We primarily track the S&P 500 (SPX) using the Elliott Wave Principle (EWP). The EWP allows us to identify the potential paths the market can take based on known patterns, which must adhere to specific price-based rules. Since we cannot predict the future, the EWP can help us identify the most likely path.

However, since financial markets are non-linear, stochastic, and probabilistic, we must, like any other forecasting discipline, always “anticipate, monitor, and adjust if necessary.” Besides, since the EWP is price-based, it is superior to using news, opinions, and other non-price-based analyses to forecast the stock market because A) price is the aggregate of all market participants at any given time, B) only price pays, and C) it should therefore be in every trader and investors’ tool kit.

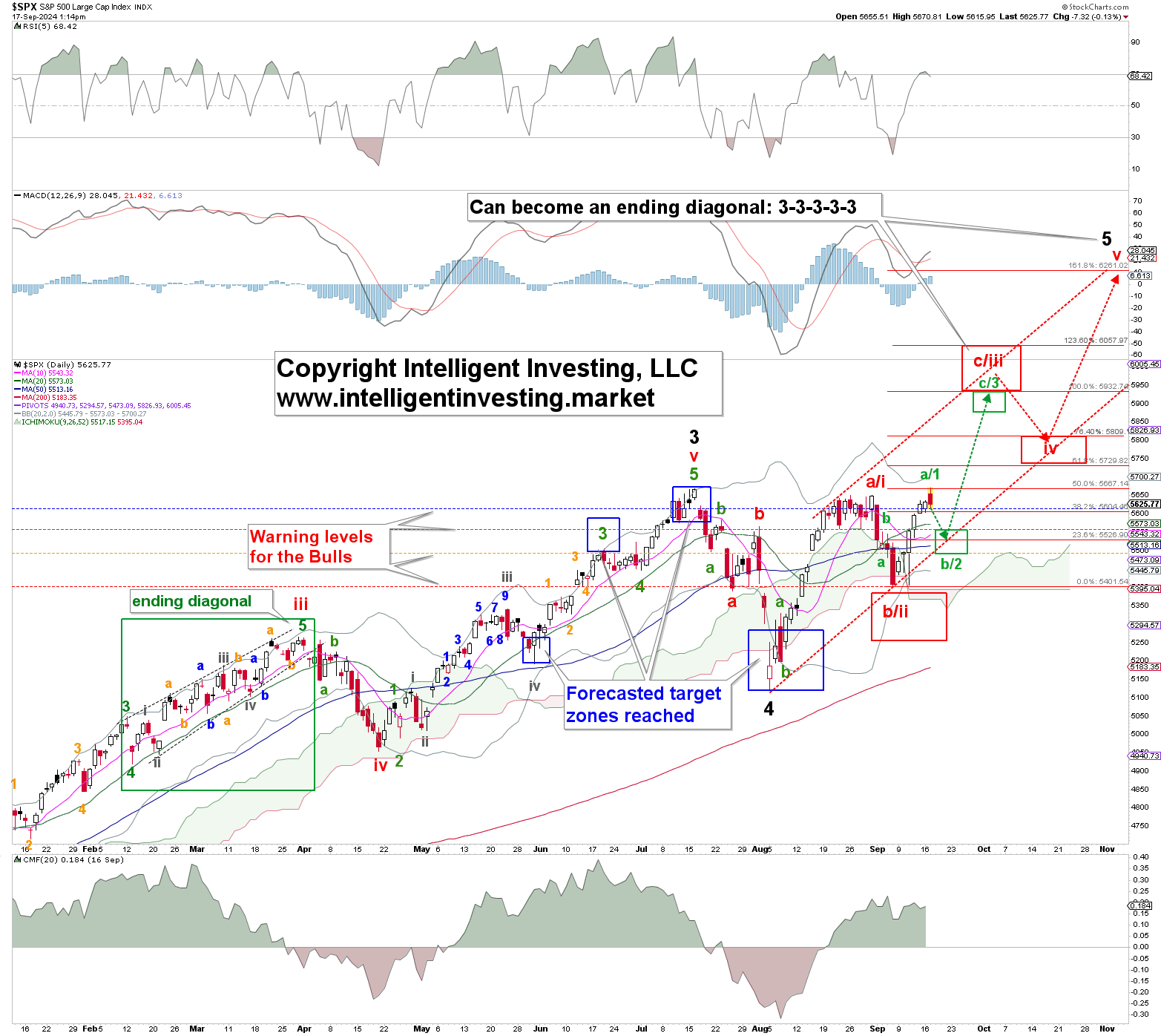

With that in mind, let’s look at the current price setup to see if tomorrow’s important Federal Reserve (FED) interest rate decision can crash the stock market. See Figure 1 below.

Our preferred assessment of the price action (since the infamous October 2022 low) is that the index completed the (black) major W-3 and W-4 this summer and is now working on the black W-5. The latter appears to form a (contracting) ending diagonal (ED) pattern. EDs comprise a 3-3-3-3-3 pattern and are, therefore, initially indistinguishable from a correction: a 3-3-3 pattern. Thus, it takes time to be confident that the SPX is in an ED.

The index also formed an ED during the February-March rally. See the green box in Figure 1, which illustrates its overlapping abc-abc-abc-abc-abc nature well. We should, therefore, expect something similar over the next few months but on a grander scale, as that was a (green) minor-5 wave, and the current rally should be a two-degree larger Major wave.

With that in mind, we expect the green W-a/1 of the red W-iii/c to be completed soon, and the green W-b/2 to ideally $5525+/25 should be underway from where the green W-3/c to ideally $5950+/-25 can kick in. A break below the (blue) warning level for the Bulls at yesterday’s opening ($5615) will be the first sign that the green W-b/2 is underway, with confirmation below the grey, 2nd warning level, at $5555.

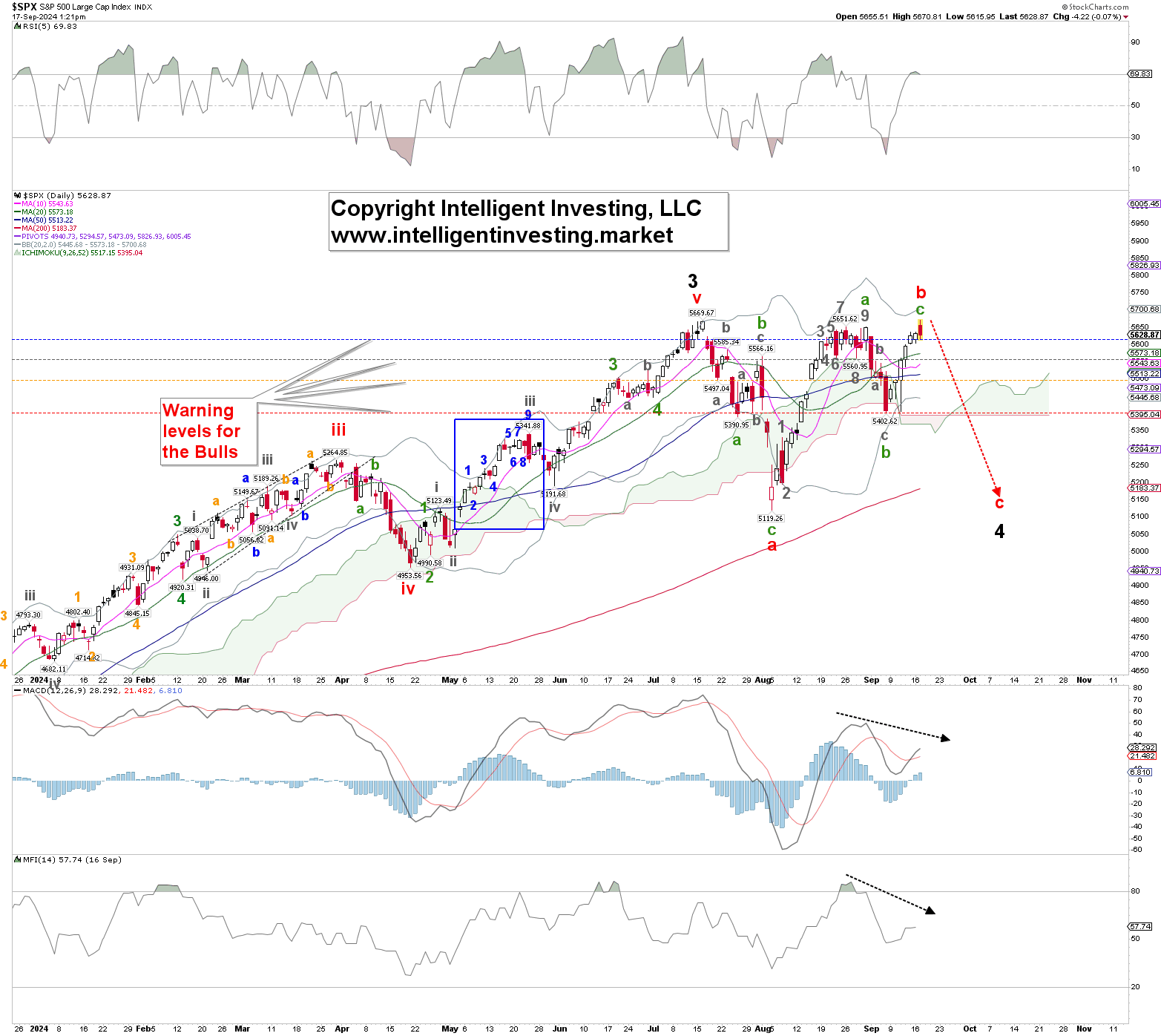

The Bulls will be in more trouble on a break below the orange, 3rd warning, level at $5490, as that significantly increases the odds that the market will go below the September 6 low at $5402. Namely, since markets are—as said—complex probabilistic systems, while the EWP is interpretive, we must always be aware that our assessment could be wrong. Thus, the rally from the notorious August 5 low could also be a protracted three-wave rally—a corrective B-wave. See Figure 2 below.

Like in May, see the blue box; we can count nine (grey) waves from the August 5 low to the September 2 high based on closing prices, which can be the green W-a of the protracted red W-b. There were then three waves lower to the September 6 low, grey W-a, -b, -c, followed by another five waves up to today’s high. Hence, a protracted 5-3-5, a-b-c pattern can be completed. This would mean the black W-4 morphs into a flat correction. A flat correction often has a=b=c; thus, the red W-c can drop back to the $5100 level.

However, it requires a break below the September 6 low, with a severe warning below $5490, to tell us that will be the case. From there, the black W-5 can start. However, this is our alternative view, which serves as an insurance policy for any trade we may initiate when the ideal green W-b/2 target zone is reached.

Thus, unless we are entirely mistaken, one way or another, we don’t see the FED’s rate decision crash the market. Because our analysis is price-based, we don’t care or worry if the FED will lower rates by 0.25, 0.50, or even 0 bps. Thanks to the EWP, we know that after W-4 comes W-5, so we see the worst-case scenario as a drop back to ~$5100. In contrast, we anticipate only a drop to ideally $5525+/25 before the next rally to potentially as high as $6000 kicks in, contingent on holding above the September 6 low at $5402.