Last week's market and economic data key points:

PCE inflation rose steadily

U.S. GDP grow 2.8% in 3Q

Dow, S&P 500 end November at record highs

Retail stocks climb on black Friday boost

JPMorgan (NYSE:JPM) drops tesla lawsuit

U.S. 10-year yields drop to 4.18%

Gold swings ahead of fed’s rate cut

WTI crude drops to $68

Yen hits six-week high, dollar dips for month-end

Euro gains on dollar as ECB bets shift

British pound gains, pound-dollar up for week

Asian equities set for monthly falls on Trump tariff fears

Ethereum rockets to $3,700, bitcoin lags this week

Dogecoin loses momentum, snaps 6-week bull run

Last Week’s Economic Reports:

GDP Growth: U.S. economy grew 2.8% in Q3 2024, following 3.0% in Q2, signaling strength and boosting consumer spending.

Inflation: PCE price index rose 2.3% YoY; core PCE up 2.8%, showing steady inflation pressures.

Income Growth: Personal income rose 0.6% MoM; disposable income up 0.7%, giving consumers more to spend.

Spending: Personal spending increased 0.4% in October, indicating confidence and contributing to GDP.

Healthy Balance: Spending grew slower than income, reducing risks of debt and financial instability.

Last Week’s Earnings Reports:

Zoom (ZM)

Q3 Revenue: $1.18B (+4% YoY), surpassed estimates.

EPS: $1.38 (non-GAAP), exceeded expectations.

Highlights: Launched Custom AI Companion & webinars for 1M attendees; raised FY revenue forecast to $4.656B–$4.661B.

Concerns: Slower growth pace; increased competition from Cisco (NASDAQ:CSCO) affecting market share.

CrowdStrike (NASDAQ:CRWD)

Q3 Revenue: $1.01B (+29% YoY); ARR exceeded $4B (+27% YoY).

Gross Margin: 78%; customer retention 97%; free cash flow $230.6M (23% of revenue).

Setbacks: GAAP net loss of $0.07/share; July software incident extended sales cycles; weaker forecast led to a 6% stock drop.

Technical Outlook: Bullish trend towards $377–$387 as long as price stays above $332.75. Breaking below $332.75 risks a decline to $295.

READ FULL MARKET MORNING

READ FULL MARKET MORNINGIndices Performance:

Market Gains:

Dow +7.5%, Nasdaq +6.2%, S&P 500 +5.7% in November.

Dow and S&P 500 hit all-time highs.

Fed Outlook:

Inflation gauge (core PCE) at 2.8% YoY, up from 2.7%.

Traders see a 66% chance of a 25 bps rate cut in December.

SPX Technicals:

Key resistance: Fibonacci level at 6,100; RSI shows weakening momentum.

Possible moves:

Rejection → decline to 5,870 (support zone).

Breakout above 6,030 → potential further gains.

