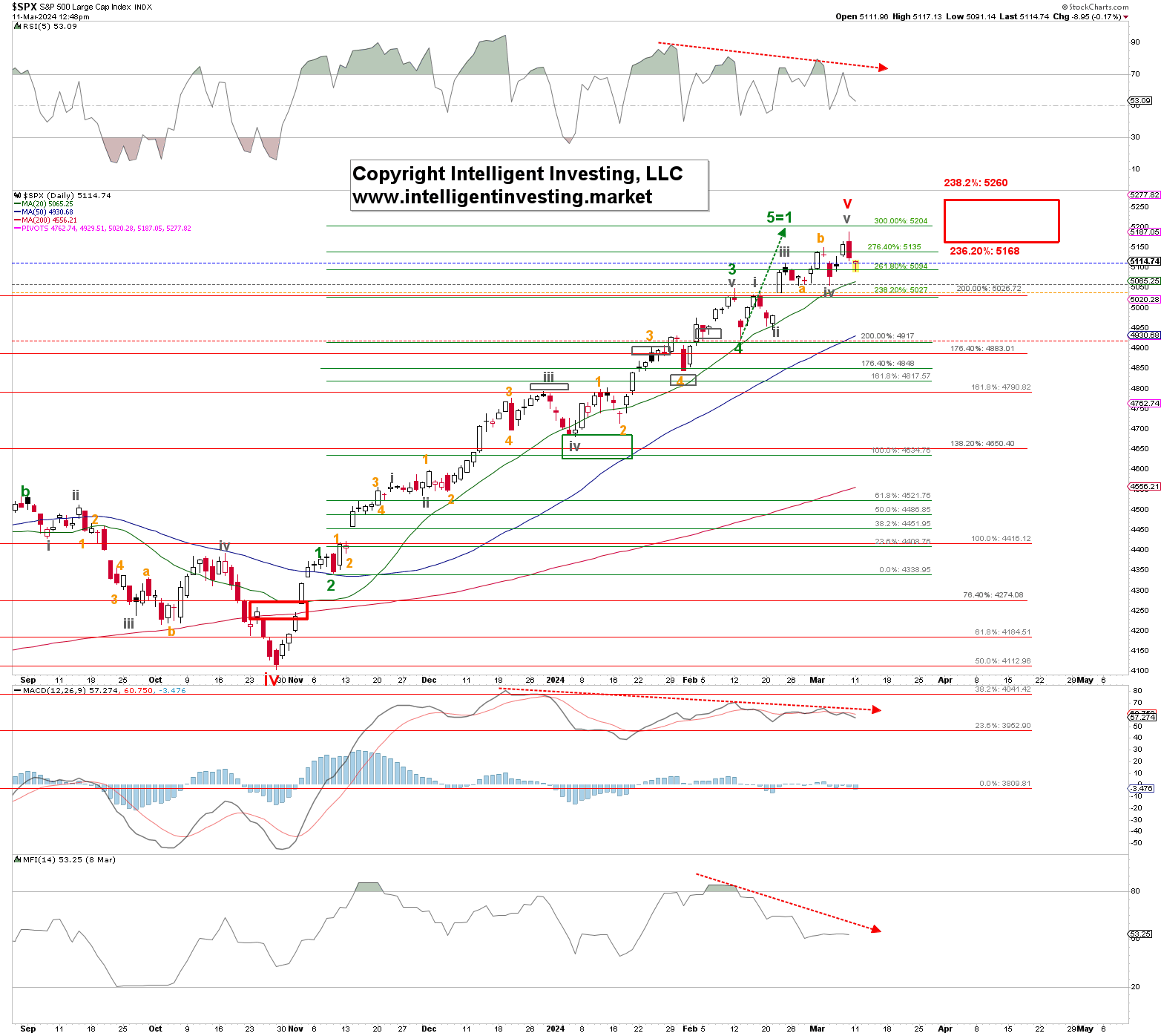

In our previous update, we anticipated using the Elliott Wave Principle (EWP) for the S&P 500 to ideally reach $5026ish, assuming a standard Fibonacci-based impulse pattern, where the 5th wave tops at the 200% extension of the 1st wave, measured from the 2nd wave. Fast-forward and the index decided to extend, which is a known unknown. It peaked last Friday at $5189.26, which appears to have completed another, i.e., additional, five-wave sequence from the February 13 (green W-4 low). See Figure 1 below.

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

Moreover, the negative divergences between several technical indicators are blatantly obvious, but they are a condition, not a trigger, as “divergence is only divergence until it is not.” Price is the final arbiter, and as such, the Bears have yet to break it below the colored levels, both on the daily chart above and in the hourly chart below (see Figure 2), which we use to alert our premium members the odds are for a top are increasing with each subsequent break lower.

