Sovereign wealth funds (SWFs) – the titans in the venture capital (VC) world – squirrel huge reserves of capital that shore up a country’s economy under stress and help spread the risk. SWFs’ immediate response to the COVID-19 pandemic has been a blend of contrarian investments and drawdowns to steady the economy. However, these funds are shrewder and smarter than they were during the global financial crisis. Currently, they are revisiting their investment strategies, keeping an eye on the economic downturn powered by the COVID-19 crisis. As of August 2021, the world economy boasted 151 SWFs, with disclosed assets under management (AuM) at USD10.9tn, or c.10% of the worldwide AuM.

Weathering the storm

Funds like Singapore’s Temasek Holdings act as ‘rainy day’ funds, plugging the funding gaps created by the decline in oil prices and economic downturn owing to the fallout from the COVID-19 pandemic. In a similar vein, Kuwait’s government has sought permission from the parliament to withdraw USD16.5bn from the country’s USD600bn SWF – the Future Generations Fund – to finance the country’s spiralling debt owing to the pandemic, the first such incidence after the Gulf War.

While overseas investment remains SWFs’ chief focus area, the trend towards domestic deals has accelerated during the recent pandemic. For instance, Turkey’s fund injected USD3.1bn into three state banks, and Singapore’s Temasek Fund recapitalised Sembcorp Marine state’s struggling rig-building sector by backing a USD1.5bn rights issue. Similarly, SWFs in Norway, Iran and Nigeria are funding their government through increased dividend distribution or withdrawals. Ireland is also using its SWF to help small and medium-sized enterprises augment their liquidity in the wake of the pandemic.

Temasek and Australia’s Future Fund were utilised to fund the scientific research for the development of a COVID-19 vaccine. Similarly, Russia’s SWF – Russia Direct Investment Fund (RDIF) – financed the production of the promising drug Avifavir in 17 countries, which is the first drug to be approved for the treatment of COVID-19. This highlights the fact that not all domestic assistance is financial.

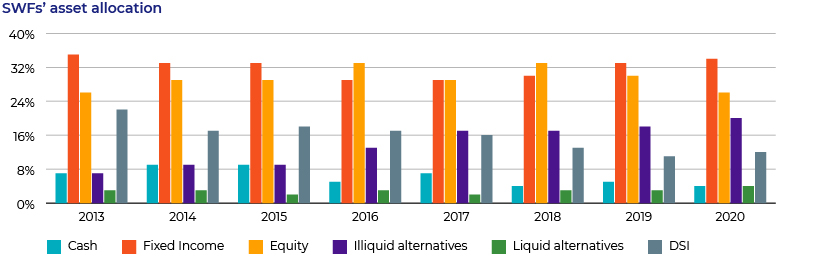

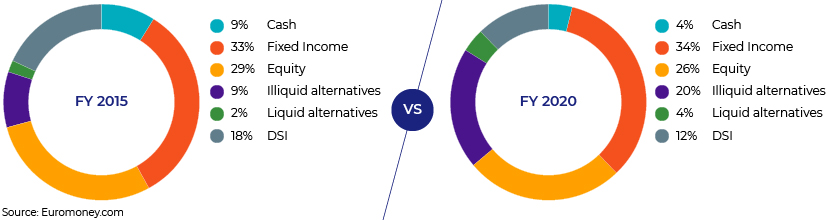

SWFs, targeting primarily traditional investments (listed equities and government and corporate bonds), were skewed towards fixed-income securities prior to the outbreak of the pandemic. However, as per an Invesco survey, SWFs are shifting from fixed income to equities to seek liquidity. This can be observed in the company’s ninth Global Sovereign Asset Management Study, reflecting SWFs’ fixed-income allocation, which dipped to 30% in March 2021 from 34% in March 2020 (vs 26% to 28% for equity over the same period), underlining opportunities amid volatile market conditions.

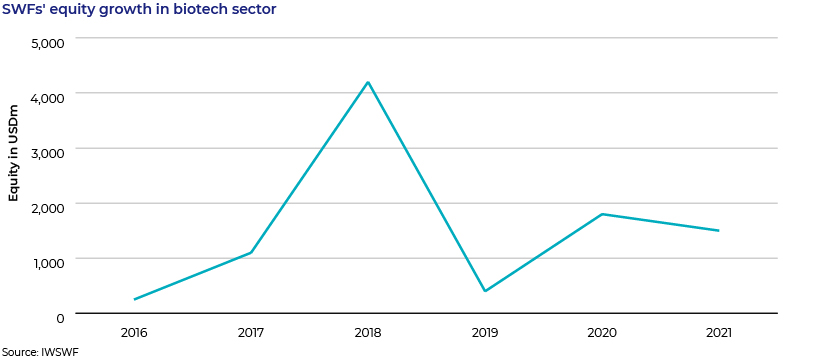

The yearly growth in equity value of SWFs’ direct investments in biotechnology has ratcheted up, translating into increased solutions for health information systems (e.g., vaccines) or applied artificial solutions. Major beneficiaries include China’s tech companies, such as video streaming firm Kuaishou and game developer Tencent, funded by Singapore’s Temasek Holdings via the Tencent industry Win-Win funds.

Sustained robust M&A volume

Despite the havoc wreaked by the pandemic on the world economy, SWFs did not hesitate to pursue opportunities in both growth equity and VC. Asian SWFs were noticeably investing in real estate niches such as data centres and self-storage. In 2020, SWF investments recorded 294 private market investments amounting to USD77.16bn (vs 301 investments for USD74.73bn in 2019). Private equity (PE) sponsors remain the most active dealmakers, with private-equity-backed buyouts amounting to 17% of M&A activity, the highest since 1H07.

Logistics and biotechnology

The COVID-19 pandemic has led SWFs to venture into other asset classes and industries, thereby bringing diversification and making the portfolio more resilient. A rapid surge in investment properties was noticed in the logistics space, such as warehousing, rather than offices and retail buildings. As per Global SWF, logistics made up c.22% of the funds’ real-estate investments in FY 2020 (vs 15% in FY 2019), whereas spending in offices and retail property slid to 36% and zero, respectively in FY 2020 (vs 49% and 15% in FY 2019). Following the trend would be Temasek Holdings, which invested USD500m in e-commerce firm Tokopedia (based in Indonesia) in June 2020.

Way forward

The future role of SWFs would hinge on the deep understanding of how stimulus from central banks counters the pandemic, pushing the value of shares and other assets. The growth in SWFs and their assets contributes to long-term growth by supporting post-pandemic economy. A direct example of this is SWF Russian Direct Investment Fund, which partly financed the development of the Sputnik V Vaccine. Another example is of Temasek’s joint venture with DBS, Standard Chartered (LON:STAN) and the Singapore Exchange to create Climate Impact X, a Singapore-based global carbon exchange and marketplace.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI