It’s that time of year when Wall Street polishes up its crystal balls and predicts next year’s market returns. Since Wall Street never predicts a down year, these forecasts are often wrong and sometimes very wrong. For example, on December 7th, 2021, we wrote an article about the predictions for 2022.

“There is one thing about Goldman Sachs (NYSE:GS) that is always consistent; they are ‘bullish.’ Of course, given that the market is positive more often than negative, it ‘pays’ to be bullish when your company sells products to hungry investors.

It is important to remember that Goldman Sachs was wrong when it was most important, particularly in 2000 and 2008.

However, in keeping with its traditional bullishness, Goldman’s chief equity strategist David Kostin forecasted the S&P 500 will climb by 9% to 5100 at year-end 2022. As he notes, such will “reflect a prospective total return of 10% including dividends.”

The problem, of course, is that the S&P 500 did NOT end the year at 5100.

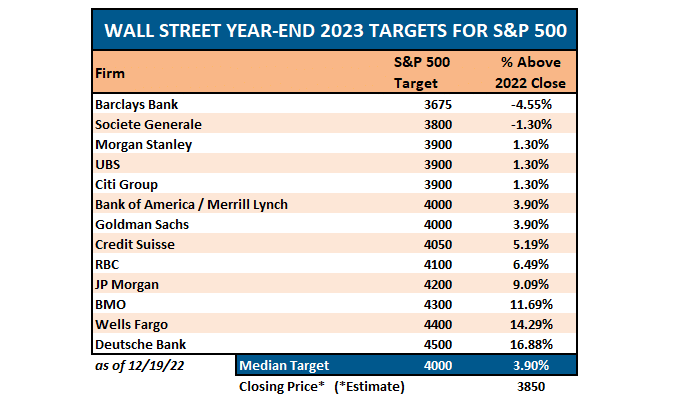

Then, in 2022, Wall Street suggested that 2023 would be a meager return of just 3.9%.

Of course, reality turned out to be markedly different.

It was the same in 2023 for 2024 as analysts wildly underestimated the valuation expansion, which sent the index up nearly 30% for the year.

However, while analysts repeatedly fail at the guessing game, Wall Street’s annual tradition is always of higher returns. To borrow a quote:

“(Market) Predictions Are Difficult…Especially When They Are About The Future” – Niels Bohr

Okay, I took a little poetic license, but the point is that while we try, predictions of the future are difficult at best and impossible at worst. If we could accurately predict the future, fortune tellers would win all the lotteries, psychics would be more prosperous than Elon Musk, and portfolio managers would always beat the index.

As investors, we must rely on our data, analyze what occurred previously, weed through the present noise, and discern the possible future outcomes. The biggest problem with Wall Street today and in the past is its consistent disregard for the unexpected and random events that inevitability occur.

We have seen plenty in recent years, from trade wars to Brexit to Fed policy and a global pandemic. Yet, before those events caused a market downturn, Wall Street analysts were wildly bullish that it wouldn’t happen.

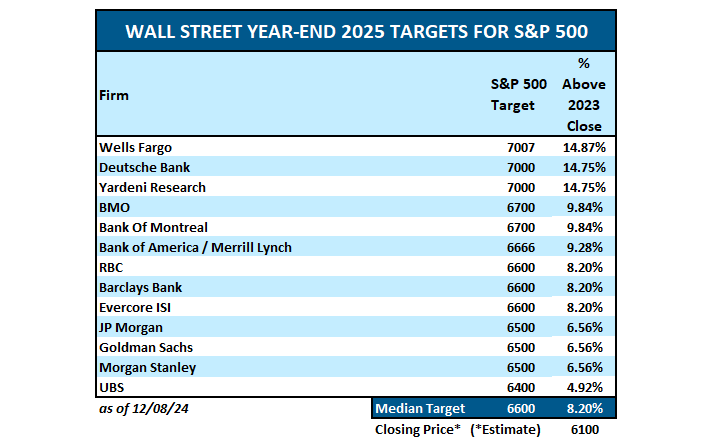

So what about 2025? We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are primarily optimistic for the coming year. The median estimate is for the market to rise to 6600 next year, which would be a disappointing return of just 8.2% after two years of 20% plus gains. However, the high estimate from Wells Fargo suggests a 14% return, with the low estimate from UBS of just a 5% return. Notably, there is not one estimate available for a negative return.

There are several risks to these forecasts.

Estimating The Outcomes

The problem with current forward estimates is that several factors must exist to sustain historically high earnings growth.

- Economic growth must remain more robust than the average 20-year growth rate.

- Wage and labor growth must reverse to sustain historically elevated profit margins, and,

- Both interest rates and inflation must reverse to very low levels.

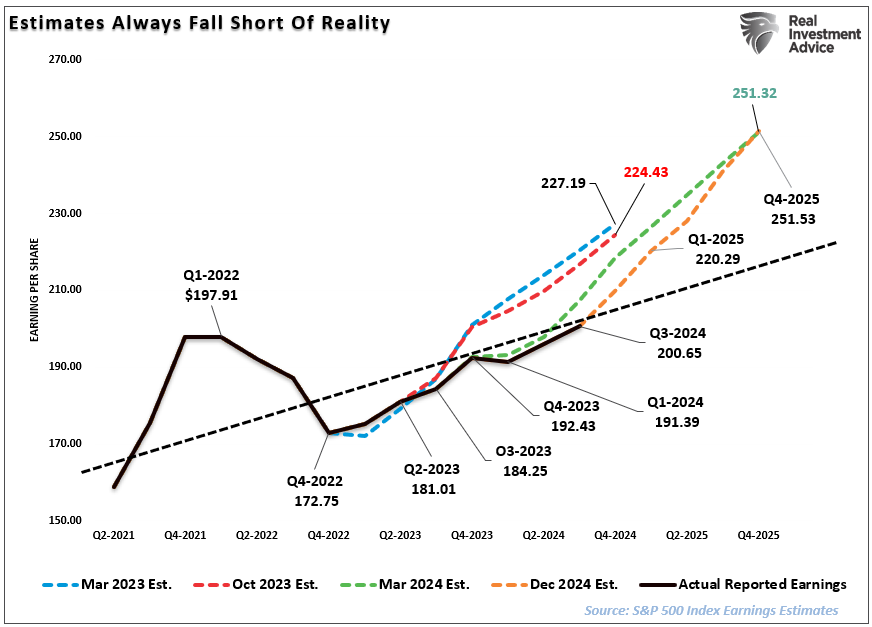

While such is possible, the probabilities are low, as strong economic growth can not exist in a low inflation and interest-rate environment. More notably, if the Fed cuts rates further, as most economists and analysts expect next year, such will be in response to a slowing economic environment or financial stress. Such would not support more optimistic earnings estimates of $251 per share next year. This represents roughly a 19% increase from Q4-2024 levels. (In 2023, estimates for 2024 suggested a 14% increase, which was just 9%. The long-term trend of earnings growth from 1900 to the present is just 7.7%)

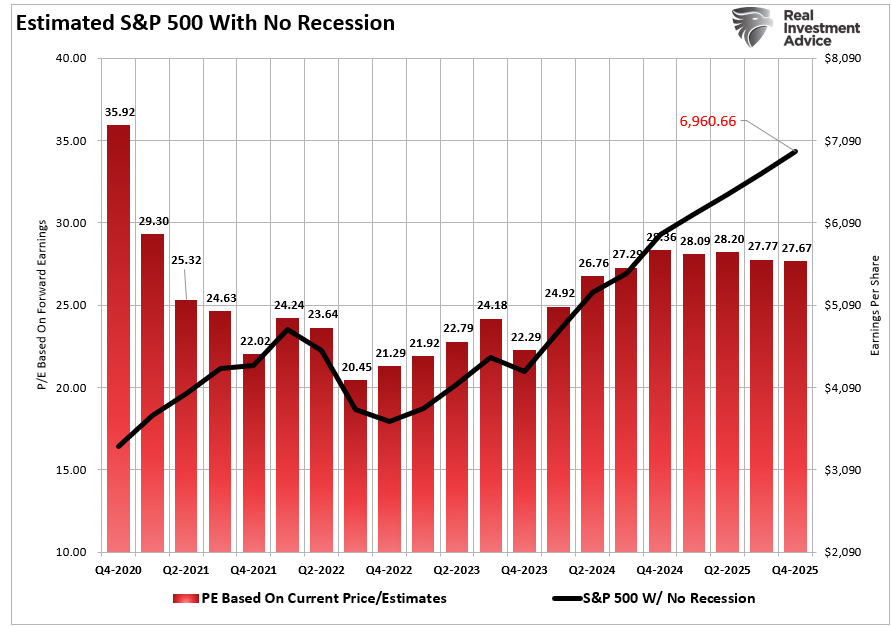

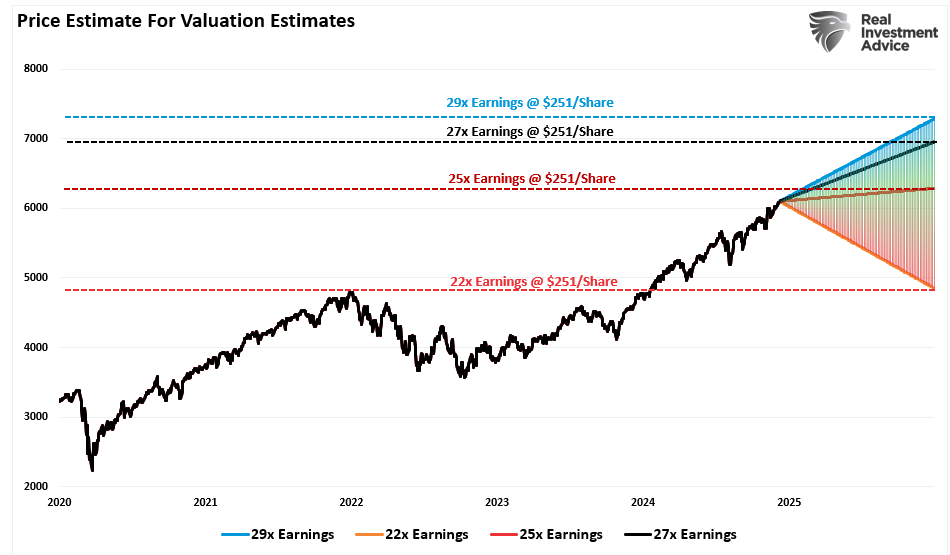

Nonetheless, with that said, we can use the current forward estimates of $251 to estimate both a recession and non-recession price target for the S&P 500 as we head into 2025. These assumptions are based on valuation multiples within ranges of current market levels.

The current earnings predictions will prove correct in the NO-recession scenario, and valuations will fall slightly over the next year. Therefore, based on current estimates, the S&P 500 should theoretically trade at roughly 6960 by 2025. Given that the market is trading at approximately 6100 (at the time of this writing), this would imply a 14% increase from current levels.

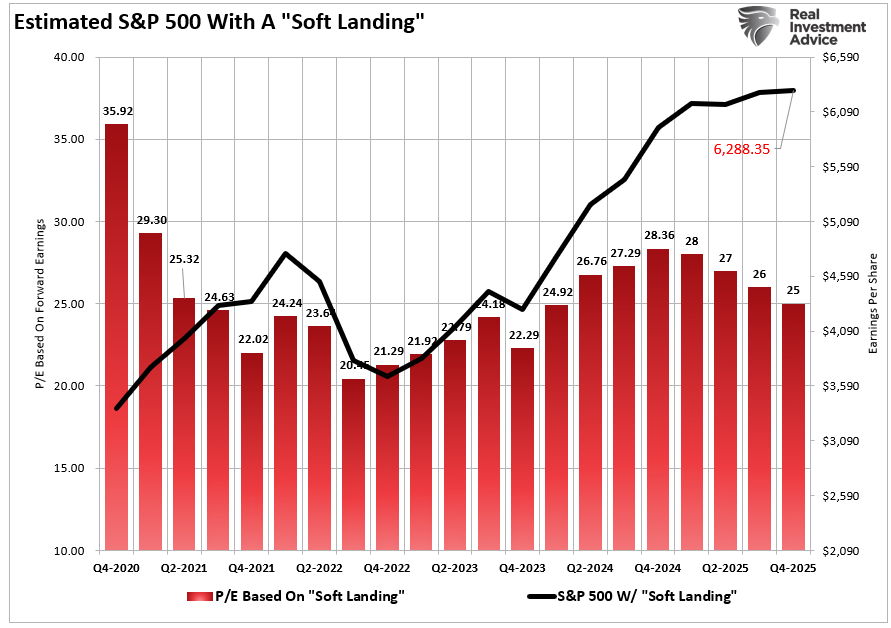

However, should the economy slow next year in a “soft landing” scenario, valuations would be expected to revert toward the average of the last few years of 25x earnings. This would imply a market rising to just 6288, or roughly a 3% advance next year.

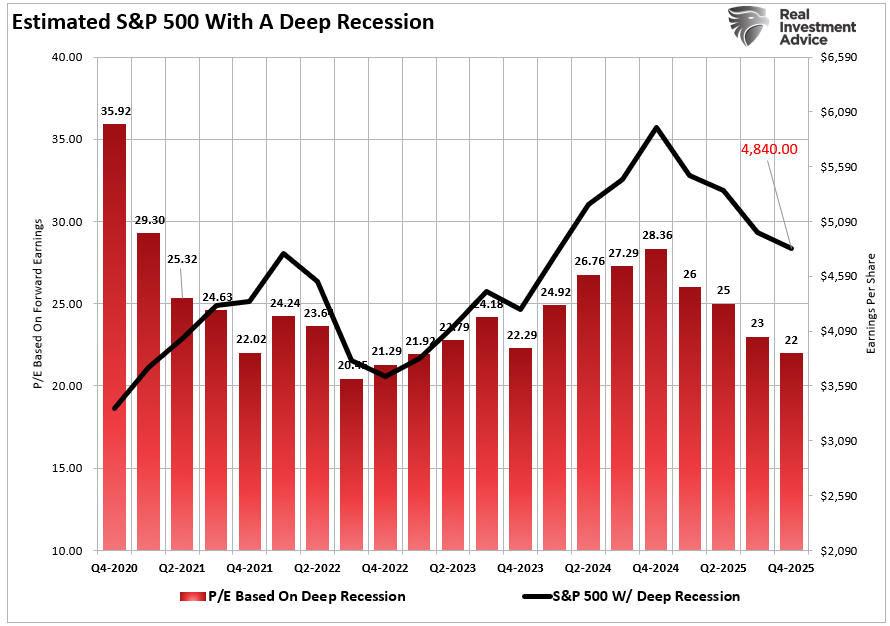

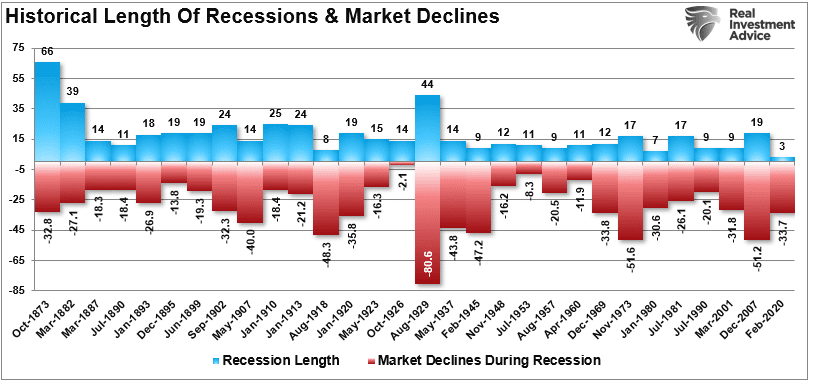

But what if the U.S. encounters a recession due to economic or political policies or a credit-related event? Then, a decline in valuations toward the 2022 level of 22x earnings should be expected. Such would equate to roughly a 20% decline from current levels.

While a 20% decline may seem hostile, such would align with typical recessionary bear markets.

However, we must consider one more scenario.

Maybe The Bulls Are Right

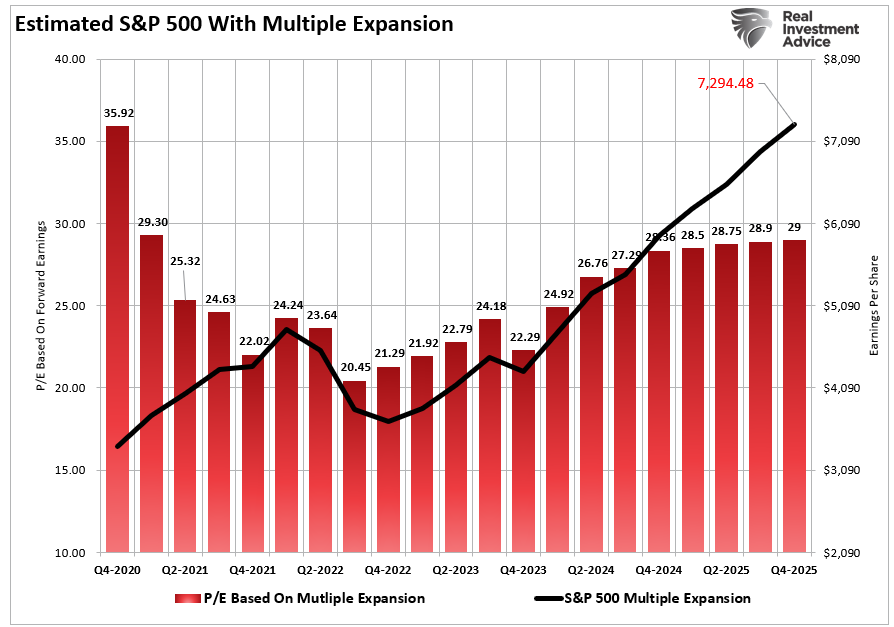

We would be remiss in not providing for a bullish outcome in 2024. However, several factors must be considered for that bullish outcome.