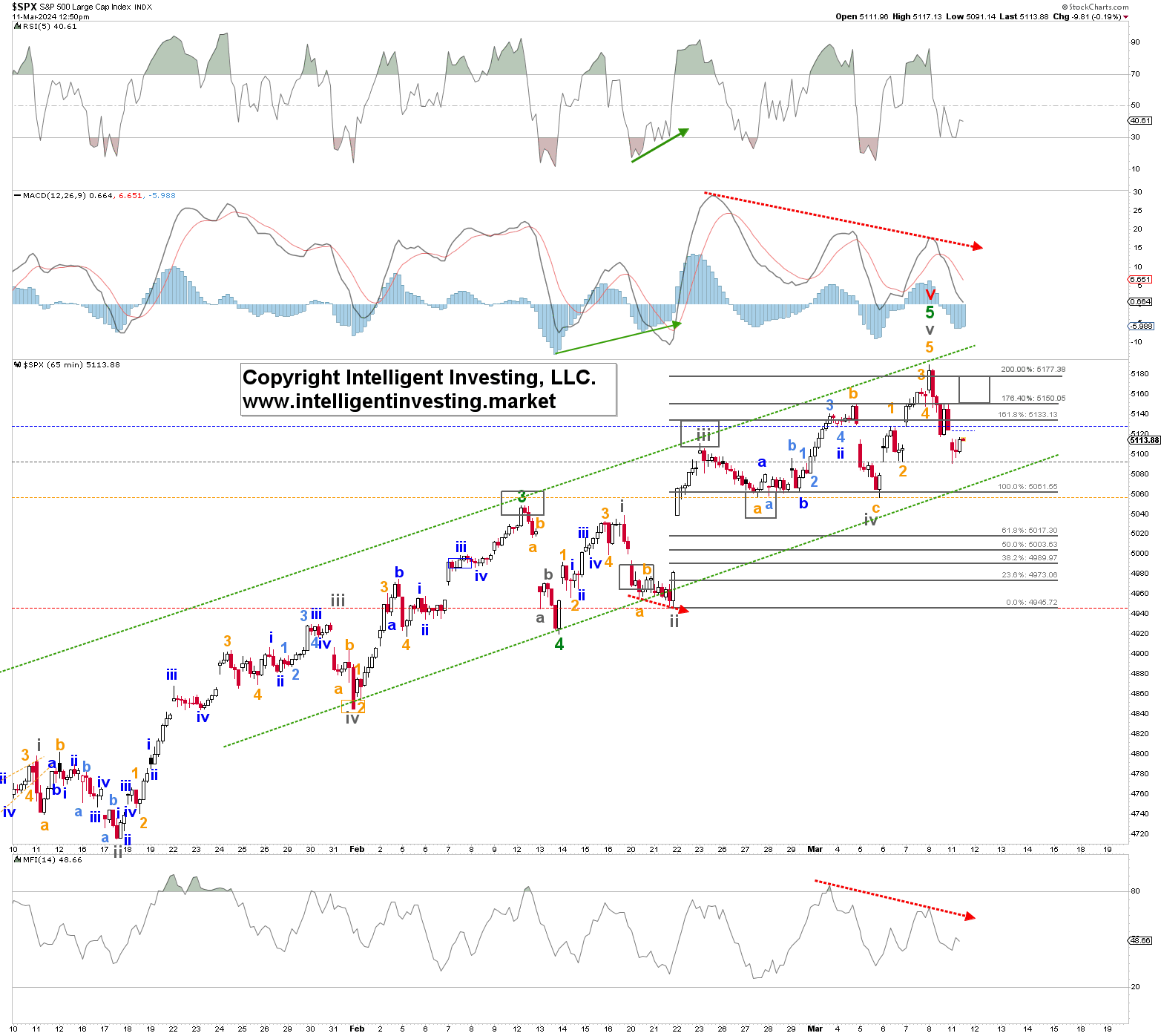

Figure 2. Hourly SPX chart with detailed EWP count and technical indicators

Thus, based on the EWP count presented in Figure 2 above and the associated colored warning levels, we find that the (grey) $5093 level is support, tested today, and a break below it would be a strong warning to the bulls. Ultimately, we need to see a break below $5056 (the low of the grey W-iv = the orange level) and a follow-through below $4946 (the grey W-ii = the red level) to confirm a significant top has been struck.

However, if, like last, the index breaks higher because the bears fail to break below critical levels and reach the next target zone of ~$5260, support will be moved up to $5150.