Over a month ago, we found using the Elliott Wave Principle (EWP) for the S&P 500:

“[A]s long as last week’s low at $4098 holds, the index can allow for a more direct rally to ideally $4315- 4370, reaching our long-standing target set forth Mid-October last year, see here.”

We then tracked the current rally from the May 3 low as an ending diagonal (ED) 5th wave, with an ideal 3rd wave target zone of $4280-4290, which was reached last week, and found:

“Thus, the Grey W-iii can be considered complete for as long as price stays below this week’s high [$4299]. Above it, and $4310-4330 is the next target zone for a more extended 3rd wave.“

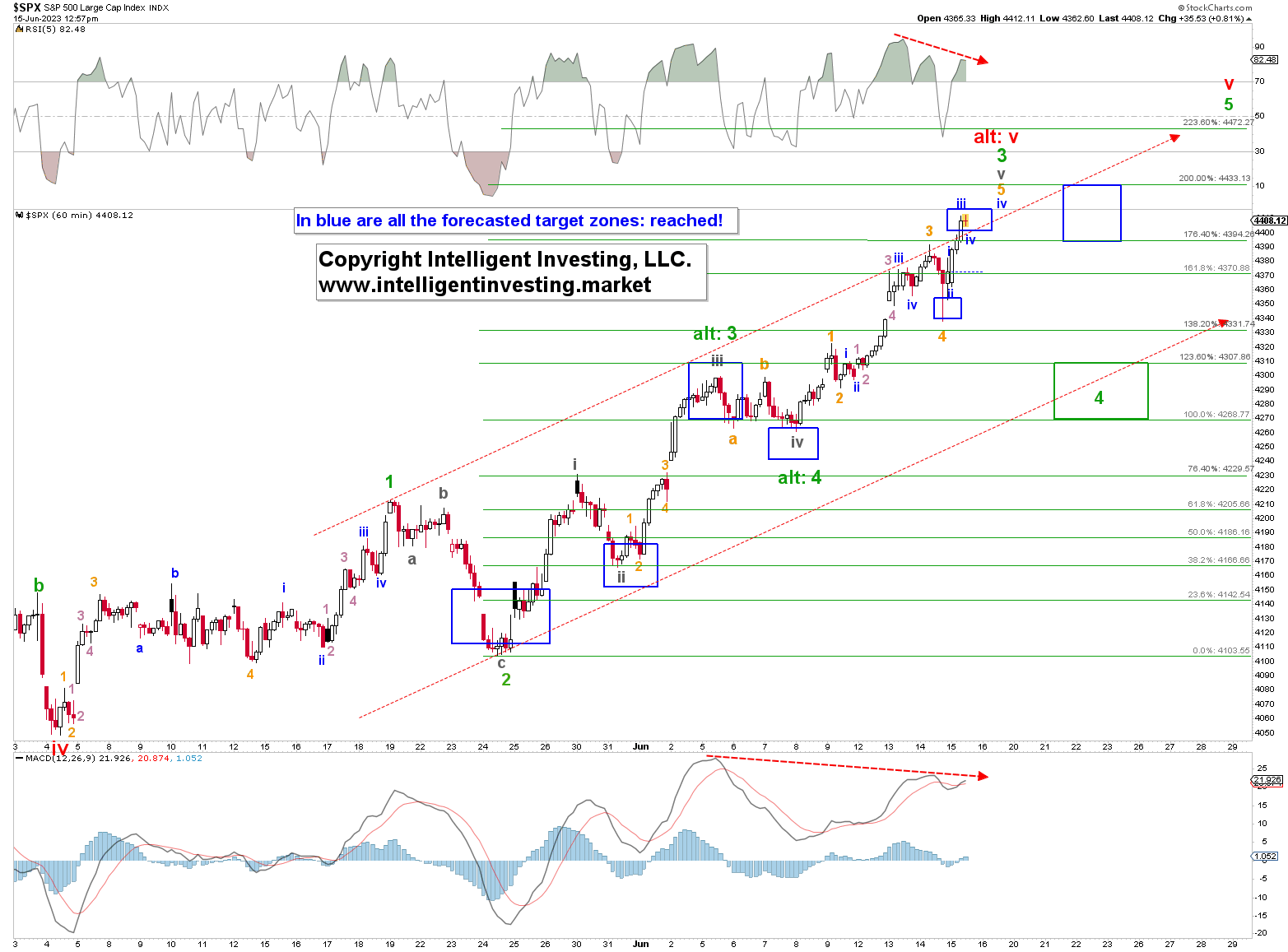

And boy, what an extension we got, as the index now trades at the low $4000s. Thus, our primary expectation was up to last week correct and on track. But this week we need to adjust it. See Figure 1 below, which shows the hourly resolution chart of the SPX. We decided to use the hourly resolution chart because it provides the granularity to explain our current thinking.

Figure 1

In an ED (a 3-3-3-3-3 pattern) the 3rd wave typically reaches 100.00 to 123.60% of Wave-1, measured from the Wave-2 low, sometimes 138.20-161.80%. But the latter is most often reserved for a standard impulse (5-3-5-3-5). In this case, even that target zone was exceeded this week as the index is now in the 176.40-200.00% extension zone, typically reserved for 5th waves. As said, extensions can always happen but are not known beforehand.

Namely, we start with the typical 3rd, 4th, and 5th wave target zones and then monitor the market to see if it adheres to each. Most often, the market will tick off three to four of the five waves’ target zones’ boxes, but then it decides to throw a curve ball for the other one or two. Hence why we say we are always ~70% reliable. Beats most though.

Back to the current market. Such an extension strongly suggests the index is in an impulse, not an ED. Moreover, the rally from the May 24 green W-2 low now comprises five (grey) waves up, which is an impulse pattern, not an ED. Lastly, the smaller waves up and down behave like an impulse pattern. Take yesterday, for example; the index bottomed precisely in the ideal orange W-4 target zone on the FED’s “no rate hike this month” announcement and has now reached the orange W-5 target zone as forecasted in real-time.

Thus, while we now expect a last (blue, nano) W-iv and v to fill in, see Figure 1 above, to ideally $4395+/-5 and $4415-4430, respectively, it also means upside potential is currently very limited as the green W-4 back down to ideally $4270-4305 looms. Once the green W-4 completes, we should expect another rally, green W-5, to $4470-4500. However, should the index drop below $4270 and especially $4230, the market has most likely begun the next leg lower of the Bear market to ~$2800+/-1000. In the meantime, whereas most were thinking we were crazy about our expectation for the market to rally to $4300+ last year, we have arrived.

Although the market still has the potential for more upside, but as market participants are turning quite bullish, maybe now is an excellent time to become more cautious and think of risk management to avoid getting caught holding the bag if this rally is the high we will see in the market for the next few years. Because once this rally completes, expect a sizable drop in the market.