“So Far, So Good” Stock Market (and Sentiment Results)…

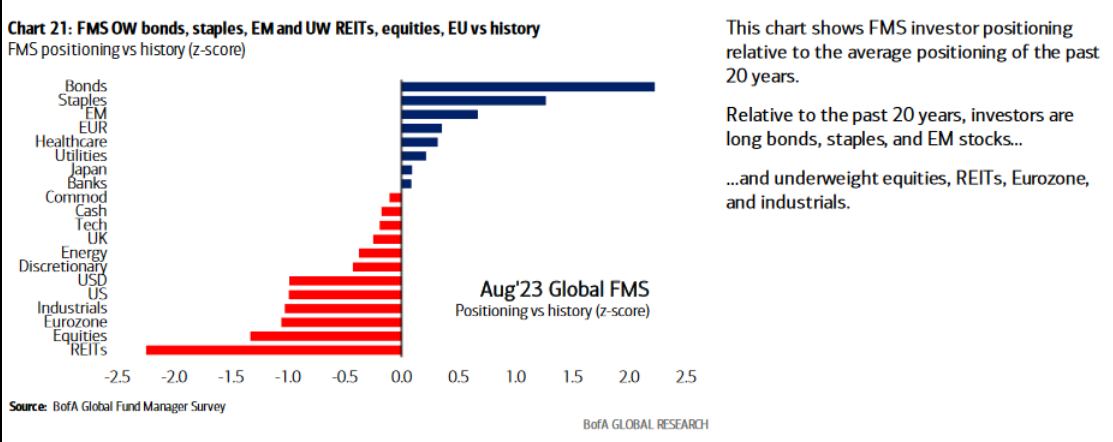

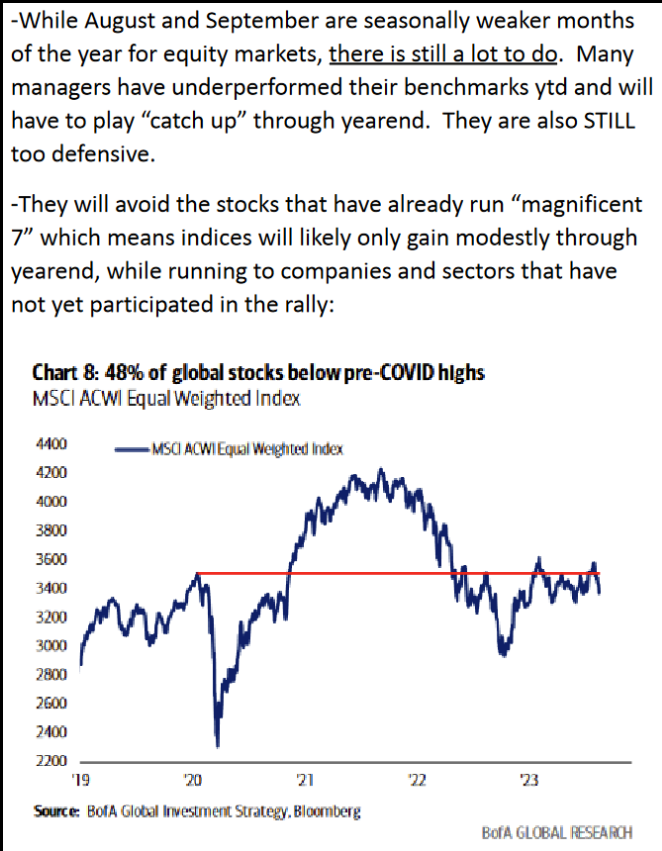

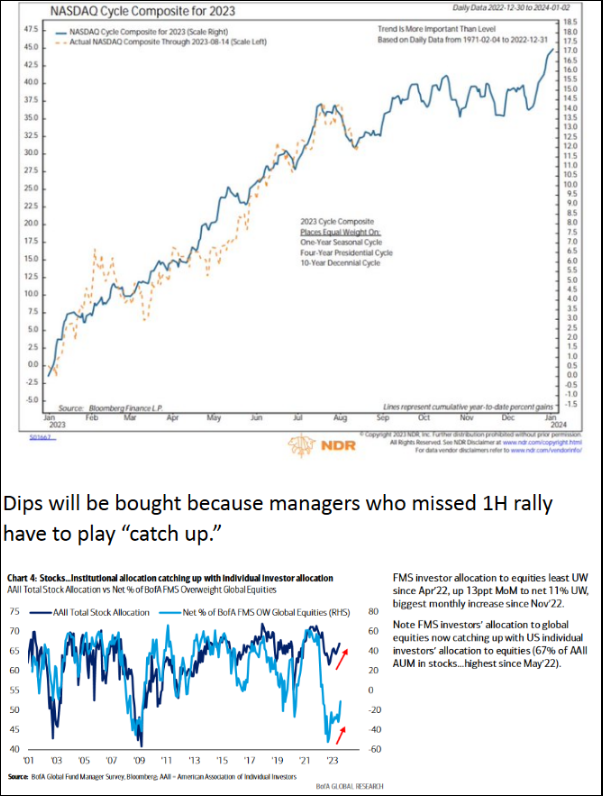

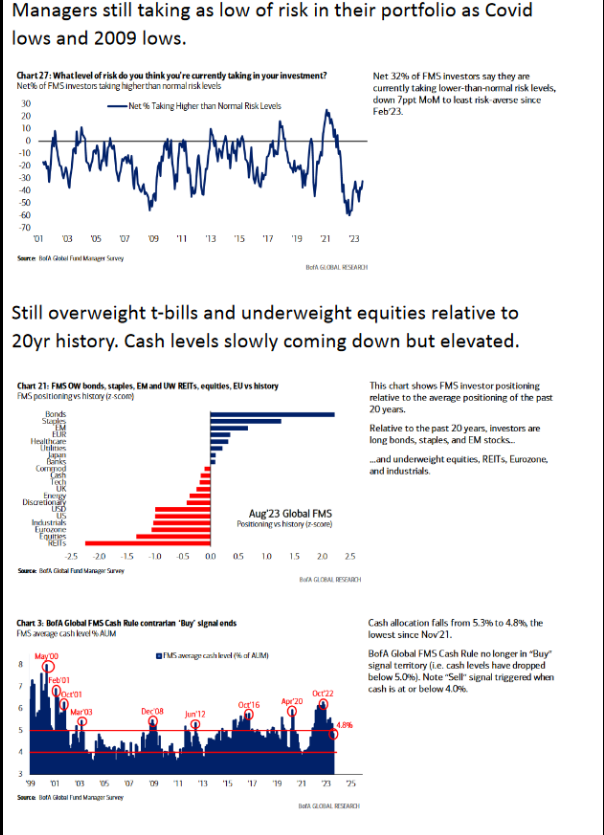

In our July 27, 2023 weekly note and podcast|videocast we talked about a 3-5% pullback in the month of August. We also said we expected these dips would be BOUGHT due to the fact that most managers under-performed in 1H and were still overweight cash/t-bills and underweight equities (relative to their 20 year history):

In my media appearances yesterday I talked about what this “catch up” trade would look like and some areas we are finding opportunity to pounce.

First, I joined Nicole Petallides – on The Schwab Network – live from the NYSE. Thanks to Heidi Schultz and Nicole for having me on (and Kenny Polcari for making the connection). Also Thanks to Joshua A. Gallant for being a great host. You can watch it here

Later in the afternoon I joined Seana Smith and Akiko Fujita on Yahoo! Finance. Thanks to Taylor Clothier, Sydnee Fried, Seana and Akiko for having me on. You can find it here

