During the past month, the S&P 500 Index advanced to all-time highs and is in a confirmed uptrend.

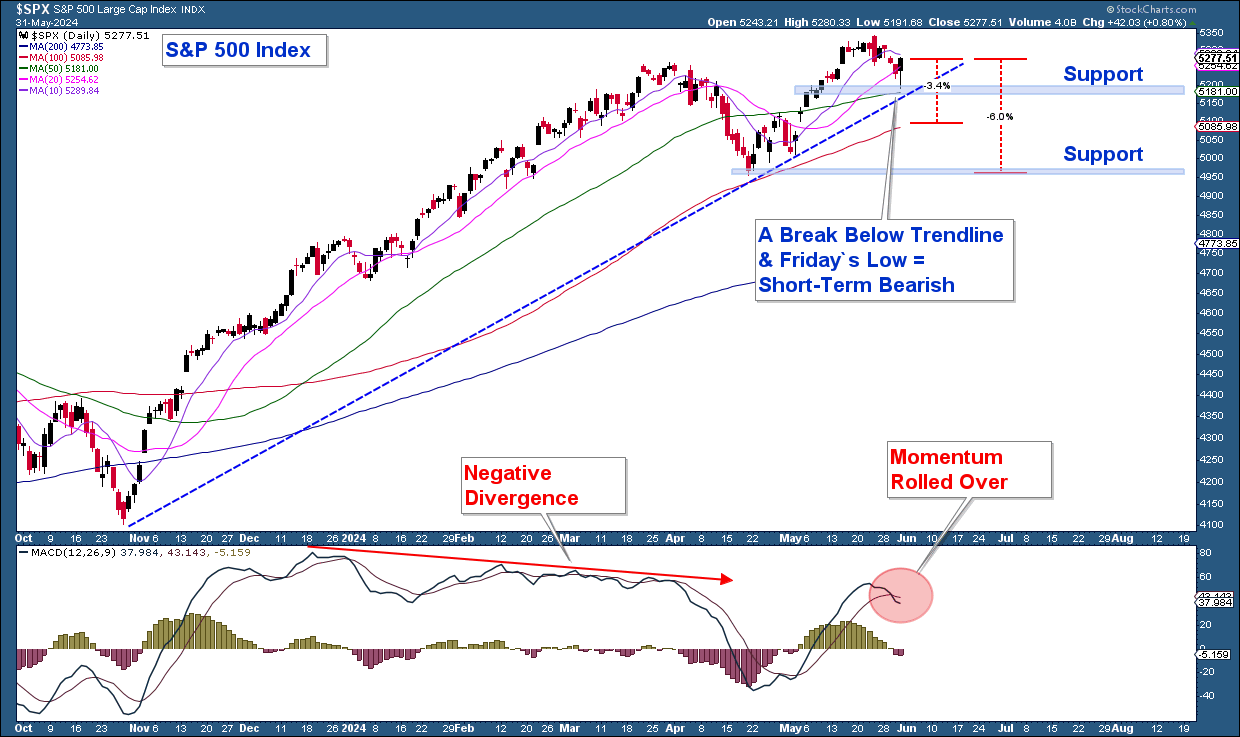

However, market breadth is increasingly suggesting internal market weakness. I view this deterioration in market breadth as a warning, rather than a signal. If the S&P 500 moves decidedly below Friday’s intraday low, I would view that move as a bearish signal. Such a move would negate Friday’s bullish candle, push the index below its 50-day moving average, and violate its uptrend line.

If we get that move lower, the next support levels (annotated in blue) is at the 100-day moving average (3.4% below Friday’s close) and the April low (about 6% below Friday’s close).

Below is a chart of the S&P 500 Index in the top pane, and the MACD (a momentum indicator) in the lower pane. Here are my takeaways:

- The index is in a confirmed uptrend. Conditions are bullish as long as the index does not fall decisively below Friday’s low.

- The MACD (a momentum indicator) in the lower pane has rolled over, signaling a swing in momentum to the downside.

Market Breadth

Internal Market Weakness

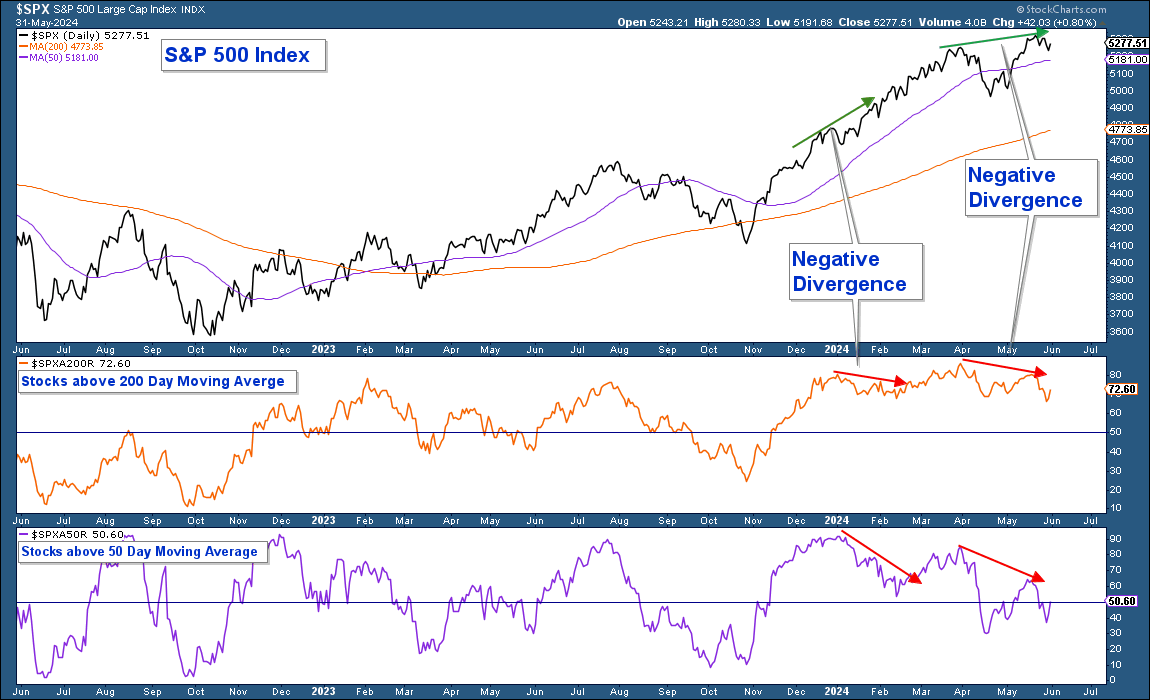

Below is a daily chart of the S&P 500 in the top pane. In the lower panes are the percent of stocks above their 200-day moving average and 50-day moving average.

Here are my takeaways:

- The index has been in a confirmed uptrend since it advanced out of a short-term pullback in November of last year.

- The number of stocks within the index above their 200-day and 50-day moving averages has declined since April; however, the index has continued to advance. This is a negative divergence that indicates a deterioration in market breadth.

- Not all negative divergences result in a move lower in the index. Look at the previous negative divergence. Despite the divergence, the index continued to advance. This is why we use the index as the signal.

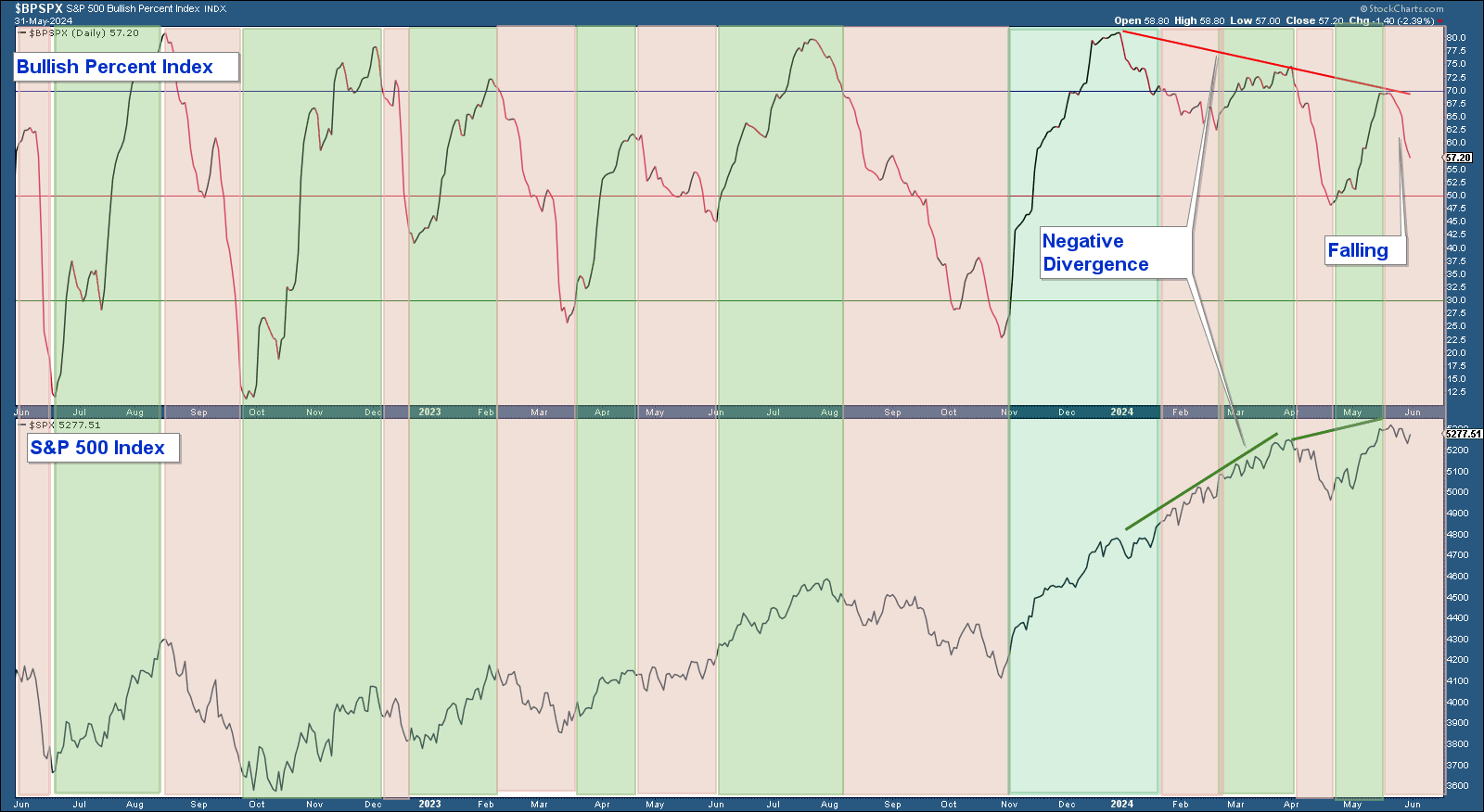

Below is a chart of the S&P 500 in the lower pane and its Bullish Percent Index (BPI), a breadth indicator, in the upper pane.

BPI is an indicator based on the number of stocks on Point & Figure Buy Signals within an index. BPI helps you understand the internal health of an index by looking at the number of components that are on a bullish or bearish track.

I have color-coded the up and down moves in the BPI, showing that it has effectively identified major moves in the index.

BPI is also displaying a negative divergence. The number of stocks within the index that are in uptrends is deteriorating as the index advances higher.

Conclusion

The stock market is in a confirmed uptrend and bullish. However, market breadth and momentum are suggesting that risk is increasing. This deterioration in internals is a warning sign, not a signal that the market is likely to fall. A strong move below Friday’s low would be the signal to reduce risk.

Client Account Update

Our conservative and aggressive models are slightly below their fully allocated equity levels.

If the market can push higher, I will look to increase our equity allocations. If the market falls decisively below Friday’s low, I will likely decrease our allocation to stocks.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.