Spotify's Business ModelSpotify Technology S.A. (NYSE:SPOT) is one of the world's leading audio streaming platforms, with 640 million MAUs (Monthly Active Users) as of September 2024. This includes 252 million premium subscribers and 402 million ad-supported users. According to Statista's report, Spotify has a dominant 31.7% market share in the global music streaming industry, more than double that of the second-place contender Tencent Music (14.4%).

Created by Warp Analysis

Spotify's business model relies on two primary streams: premium subscriptions and ad-supported services. The ad-supported segment generates revenue through audio, display, and video advertisements featured on its extensive catalog of music and podcasts. In the premium segment, revenue comes from direct subscriptions, partnerships with telecom providers offering bundled packages, and collaborations that integrate Spotify Premium with other services. Spotify offers diverse subscription options to cater to different user needs, such as the Standard, Family, Duo, and Student plans. These plans vary by region, aligning with demographic trends and user preferences. Importantly, Spotify's premium growth primarily stems from converting ad-supported users to premium subscribers, enhancing its overall user base and revenue.

Spotify enjoys a vast global footprint as it operates in 184 countries and territories. Europe leads with 27% of MAUs, followed by North America with 18%. Notably, the platform's fastest-growing regions are Latin America (22% MAUs) and the Rest of the World (33% MAUs).

Third Quarter 2024 Earnings ReviewSpotify delivered strong third-quarter financial results as the revenue jumped 19% year-over-year to 3,988 million on a constant currency basis, driven by increases in subscriber numbers and Average Revenue Per User (ARPU). Premium subscriber revenue surged by 21% year-over-year to 3,516 million, supported by a 12% rise in premium subscribers and an ARPU increase of 11% to 4.71. The ARPU improvement reflects the benefits of price increases, though partially offset by an unfavorable product mix. Meanwhile, ad-supported revenue grew by 7% year over year to 472 million, primarily due to the number of impressions sold, partially offset by weak pricing in music and podcast advertisements.

Spotify outperformed management expectations, with MAU net additions reaching 14 million (versus guidance of 13 million) and premium net additions hitting 6 million (versus 5 million). These gains were largely fueled by Spotify's strategic promotional campaigns targeting new users and encouraging premium subscriptions.

The gross margin improved by 470 bps year-over-year to 31.1% due to lower content costs in music streaming and audiobooks. Furthermore, operating margins improved by 1040 bps year-over-year to 11.4%, driven by strong gross margins, lower personnel-related costs, and marketing costs. However, these benefits were slightly tempered by social charges, which are tied to employee share-based compensation and influenced by movements in Spotify's stock price.

Spotify's Future OutlookOver the last four years, Spotify's topline grew at a CAGR of 18.2%, driven by the increased subscriber count, expansion in different geographies, introduction of new services such as audiobooks and podcasts, acquisitions, and higher price realizations. In the first nine months of 2024, Spotify introduced several innovative features to boost user engagement and retention. Key initiatives included launching the AI DJ for Spanish-speaking users, expanding the AI Playlist Beta to the US, Ireland, New Zealand, and Canada, and adding a comment section for podcasts to enhance interactivity. Additionally, in October 2024, Spotify Music Videos became available in 85 new markets, totaling 97 markets, and the company integrated over 200,000 audiobook titles into its premium subscriptions.

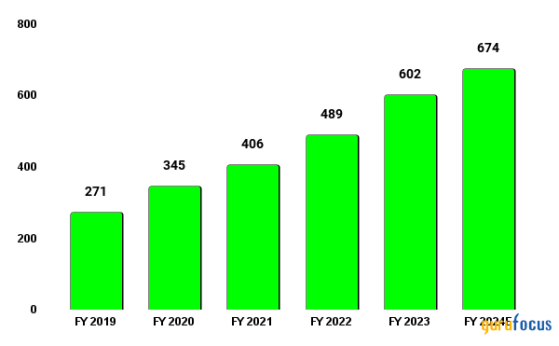

Looking ahead, I am assuming a 12% year-over-year increase in Monthly Active Users (MAUs), bringing the total to 674 million by the end of 2024, surpassing the company's guidance of 665 million. The premium subscriber net additions are expected to reach 12 million in Q4 2024, totaling 264 million premium subscribers by year-end. The reason for this optimistic outlook is the geographic expansion and increase in the availability of many audiobooks. Currently, Spotify has more than 375,000 audiobooks available for its premium users and has approximately 11% market share, ahead of Apple (NASDAQ:AAPL) and trailing the market leader Amazon (NASDAQ:AMZN)'s Audible. The increase in subscriber count and ARPU should help grow the revenue by 15% year-over-year to 15,234 million in FY2024.

Created by Warp Analysis

In the long term, Spotify is committed to increasing its product offerings by expanding its advertising business and optimizing monetization strategies. The company is developing its supply-side platform (SSP), known as Spotify Ads Exchange, and has partnered with the demand-side platform (DSP), Trade Desk. This collaboration aims to reduce reliance on direct sales teams and large brand deals. A test pilot with Trade Desk is planned for 2025, marking a strategic step toward scalable, programmatic advertising solutions. Furthermore, the company is also expanding its advertising SKU by offering premium video ads, designed to help small and medium-sized businesses that are targeting high-impact ad campaigns. Overall, these initiatives should bring in additional revenue for the company.

To enhance profitability, Spotify has streamlined its operations through multiple workforce reductions: a 6% reduction in Q1 2023 and a further 17% reduction in Q4 2023. These efforts have significantly lowered operating costs and improved efficiency. Additionally, the company's strategic realignment in podcast operations and content rationalization continues to optimize resources. These strategic initiatives are helping Spotify become a profitable company in FY2024. For the full year 2024, I am assuming gross margins to be 30% and operating margins to be 8% given the improved efficiency, lowered employee base, and higher ARPU.

Should We Buy Spotify?

Created by Warp Analysis using Alpha spread

Source: Finance charts

As Spotify is turning profitable in 2024, I am assuming this run should continue over the coming years. Hence, I am using DCF to calculate its intrinsic value. I have assumed a discount rate of 6.25% and revenue growth of 20% for the next four years. Using these values, the intrinsic value of Spotify should be $373.27, which is approximately 30% below its current stock price, indicating overvaluation. To further back my thesis, using the price-to-sales ratio, the stock is currently trading at 6.01x, which is 33% above its 12-month average of 4.51x. This elevated ratio further reinforces the likelihood that the stock is trading at a premium relative to its historical valuation. In summary, while Spotify's long-term potential remains strong, the current valuation warrants a cautious approach.

This content was originally published on Gurufocus.com