Watch in HD directly on Yahoo! Finance

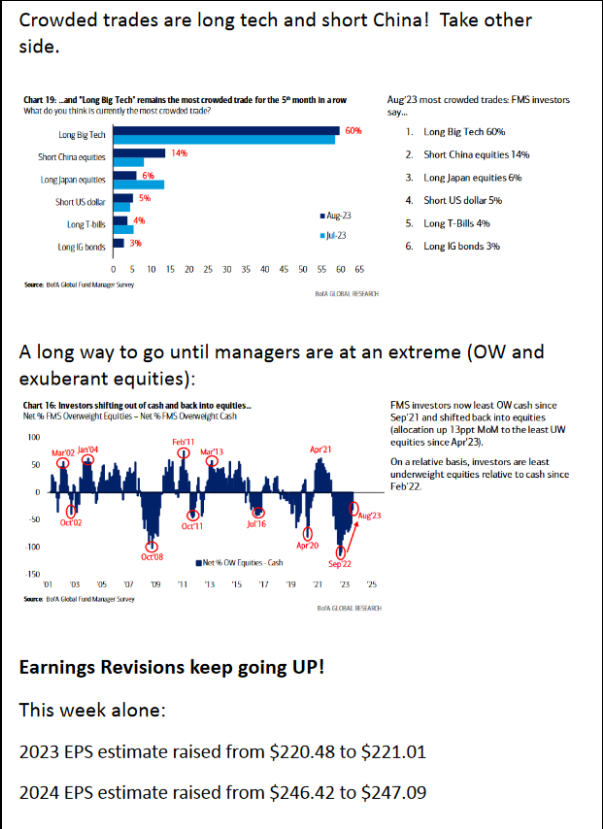

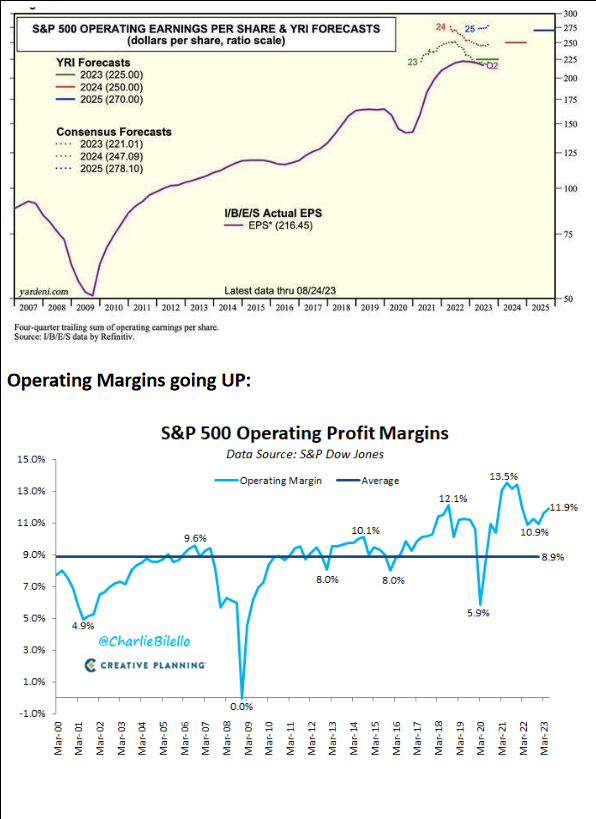

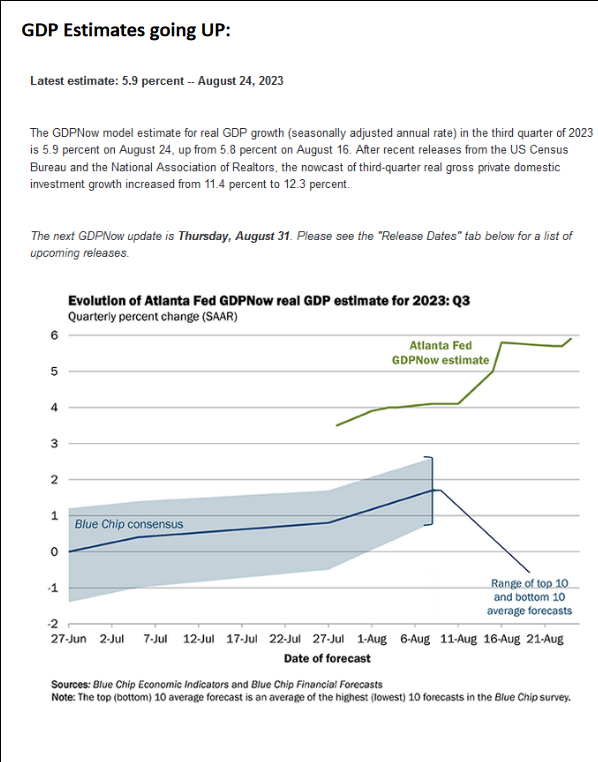