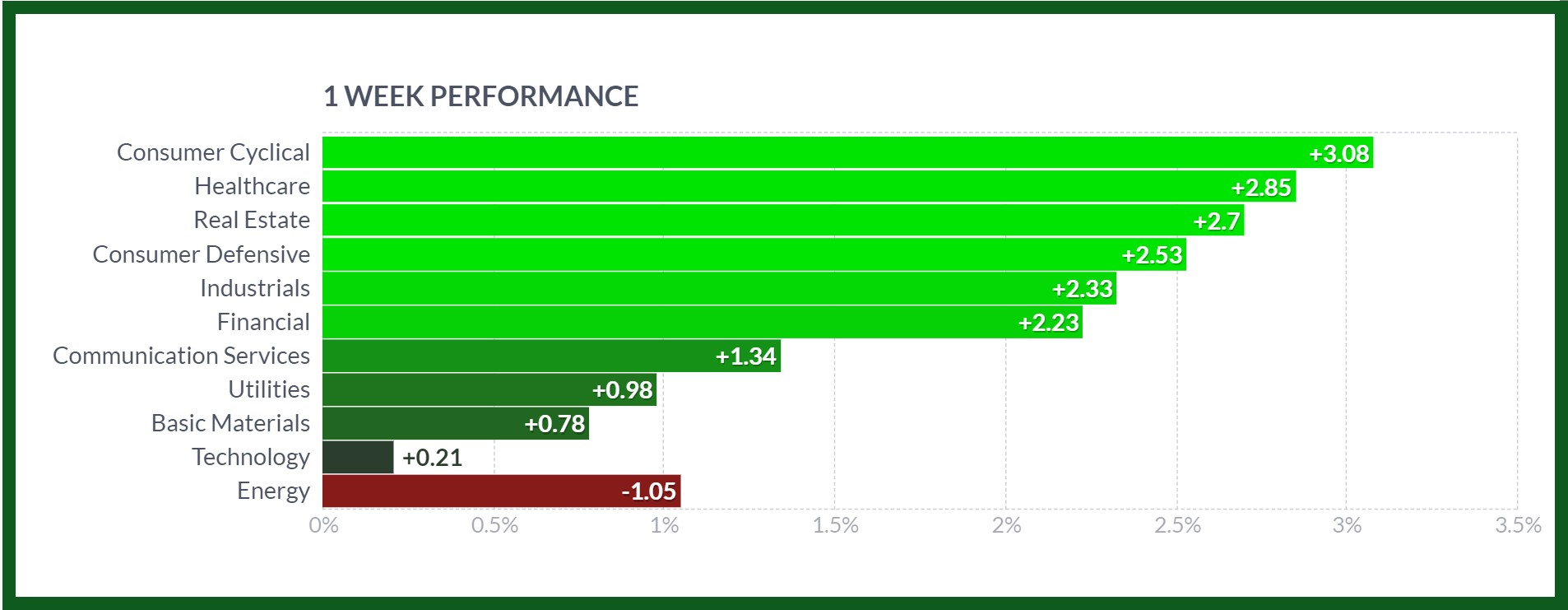

Stock Market Sector Performance:

Consumer Cyclical: +3% (higher spending and confidence).

Healthcare: +2.8% (medical tech advances, drug trials).

Real Estate: +2.7% (strong demand, rising home sales).

Consumer Defensive: +2.5% (steady demand during Black Friday).

Industrials: +2.3% (infrastructure spending, industrial output).

Financials: +2.23% (favorable interest rates).

Technology: +0.21% (chip stocks rebound, mixed semiconductor performance).

Energy: -1.05% (falling oil prices, lower demand).

