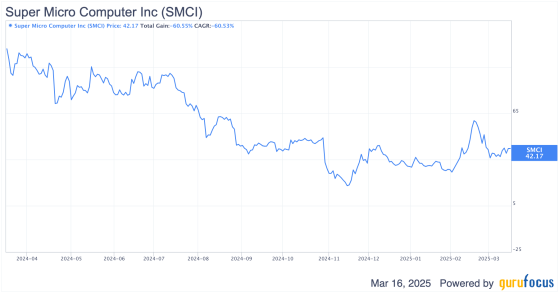

SMCI has been a wild ride lately, with plenty of noisy headlines over the past year. In August 2024, the company faced serious allegations from Hindenburg Research about accounting irregularities, which led to delayed financial filings and even the resignation of its auditor, Ernst & Young, in October 2024. These issues sent SMCI’s shares plunging by over 60% in the latter half of 2024. Fortunately, Nasdaq granted the company an extension until February 25, 2025, to meet its filing requirements, which helped avert any delisting risk. After SMCI eventually filed its delayed reports and provided a strong business update, the stock bounced back, showing that investor confidence was returning. Despite the stock being down about 60% over the past year, it’s up roughly 38% YTDhighlighting just how volatile it can be.

SMCI Data by GuruFocus

I prefer to focus on the fundamentals, which I believe are extremely strong. SMCI is demonstrating massive revenue growth that I expect will continue to accelerate, especially with the secular tailwinds from AI. I see a lot of potential for significant growth at the beginning of eFY26, when new data center capacity is set to come online. While consensus remains skepticalforecasting $33 billion in net revenue for eFY26 instead of management’s guidance of $40 billionI think that skepticism actually presents a big upside if SMCI meets its targets. With the stock attractively valued and huge growth potential, I believe now is the perfect time to start building a position in SMCI. Even though the market focuses on negative news and chip export concerns, the long-term growth story remains solid, and I’ll explain more about this opportunity in the rest of the article.

$40 Billion Revenue Target (NYSE:TGT) for FY26 I’m really impressed with SMCI’s top-line performance. The company has quadrupled its revenue over the last five yearsfrom about $3.34 billion in FY2020 to nearly $15 billion in FY2024which translates to a 4-year CAGR of around 46%. This growth has accelerated dramatically over the last two years thanks to the AI demand pickup. A big part of my bullish view on SMCI is my trust in management to hit close to their $40 billion revenue guidance for FY26 through increased market adoption of their leading direct liquid cooling solutions. Although consensus estimates are only forecasting around $33 billion for FY26a respectable 22% YoY growththis gap gives me hope for a positive surprise if SMCI performs as management expects.

SMCI Data by GuruFocus

Strong Remaining Performance Obligations (RPOs) PipelineLooking at recent clues from their RPOs, I’m encouraged by over 50% YoY growth in RPOs over the last few quarters, which has added more than $200 million in net new backlog. This gives me confidence that the ambitious targets are achievable. In Q1 2025, SMCI delivered a dual beat on consensus estimates, and the revenue growth trajectory remains impressive with a 55% YoY increase in FQ2 2025. Although the bottom line hasn’t expanded as muchmainly due to heavy investments in growth and R&Dthe focus is clearly on capturing top-line growth and increased volume, a trade-off I’ve seen before in hyperscaler-fueled cycles.

Capacity and Margin ExpansionFurthermore, management is pushing the transition from NVIDIA (NASDAQ:NVDA) Hopper to Blackwell GPUs, which has already started in Q2 2025 as B200 GPUs hit volume production. With this transition, and the shift from air-cooled to liquid-cooled systemswhere management expects 30% of new data centers to adopt liquid cooling in the next 12 monthsI see a significant ramp-up in customer demand. SMCI is even expanding its manufacturing capacity with plans for a third campus in Silicon Valley, which will be 10x the size of its current facility, allowing it to deliver thousands of racks monthly. With facilities in the US and Taiwan already running at 55-60% utilization (and improvements expected at its Malaysia campus), I anticipate sequential gains in operating margins as production scales up.

I’m also excited about the broader tailwinds. The strong long-term potential of the AI infrastructure market is further validated by TSMC’s recent $100 billion investment, which confirms the multi-year bullish outlook for AI computing. This move is likely to boost demand for SMCI’s liquid-cooled server solutions as cutting-edge semiconductors require them, and it will also help expand the U.S. semiconductor ecosystem, mitigating supply chain risks.

All these factors make me confident that SMCI will continue its strong top-line growth and eventually translate that into significant free cash flow. I expect the company to have enough bandwidth to hit that $40 billion revenue mark by FY26, making this an exciting opportunity for growth investors.

Valuation Discount and Upside PotentialSMCI shares are trading at a significant discount compared to its peers in the infrastructure space, and I suspect this discount stems from the market’s hesitancy about its growth story. Management’s guidance of $40 billion in net revenue for eFY26well above the consensus estimate of $33 billionsuggests that SMCI still has a lot to prove before the market fully recognizes its potential. Despite this, the stock continues to trade at a lower valuation than the broader sector.

Looking at the numbers, SMCI’s 13.7x Non-GAAP P/E (TTM) is about 40% below the sector median of 23x, and its 13.9x forward multiple is 37% lower than the sector median of 22.12x. Even compared to its five-year average P/E of 15.5x, SMCI is trading at a discount, leaving room for a potential rerating. If the stock were to move back to its five-year average, that would imply a target price of around $47. More conservatively, if the market expands the forward multiple to 17-18x, I see significant upsidepotentially pushing the price into the $50-$55 range, representing a 20-30% gain.

To back up my thesis, I ran a DCF model using very conservative assumptionsa 10% discount rate and a 3% terminal growth rate, which is quite low for an AI infrastructure player. Even with these cautious inputs, the model gives SMCI a fair value of about $59 per share, offering nearly a 30% margin of safety. While regulatory worries and margin compression might be weighing on the stock in the short term, I believe SMCI remains a less risky play in the AI industry and is well positioned to capture future demand.

Concluding ThoughtsIn conclusion, I believe SMCI’s recent drop after its 10-K filing was driven by regulatory noise rather than any issues with its fundamentals. The company has successfully removed delisting risk and continues to deliver impressive AI-powered hypergrowth. I anticipated the correctionand it happened even quicker than I expectedcreating an attractive entry point for dip buyers. I also expect more investment banks, which paused their coverage after the SEC issues (with Barclays (LON:BARC) already back in action), to return, thereby reversing the negative sentiment and drawing institutional investors back. The stock appears oversold, and my calculations indicate it may be 12-30% undervalued based on its growth prospects. For aggressive growth investors who can tolerate short-term volatility, the potential upside is very enticing. Despite the uncertain environment, I view SMCI as a "Strong Buy" and don’t want to miss out on the vast upside potential.

This content was originally published on Gurufocus.com