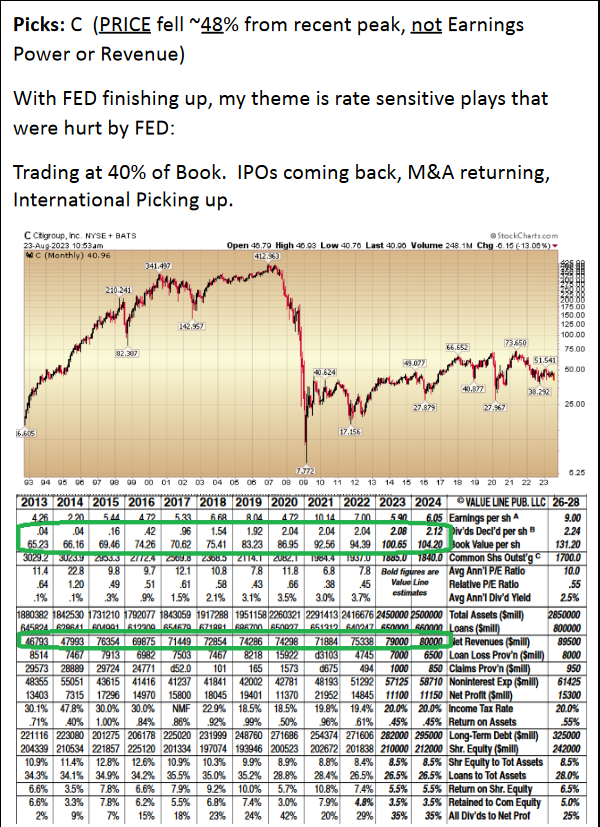

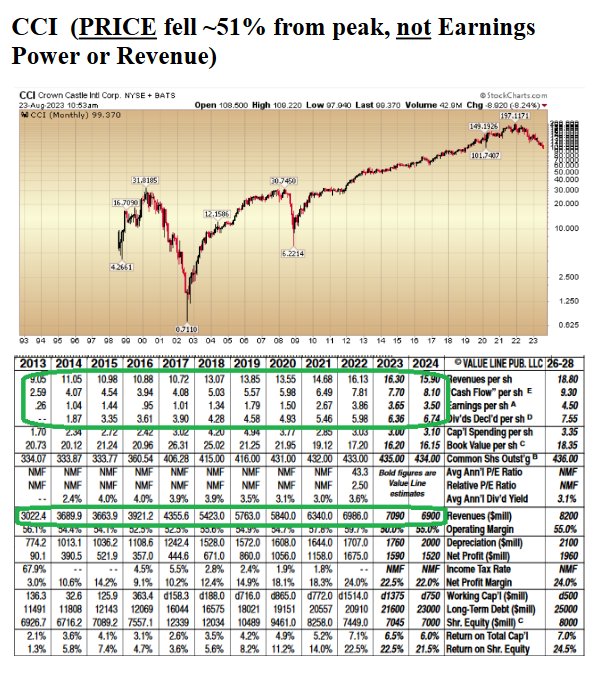

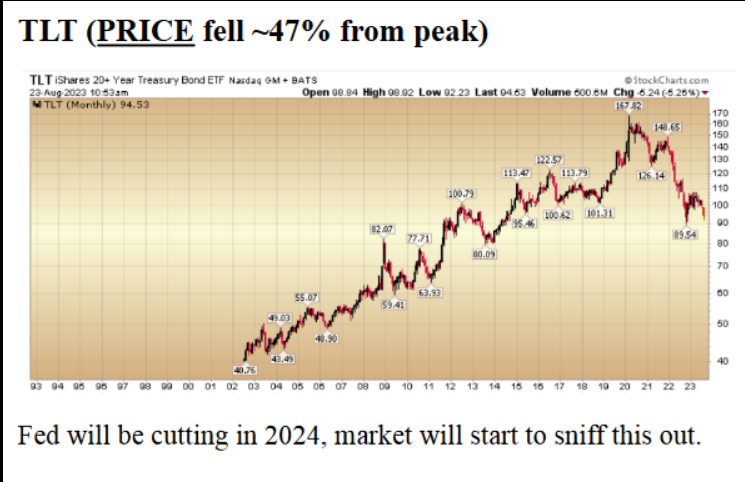

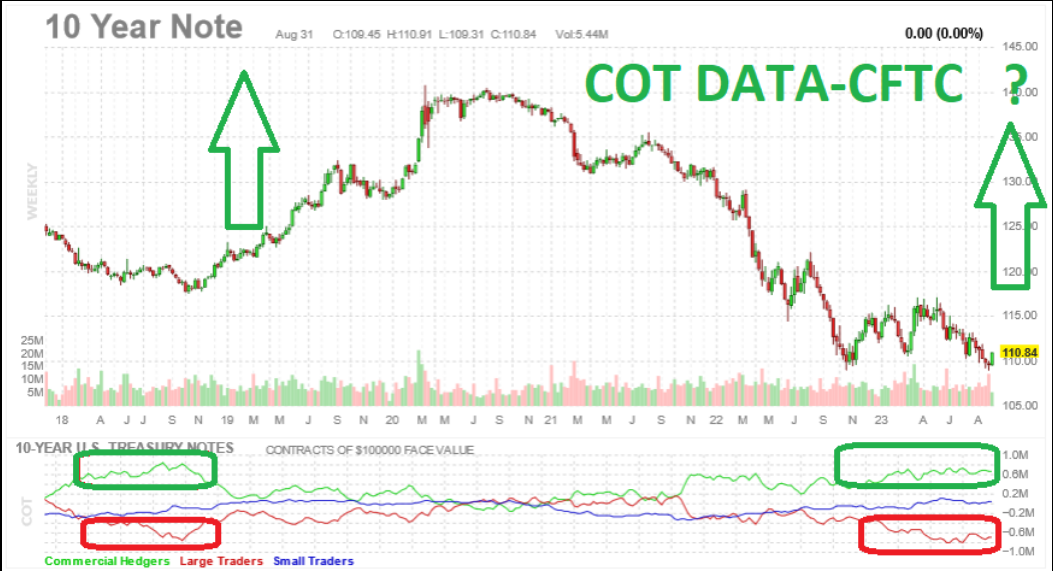