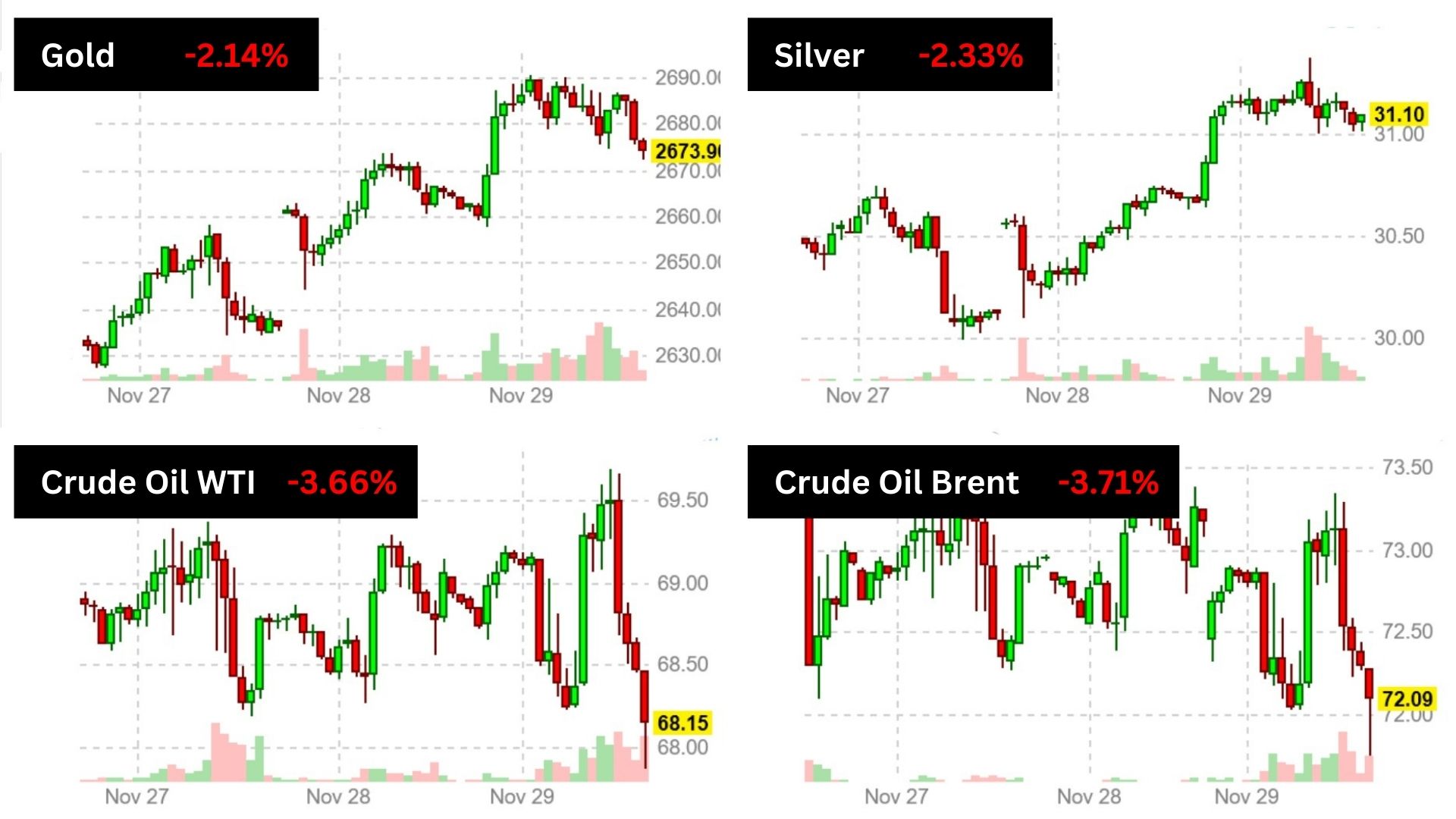

Commodities:

Gold

Current Trend: Prices rose as the dollar and Treasury yields weakened.

Santa Rally Potential: Historically, gold has gained in December for the past seven years.

Technical Outlook:

Stabilized after correcting from October's record high.

Ranging between $2,600–$2,700 after breaking a major uptrend line.

RSI indicates weakening momentum, suggesting short-term bearishness.

Crude Oil

Price Movement: Fell to $72.13/barrel, down 3% for the week due to eased supply concerns from Israel-Hezbollah ceasefire.

OPEC+ Impact: Delay in meeting creates market uncertainty as traders anticipate decisions on production cuts.

Future Outlook:

Global inventories likely to rise in Q2 2025 due to increased supply from the U.S., Canada, and South America.

Weak demand growth expected to temper price recovery.

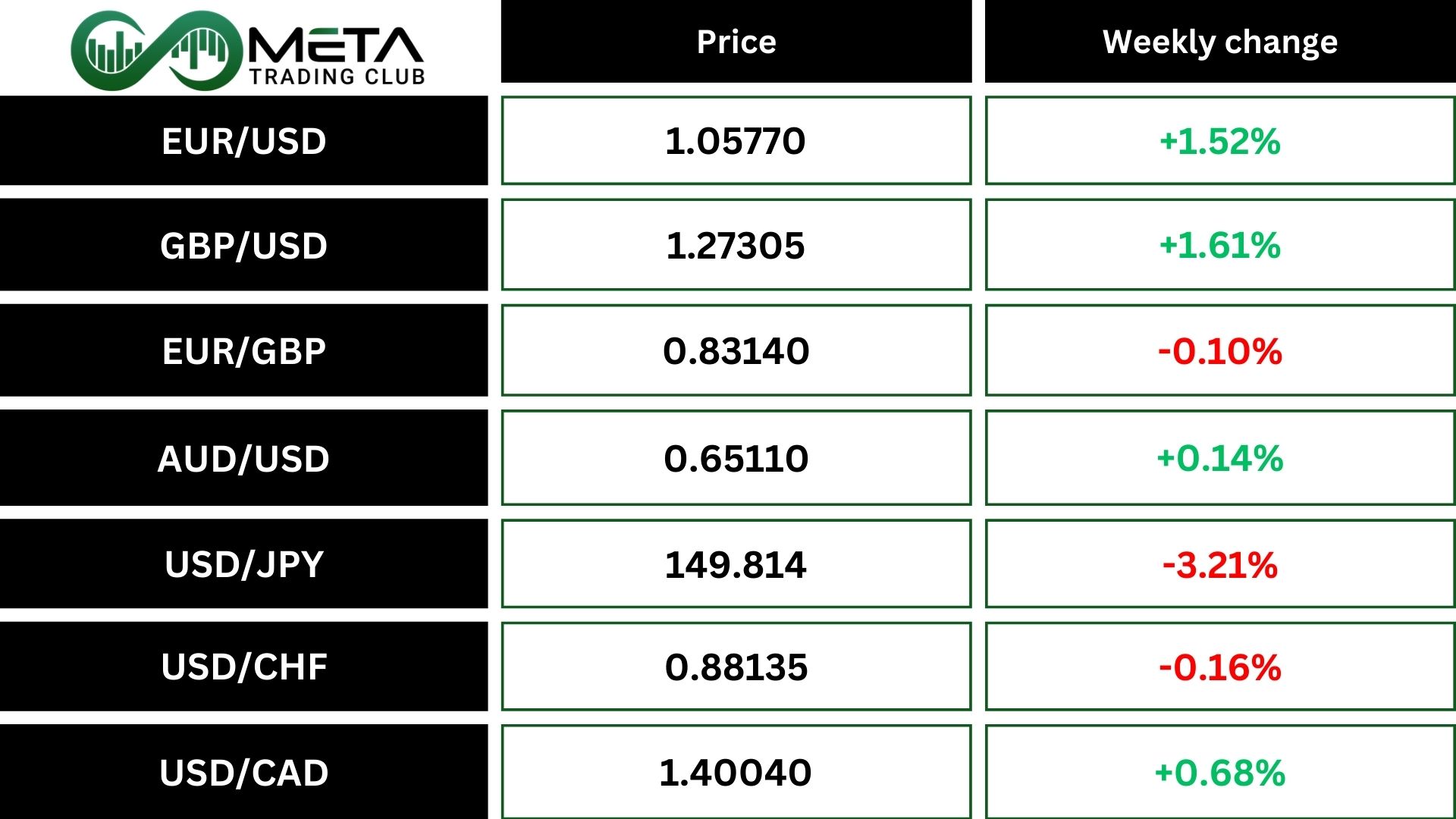

Forex:

Japanese Yen:

Surged to a 6-week high vs. the dollar, driven by Tokyo's 2.2% YoY CPI rise in November, surpassing expectations.

Dollar fell to 149.62 yen, marking a 3.21% weekly loss, largest since July.

Dollar Index:

Declined, but still on track for a 1.59% rise in November, driven by expectations of pro-growth U.S. policies.

Euro:

Gained 1.5% for the week but down 2.8% for November.

Mixed inflation data from France and Germany; ECB divided on further rate cuts.

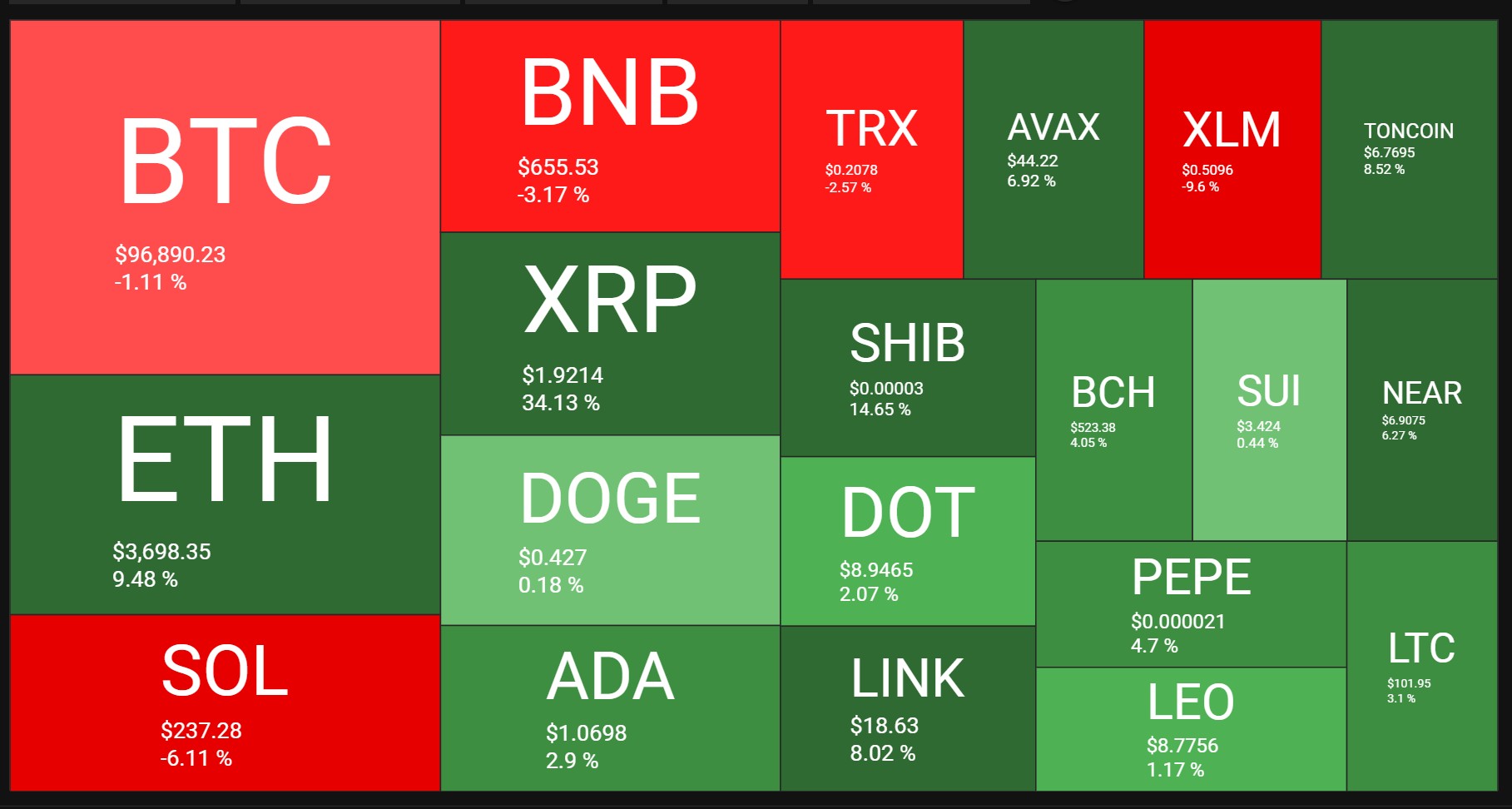

Crypto:

Ethereum (ETH):

Currently below resistance levels ($3,800 to $4,000).

If it breaks above $4,000 and stays above, a new bullish trend could push it towards its all-time high of $4,950 or higher.

Bitcoin (BTC):

Fell 1.1% last week but is attempting to recover its record high of $99,830.

On track for a 39% increase this month, the best performance since February.

Currently ranges between $90,000 (support) and $100,000 (resistance).

RSI shows weakness, indicating potential range-bound movement.

A break above $100,000 could lead to further increases, while a fall below $90,000 may bring the price down to $85,000.

READ FULL MARKET MORNING

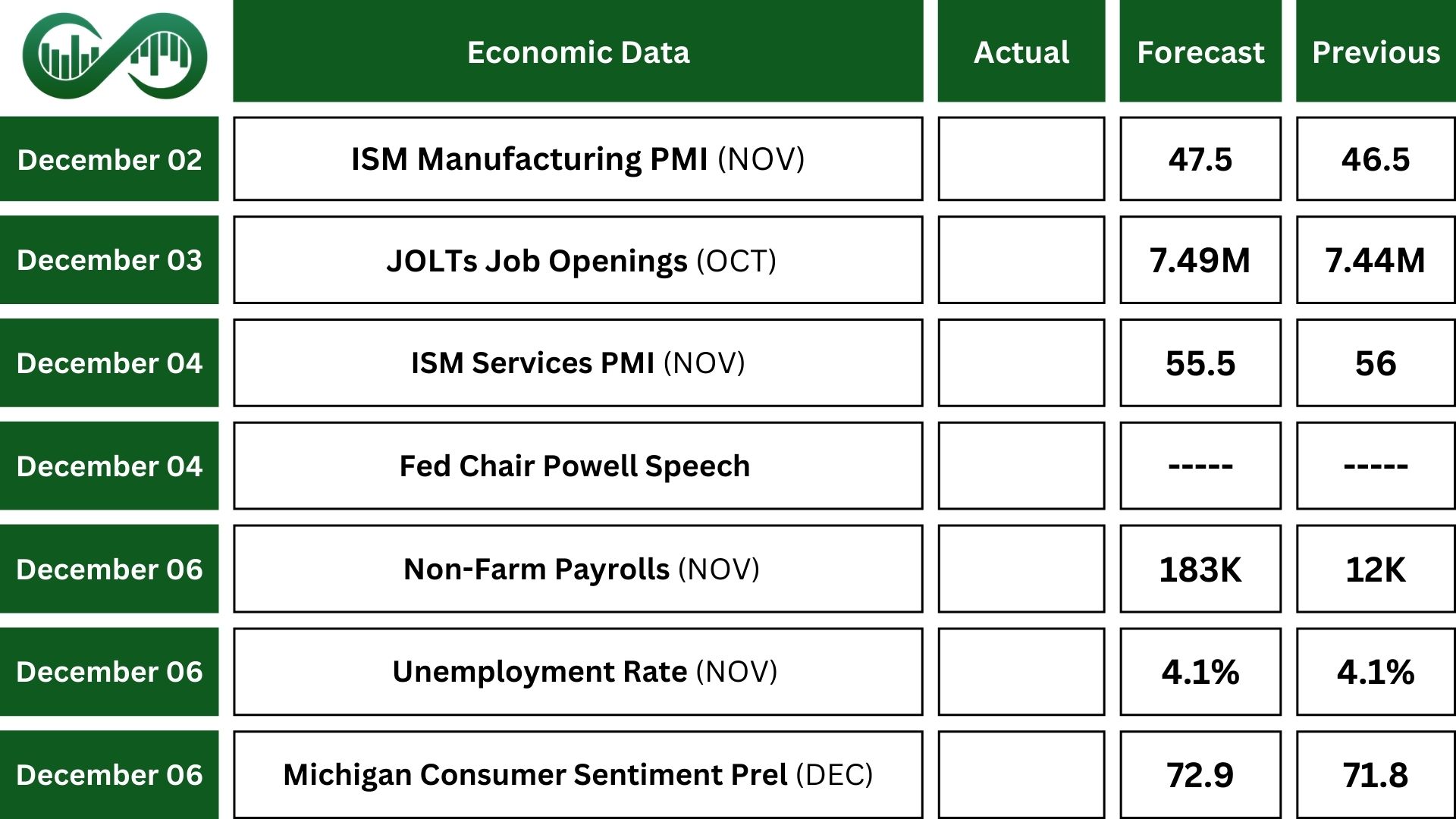

READ FULL MARKET MORNINGThis Week’s Outlook:

Economic Events:

November Jobs Report:

Economy expected to add 183K jobs, a significant rebound from October's 12K.

Unemployment rate forecast to stay at 4.1%.

Wage growth projected to slow to 0.3% from 0.4%.

ISM PMIs:

Services sector may show slight slowdown.

Manufacturing downturn likely to ease.

JOLTS Report:

Job openings expected to rise to 7.49M from 7.443M.

Other Key Data:

Michigan consumer sentiment index expected to rise in December.

Factory orders likely to increase 0.4% in October.

Additional reports include ADP (NASDAQ:ADP) employment, Challenger job cuts, consumer credit, exports/imports, and construction spending.

Fed Officials:

Market will monitor speeches from several Fed officials, including Chair Powell at the New York Times (NYSE:NYT) DealBook Summit.

Earning Events:

On the corporate side, major companies like SalesForce (CRM), AutoZone (NYSE:AZO), Synopsys (NASDAQ:SNPS) and Kroger (NYSE:KR) will release their quarterly results.

For more info check out Meta (NASDAQ:META) Trading Club's Market Mornings Newsletter.