- We assume the $251/share in year-end estimates remains valid.

- That the economy avoids a recession even as inflation falls

- The Federal Reserve continues to cut interest rates.

- Valuations rise slightly to 29x earnings.

In this scenario, the S&P 500 should rise from roughly 6100 to 7294 by the end of 2025. Such would imply a 19.5% gain for the year. With the market already higher by more than 20% over the last two years, historically speaking, another strong year is not impossible due to momentum and psychology as long as liquidity remains positive.

The chart below combines the four potential predictions to show the possible market range for next year. Of course, you can analyze, make valuation assumptions, and derive your targets for next year based on your views. This analysis is an exercise in logic to develop a range of possibilities and probabilities over the next 12 months.

Conclusion

Here is our concern with the more bullish predictions. It entirely depends on a “no recession” outcome, and the Fed must reverse its monetary tightening. The issue with that view is that IF the economy does indeed have a soft landing, there is no reason for the Federal Reserve to reverse reducing its balance sheet or lower interest rates.

More importantly, the rise in asset prices eases financial conditions, reducing the Fed’s ability to bring down inflation. This would also presumably mean employment remains strong, along with wage growth, elevating inflationary pressures.

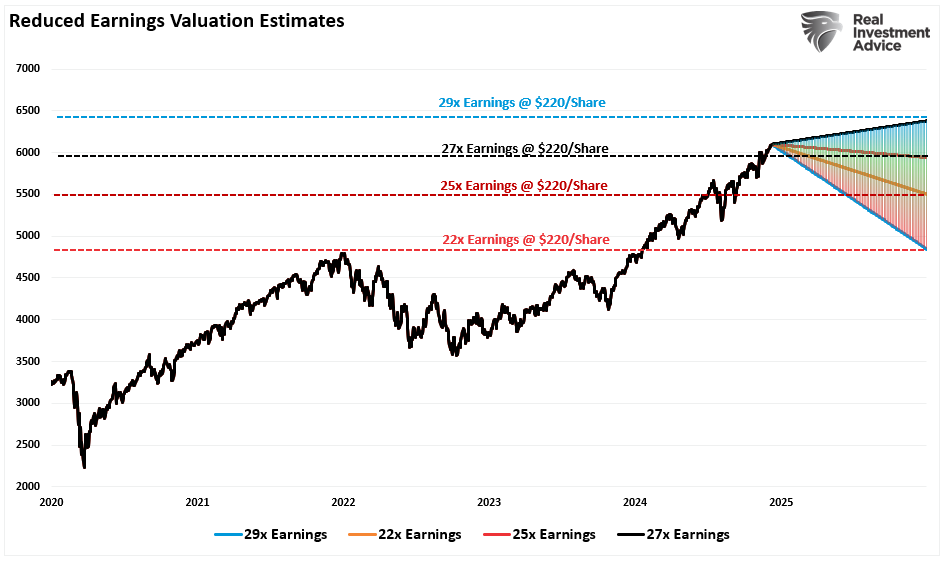

While the bullish prediction is possible, that outcome faces many challenges in 2025, given the market already trades at fairly lofty valuations. Even in a “soft landing” environment, earnings should weaken, which makes current valuations at 27x earnings more challenging to sustain. Therefore, assuming earnings decline toward their long-term trend, that would suggest current estimates fall to $220/share by the end of 2025. This substantially changes the outlook for stocks, with the most bullish case being 6380, assuming a roughly 4.5% gain versus every other outcome, providing losses ranging from a 2.6% loss to a 20.6% decline.

Our best guess is that reality lies somewhere in the middle. Yes, there is a bullish scenario where earnings decline and monetary policy leads investors to pay more for lower earnings. However, that outcome has a limited lifespan, as valuations matter to long-term returns.

As investors, we should hope for lower valuations and prices, which gives us the best potential for long-term returns. Unfortunately, we don’t want the pain of getting there.

Regardless of which scenario plays out in real-time, there is a reasonable risk of weaker returns in 2025.

That is just the math.