In my book “Tomorrow Happened Yesterday – Bringing Together Life’s Cycles,” I start by quoting Richard Nisbett:

“You know, the difference between you and me is that I think the world is a circle, and you think it is a line.” [The Geography of Thought. How Asians and Westerns Think Differently-And Why.]

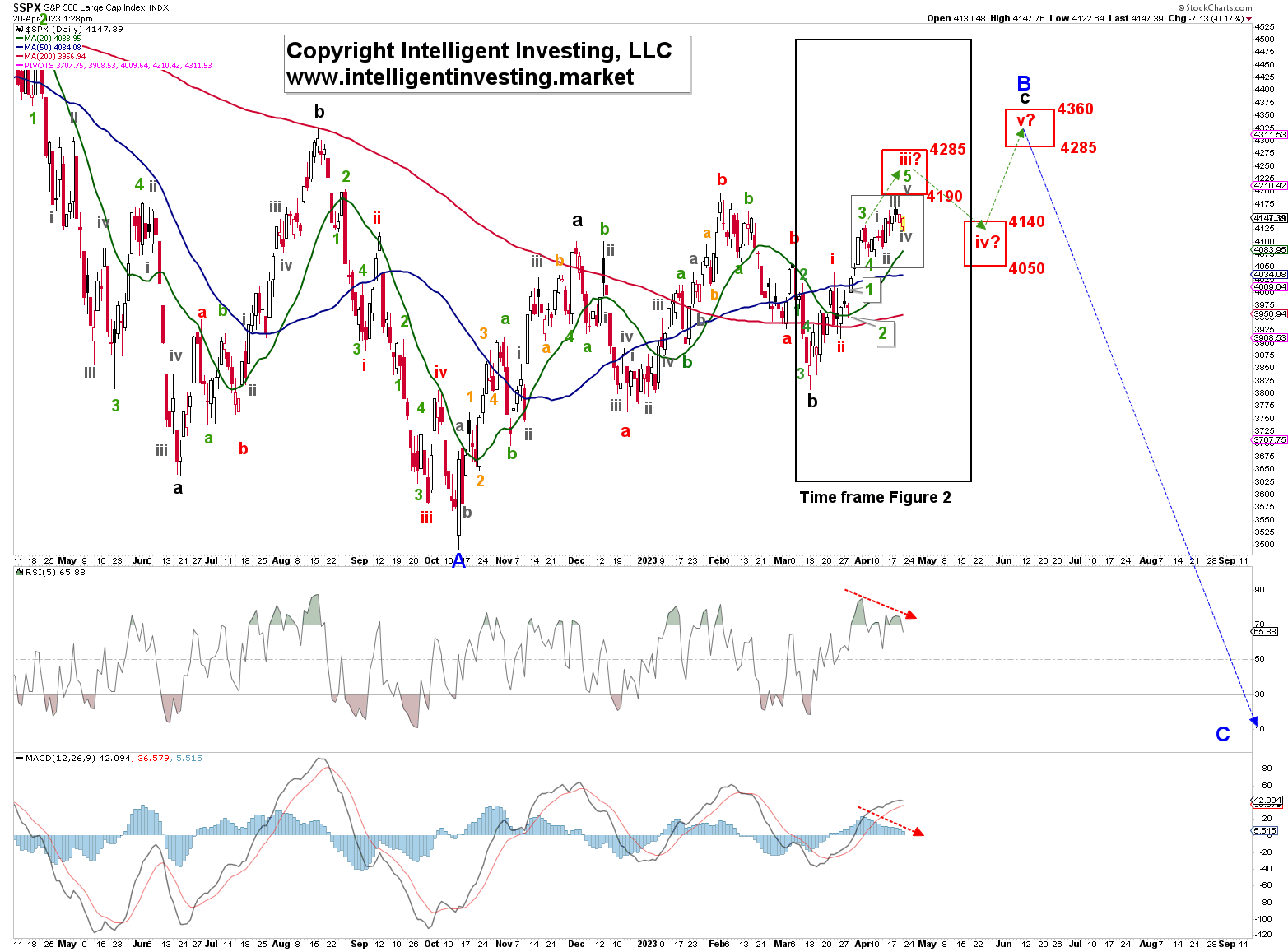

Society and its many facets, such as the economy and the stock market, move in cycles. And as I showed in my update from last week, see here, the US stock market, in this case, the S&P500 (SPX)- is now in what is called in Elliott Wave Principle (EWP) terms a Super Cycle Wave-IV.

Besides, our “Bullish outlook for the next several weeks to months is also based on two additional layers of information; … average pre-election year seasonality and the Crude Oil-Dow Jones 10-year-lag relationship” was correct, and we remain Bullish as such.

Moreover, back then, the index was trading at $4120 and has since reached higher to $4170 and now trades in the $4140s, proving our Bullish POV, as we found by using the EWP that “The index should now be in green W-5 of red W-iii?”, which in layman terms means “higher prices.” See Figure 1 below.

Figure 1.