Here were some of my “show notes” ahead of the segments:

h/t Seth Golden

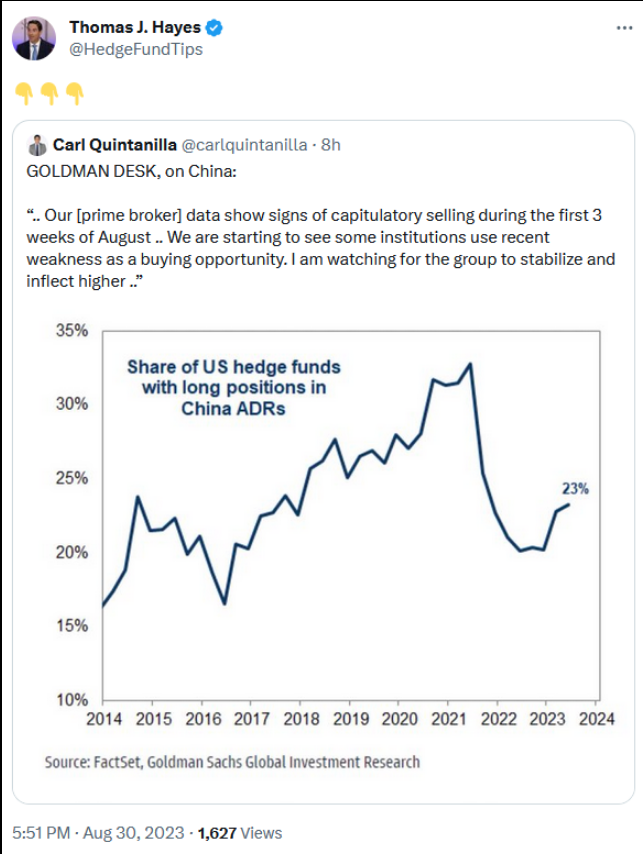

BABA UPDATE

Now onto the shorter term view for the General Market:

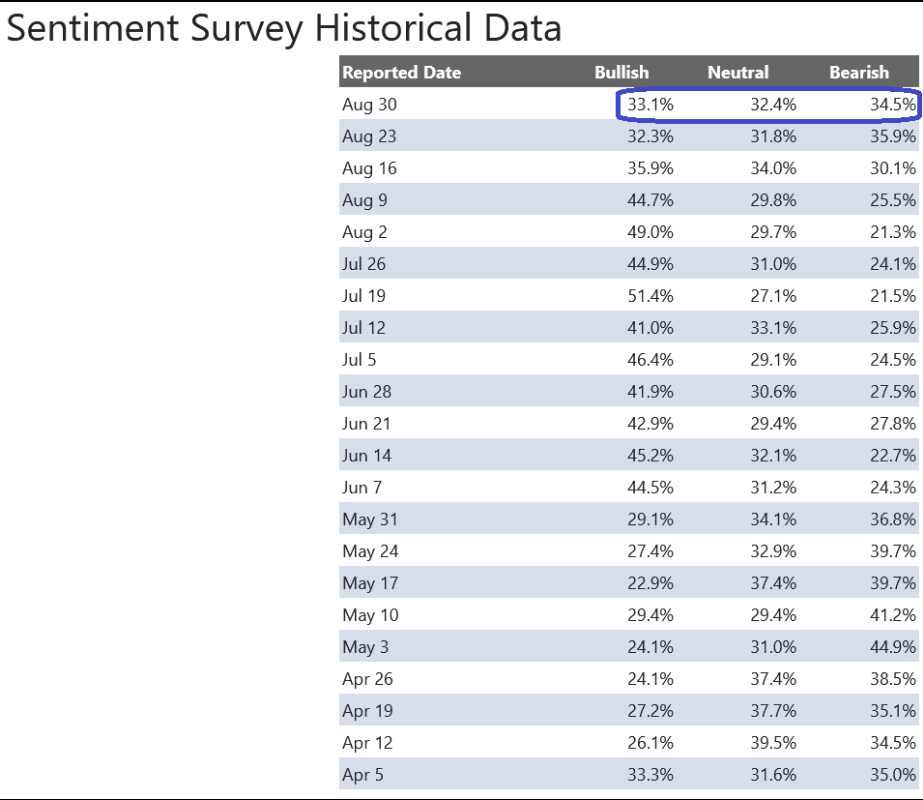

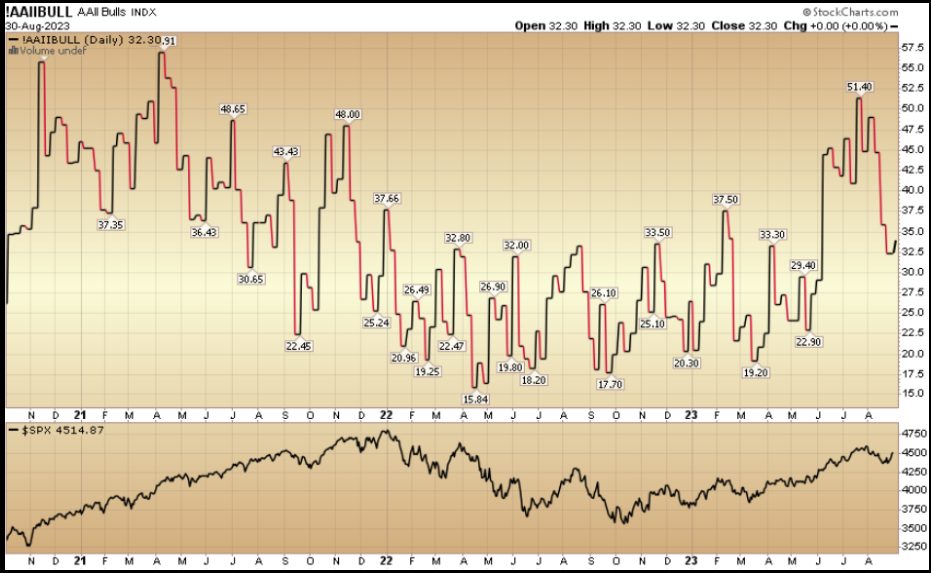

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 33.1% from 32.3% the previous week. Bearish Percent ticked down to 34.5% from 35.9%. The retail investor is showing continued trepidation.

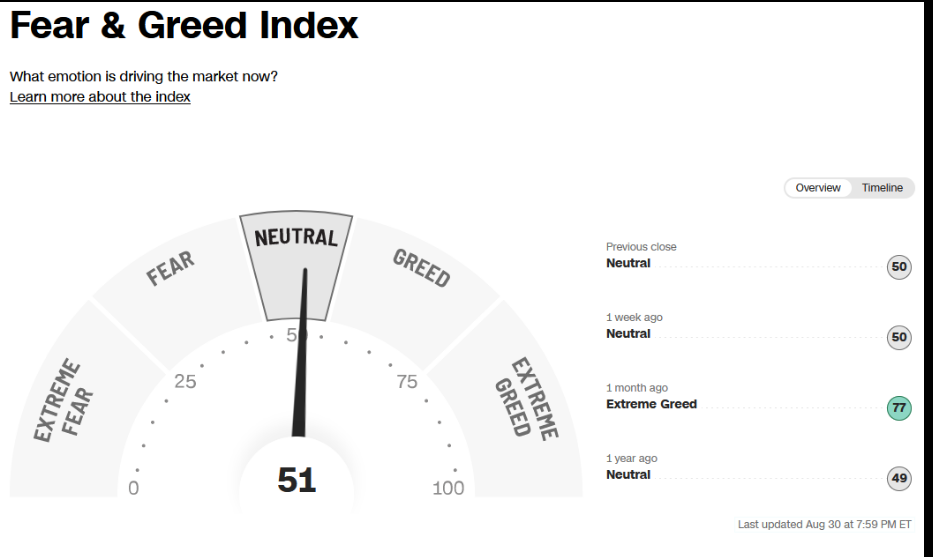

