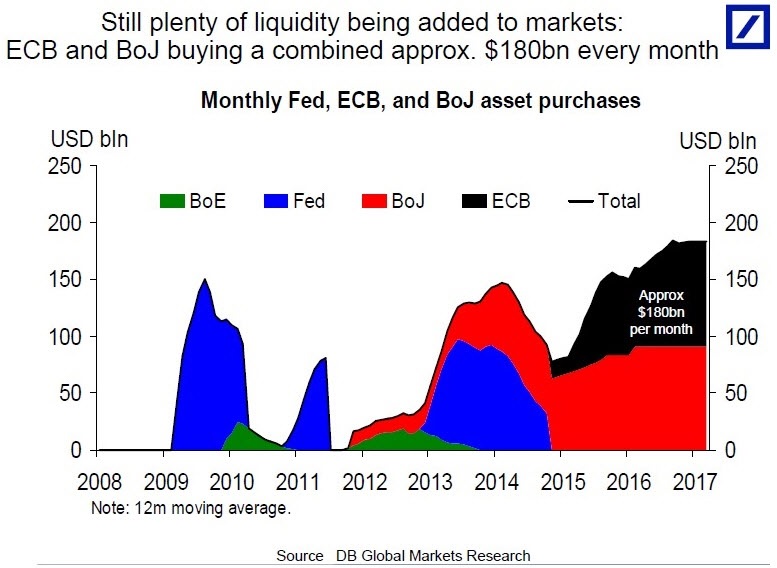

$180 Billion Of Bond Buying – Even Larger Than 2009

The European Central Bank and the Bank of Japan combined are purchasing a whopping $180 billion of bonds monthly, as shown in the chart below. Add to that, the new bond buying program announced by the Bank of England, and the number goes even higher. All three are expected to recommend either adding to their existing bond purchases or extending the purchasing duration in their next policy meetings.

This has led the Bond King, Bill Gross, to warn investors of the dangerous consequences. In a letter to clients, he wrote: “Investors should know that they are treading on thin ice”.

“This watch is ticking because of high global debt and out-of-date monetary/fiscal policies that hurt rather than heal real economies. Sooner rather than later, Yellen’s smooth shot from the fairway will find the deep rough,” reports CNBC.

Silver Is On The Cusp Of A Massive Rally

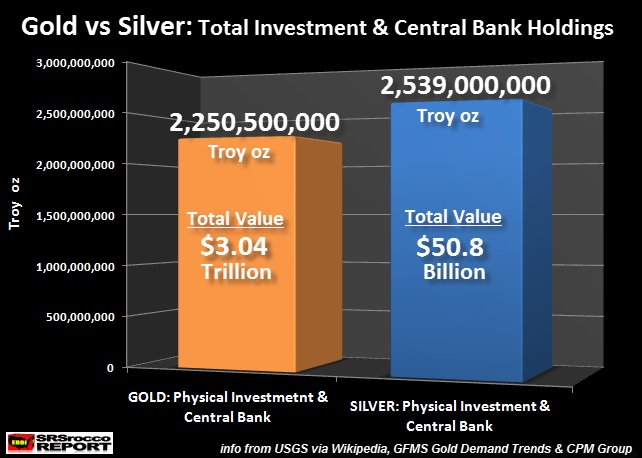

When investors realize that they are holding worthless currencies, the big money will rush into the precious metals. Consider this: The world’s total investment holdings in silver are a paltry $50.8 billion, compared to $3.04 trillion in gold, as shown in the chart below.

Did you know that the hedge funds alone manage around $2.7 trillion of assets, according to Barclay Hedge data? Even if a small portion of the trillions sloshing around out there decides to enter into silver, the white metal will shoot through the roof.

Traders Are Finally Recognizing The Importance Of Silver

Following the poor jobs report last Friday, traders jumped into silver, thus driving it higher, as shown in the chart below. As explained in earlier articles, investors should not only look to buy into the “white metal”, they should also explore options of investing in the silver miners.

What Are Silver’s Technicals Suggesting?

Silver had a massive run from the lows of $15.83 to $21.22. Since no markets rise vertically, a 50% Fibonacci correction is a healthy and accepted norm. As seen in the charts below, silver too has corrected 50% of its recent rise.

The weaker hands are out of silver, whereas the stronger hands have bought the white metal at lower levels. Silver is currently trading above both its 20-day and 50-day exponential moving average. This is a sign that it has resumed its uptrend and is set to rally higher.

Once silver crosses above the highs of $21/oz, it should reach its target of $25/oz.

Conclusion

As Bill Gross says, world markets are being manipulated by the Central Banks. Consequently, investing is becoming a difficult proposition. You need to invest at the right time and to be positioned properly for when high volatility strikes.