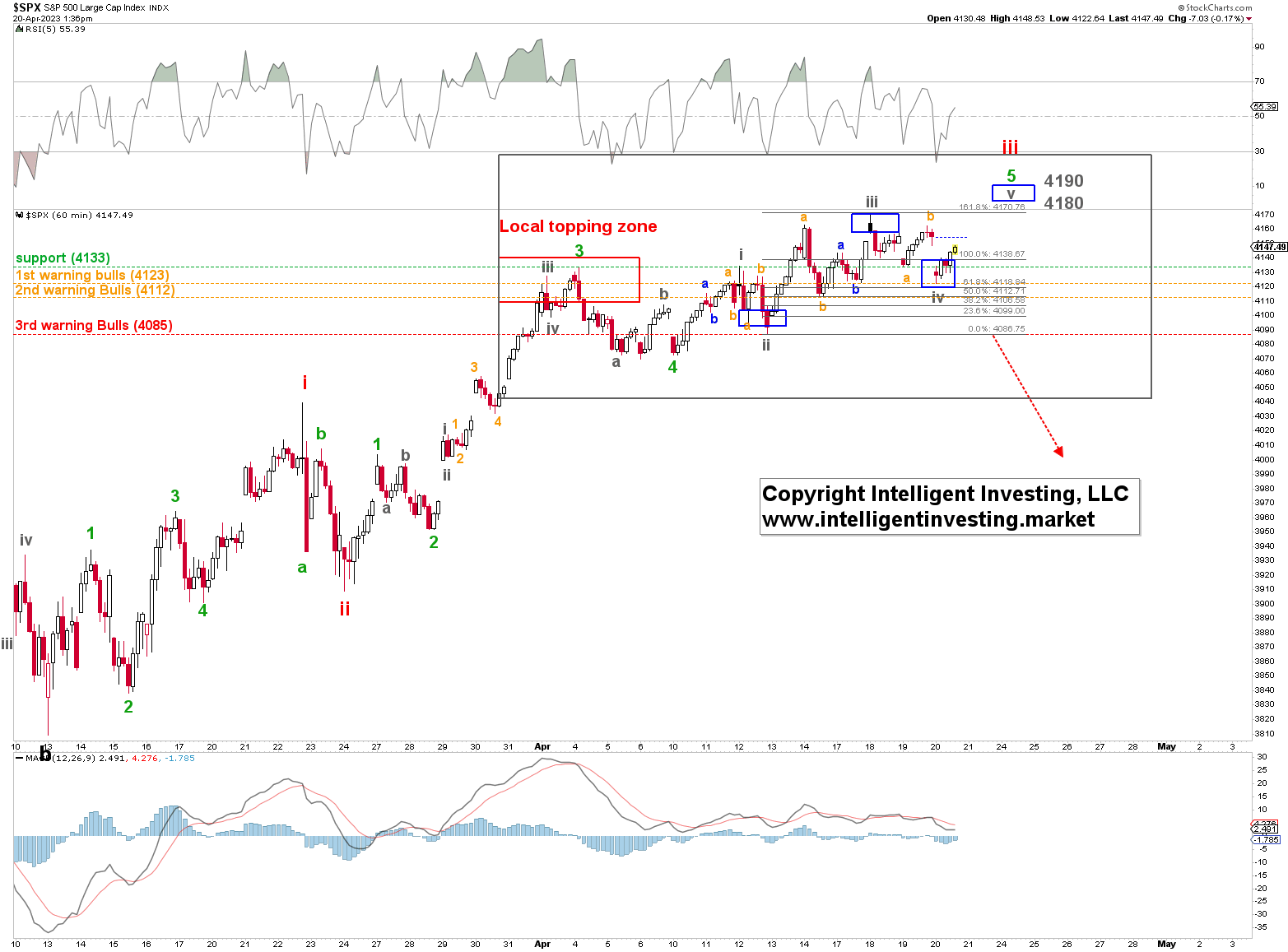

This update focuses on the price action in the grey box within the more prominent black box, which captures the time frame shown in Figure 2 below. Namely, it appears most likely that the green W-5 is morphing into an ending expanding diagonal (EED).

It is an overlapping advance consisting of three waves up and three waves down (a-b-c’s) sequences, making it harder to track and anticipate. But, so far, the index has topped and bottomed where it should go for the grey W-ii, -iii, and -v of the green W-5 of the red W-iii. See the blue boxes in Figure 2 below.

Figure 2.

It means that as long as the index can stay above $4112 and especially $4085, we should allow for a last push higher into the $4180-4190 zone, which matches with the lower end of the red W-iii target zone of $4190-4285 shown in Figure 1.

Once the red W-iii target zone is reached, we should expect the next more significant pullback, red W-iv?, to $4050-4140 before the last hurray “red W-v?” gets underway, as shown in Figure 1 with the dotted green arrows.

Given that the index dropped to as low as $4122 today, the Bulls have received their proverbial “shot across the bows” and we now have our cut-off levels below which we know the index has already topped. Those levels are our insurance policy to lock in profits, minimize losses, and keep outperforming the market. Given the, in last week’s update shared, pre-election year seasonality peak in early May, the current EWP count matches well.