In our previous update, see here; we presented three Elliott Wave Principle (EWP) options for the S&P 500.

- either a long-term top (blue W-B) and set course for $2700-3500 or

- a drop to ideally around $4417+/-144 for the black W-4?, before a final rally to as high as $4983-5026 for the black W-5? Our alternative is

- for a mild correction to around $4650+/-20, from where a rally to $4883-5026 can materialize.

And acknowledged that

“Unfortunately, at this stage, we can't discern between A), B), or C). We always wish things to be more transparent, but we are not dealing with a linear environment. We are not prophets. Nobody is; we can never be certain and not tell you which way the market will go daily. Still, we certainly can provide the most likely scenarios and the parameters, i.e., price levels to look for, so you will know what to expect.”

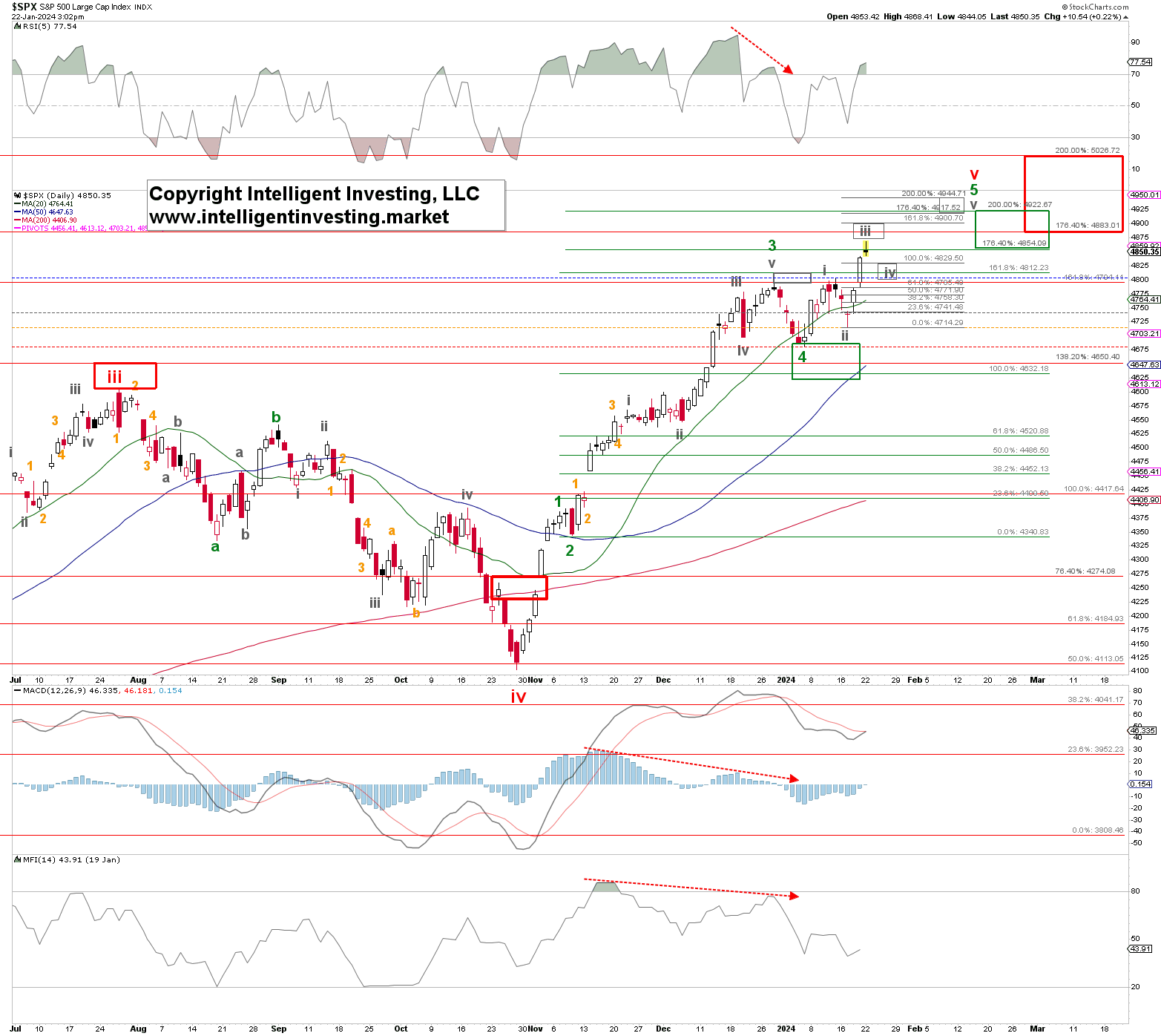

Fast-forward: The index bottomed out at $4682 on January 5th and staged a strong enough rally to produce new all-time highs, moving it from a possible more extensive correction to the rally to $4883-5026, which we were tracking. Now, we expect the impulse from that low to unfold per the (grey) Fibonacci-based impulse pattern shown in Figure 1 below.

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

Since markets, and especially impulse patterns, are fractal in nature, we expect the index to now be in W-3 of W-iii, which has an ideal target around $4830-60 (100-123.60% extension of the grey W-i, measured from the grey W-ii low). Today, the SPX reached $4868 and started to correct (slightly), which should be W-3 and W-4 of W-iii, respectively.

We expect W-4 of W-iii to ideally bottom at around $4830+/-10, which is the 23.60-38.2% retracement zone of W-3. Possibly to as low as $4805+/-5 but in uptrends, the downside often disappoints, and looking higher is preferred. Once W-4 is completed, we should see W-5 of W-iii to the ideal (grey) target zone of $4875-4900. From there, the grey W-iv and -v to ideally $4830-60 and $4915-4945 should materialize.

Please note that the grey W-v target zone at $4915-4945 falls within the ideal one-wave-degree higher target zone of $4852-4922 of green W-5, which in turn falls within the typical one-wave degree higher target zone of $4883-5026 for red W-v. Thus, we have a relatively good agreement at three different wave degrees on where to expect the S&P500 to top.

Our thesis will be increasingly in jeopardy if the index’s price starts to break subsequently below the colored dotted lines (blue at $4805, grey at $4740, etc.). Thus, while the current run may look and feel phenomenal, we urge everyone not to get caught in the hype-du-jour. The index is only 1.5% above its 2022 and ‘23 high while potentially only adding another 3.5%. Thus, the final statement in our last several updates remains relevant:

"Hence, at this point, it would be appropriate to assess the short- to long-term risk/reward at current price levels, and the warning levels above can be used as one's insurance policy to prevent havoc on one's portfolio."