In our last update from mid-April on the S&P 500 (SPX), where we were tracking using the Elliott Wave Principle (EWP) primarily, we noted:

“a potential five-wave move, i.e., an impulse, lower to ideally around $4800 for red W-a/i before we see a more significant bounce (red W-b/ii) develop—contingent on the index holding below the colored warning levels for the Bears.”

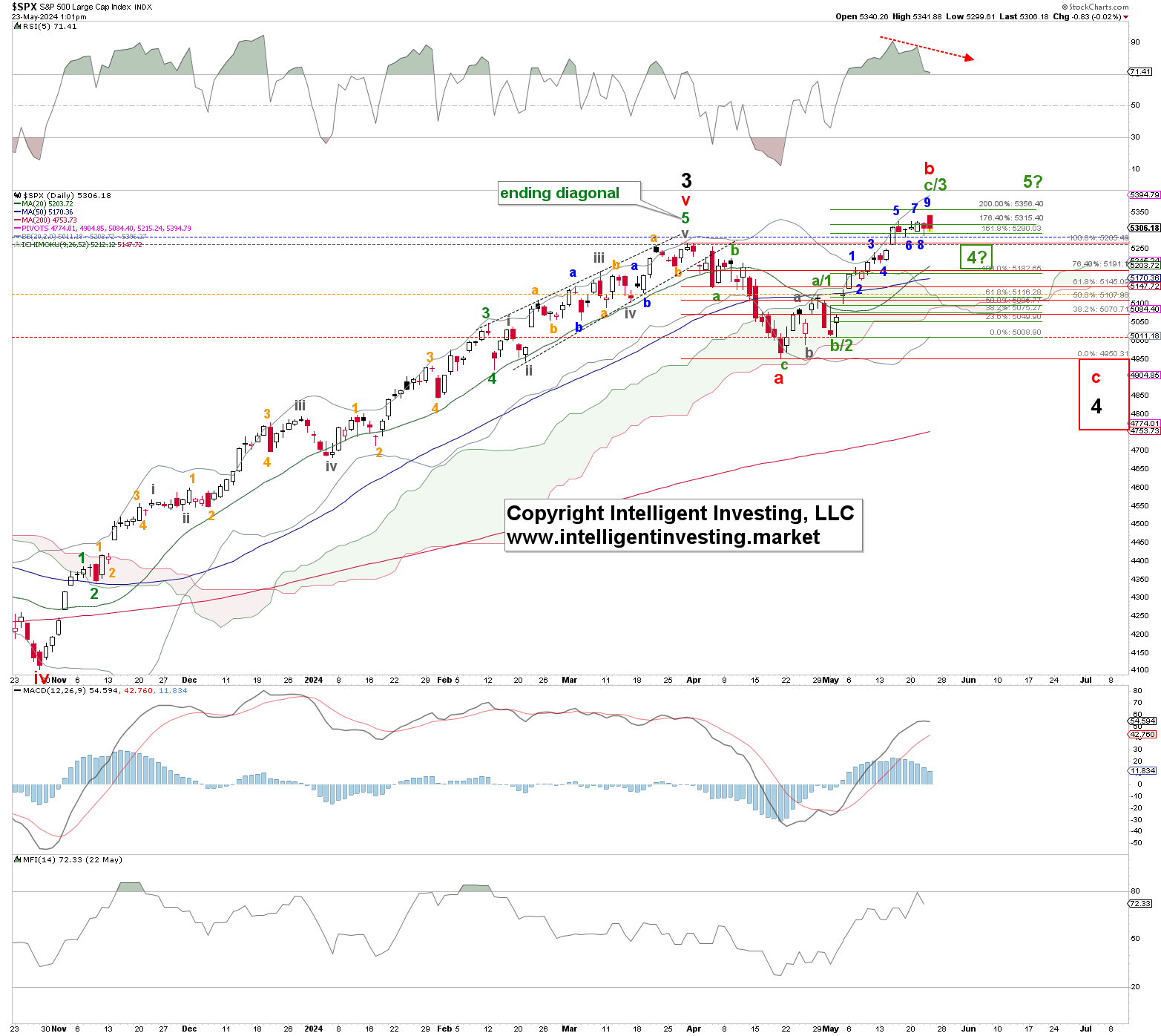

Namely, an impulse (five waves) lower from the March high would have either targeted $4600 before the next larger rally could ensue or signal the end of the Bull that started in 1932. But instead, we only got three green waves a-b-c lower into the April 19 low of $4943. See Figure 1 below.

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

Since the red W-a counted best as three waves lower, we knew that "after three waves down, expect at least three waves back up" because either the correction became protracted/complex (triangle or flat) or it ended with those three waves lower (zigzag). Moreover, we can neither know beforehand if the red W-b will be regular (100%). In this case, it became irregular.

But, as you may recall, in early April, we wondered if the index could reach as high as $5390. Instead, it had already peaked in late March at $5265. The B-wave often does the trick when the third wave fails to reach its upside target.

In this case, the rally from the April low to today’s all-time high at $5342 counts still best as three green waves a-b-c up and get the index much closer to that $5390 target. Now we need to see if price can break below the colored warning levels. Namely, the colored dotted lines in each chart indicate the warning levels for the Bulls or Bears if the chart shows a Bullish or Bearish EWP, respectively. Blue indicates the first warning, grey indicates the second warning, orange indicates the third warning, and red indicates the count is invalidated or complete.

Since the index is not even below the blue dotted line, we have no indication that the top has been struck. However, we can count nine smaller waves from the green W-b low, which complete an impulse as they travel in 5, 9, or 13 waves. But without breaking below these warning levels, nine can always become 13. So, we must wait for price to confirm and then trade accordingly. There is no front running.

Lastly, the chart also has the potential green W-4? and W-5? labels because we cannot know yet if the rally from the April low will become an impulse. That, in turn, will shift the black W-3 top forward as well. But, for now, we prefer the irregular red W-b scenario, which will be confirmed below the green W-b/2 low. The Bulls will already get a severe warning on a drop below the green W-a/1 high, the orange warning level. We will then look for the red W-c to complete around $4850+/-100.