Stocks managed to grind their way higher on the day, while rates and the dollar rebounded from yesterday’s declines. The price action in the stock market has been strange, and I can only attribute that to some internal rotation.

Yesterday, small caps and the S&P 500’s equal weight were strong. yesterday, these parts of the market were weak while the headline S&P 500 was up.

But the funny thing is that the indexes are all up the same amount after two days.

The one thing that seems clear is that something is bound to break here because when you look at the SMH relative to the RSP, it is not a chart that inspires confidence. It looks like the double top pattern mixed with a head-and-shoulder, and that can’t be a good mix.

The SMH to SPY looks the same.

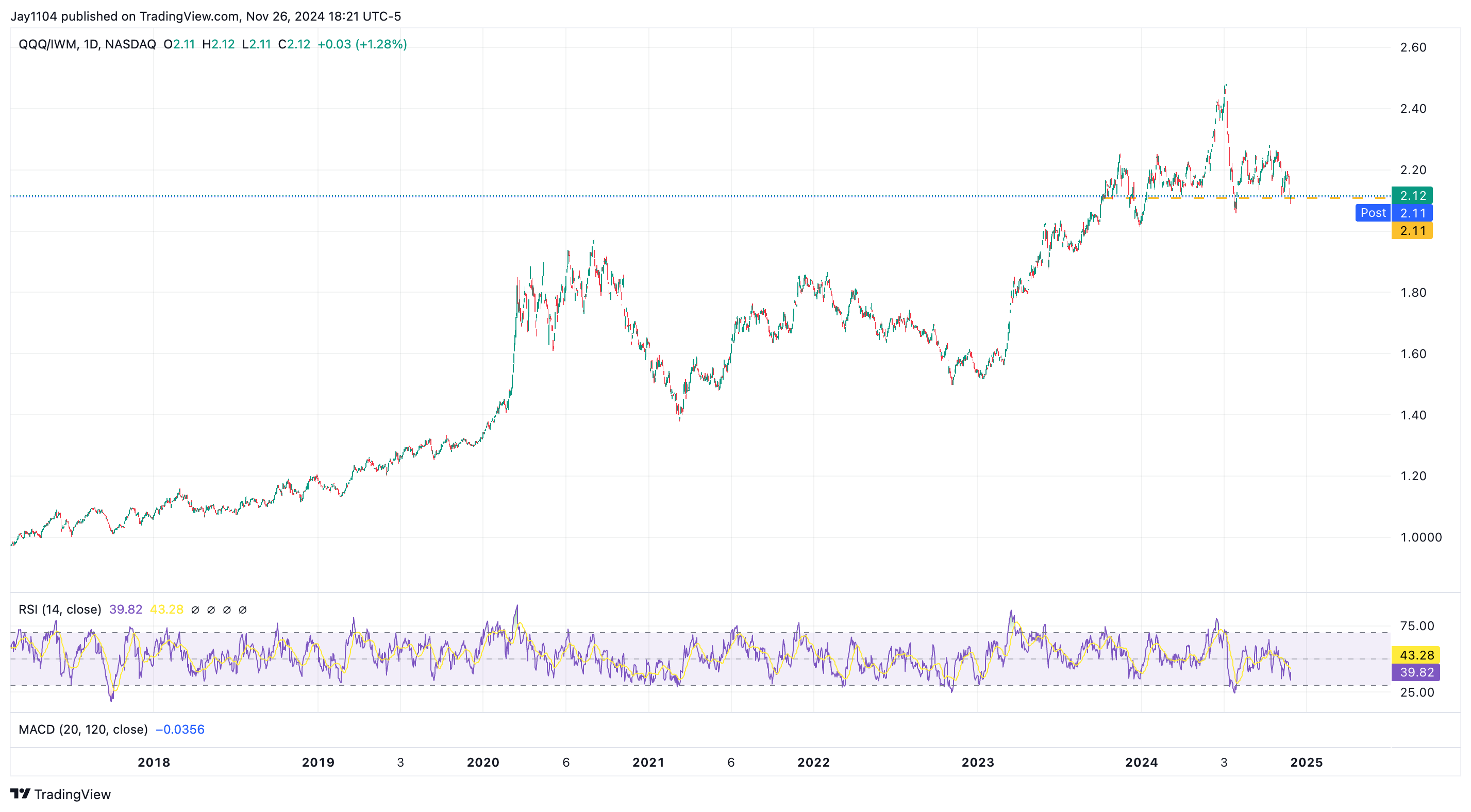

The QQQ to IWM ratio has a similar feel.

The QQQ to KRE ratio has already broken down.

As does the QQQ to DIA.

It almost feels like the market keeps rotating around, keeping this ratio afloat. TheXLK to XLF has already broken down, though it could use more follow-through.

While the XLU to XBI won’t budge.

You could see why it may be the case, for example, if someone were long tech and short small caps. Or whatever. Given the herd mentality, plenty of these trades are likely going on. The only question is whether or not something comes along to force that trade to unwind. I do not know.

It is a frustrating market for anyone who isn’t invested in an S&P 500 index fund because this endless rotation only seems to push the S&P 500 higher while everything else just churns.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI