The matrix below highlights the year-to-date percentage performance of each constituent of the S&P 500. The size of the cells is proportional to the market capitalization of each stock.

Source: Brew Markets

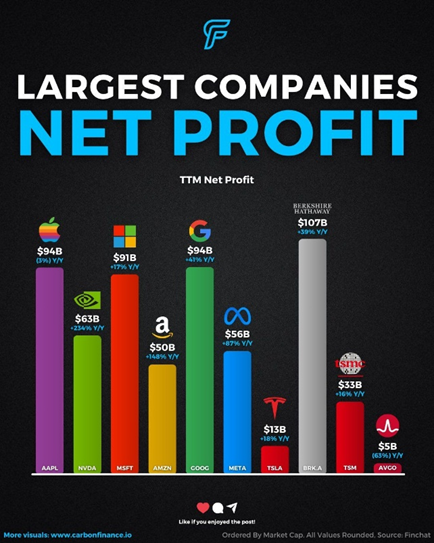

These giants of the American economy are real cash machines. Here are their net revenues and year-on-year growth for the last twelve months.

The ten top companies alone earned $606 billion this year. Will they continue to increase their profits at a similar pace in the future? Note that Berkshire's net income includes unrealized gains from its enormous investment portfolio.

Source: www.carbonfinance.io

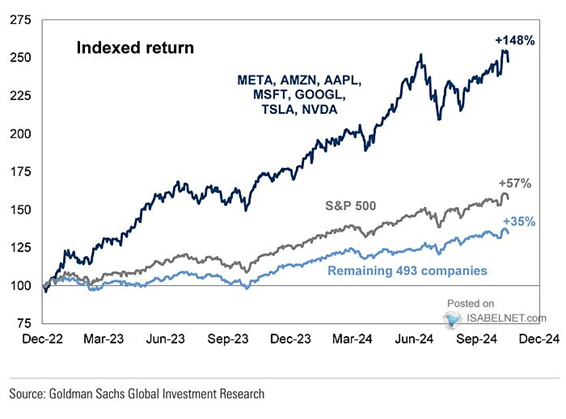

The Disproportionate Impact of the Magnificent 7 on S&P 500 Performance

The exceptional performance of the S&P 500 since December 2022 is largely due to the Magnificent 7, whose gigantic market capitalizations and strong growth have dominated the market. Without their contribution, returns would have been much closer to the average, still respectable, but far less remarkable.

Source: Goldman Sachs (NYSE:GS), @ISABELNET_SA thru Lance Roberts on X

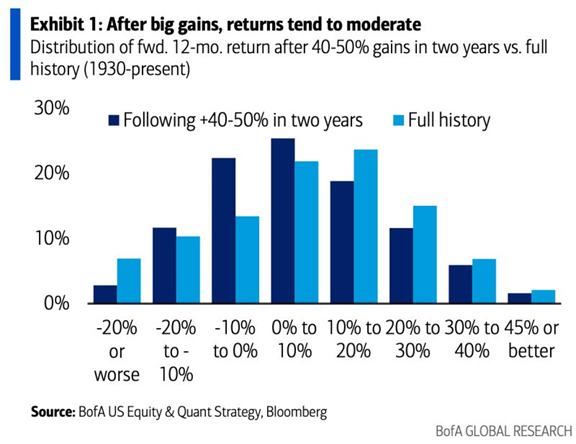

S&P 500 Performance Could Be More Modest in 2025

With the S&P 500 up around 50% over the past two years, history suggests that the index's gains will be more muted in the future. Returns have most often been in the 0-10% range, following periods when the index gained 40-50% over a two-year period.

Source: BofA, Mike Zaccardi, CFA, CMT, MBA