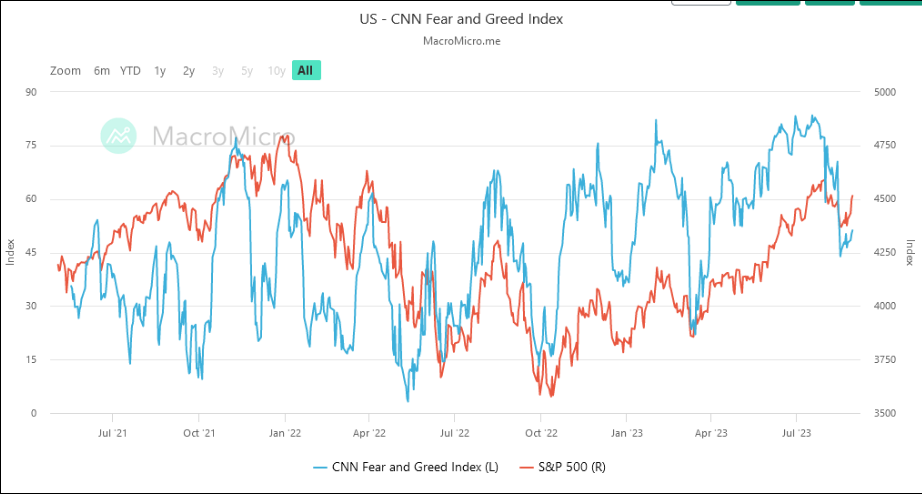

The CNN “Fear and Greed” ticked up from 49 last week to 51 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 34.36% this week from 59.87% equity exposure last week. Guess who sold in the hole and is going to have to “chase up” yet again?

This content was originally published on Hedgefundtips.com.