What does the company do?

SPS Commerce Inc. (NASDAQ:SPSC) creates software to help retailers with their supply chain management. It specializes in Electronic Data Interchange (EDI) services that help businesses automate and streamline communications across supply chains. Although its main customer target has been retailers, it's now expanding to other areas as well.SPS Commerce Numbers

RevenueThe company's year-over-year growth was 19% in 2024, well above its target model of ?15%. This growth equates to an 8-year CAGR (2016-2024) of 16%, demonstrating sustainable long-term growth.Recurring revenue now represents 94% of total revenue, demonstrating excellent revenue stability, which is helpful in a sector with high volatility. The current penetration of ~ 16% suggests significant room for expansion on a $11.1B global TAM (Total Addressable Market), with $6.5B in the U.S. alone

Growth driversSome of the drivers of the revenue growth are:

- Increasing customer base through retail programs, channel sales, and marketing

- Increasing wallet share (annualized average recurring revenues per recurring revenue customer) through upselling and cross-selling additional products

- Consolidation through customer, product, technology, and geographic expansion. This is why the company has been making acquisitions: Carbon6, SAP B1 SPS Integration Technology, and TIE Kinetics.

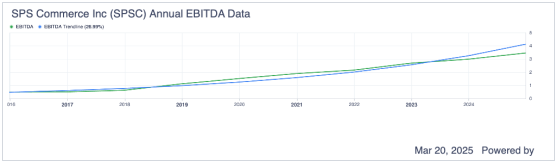

ProfitabilityUnlike other tech companies, SPS Commerce has been profitable since at least 2018, after a relatively small dip in income. Its net income margin has been stable at 12% over a 4-year period, but one major concern is that its EBITDA margin of ~29% is below the target of 35% - close to the industry average of 33.84%.

However, that's where an investor can see the first opportunity. Given the target of 35%, the company's management knows it's achievable. When that happens, the share price will follow the increase in earnings.

And with a target EBITDA growth of 15-25% annually, that does not seem far away.

As context, the change over a 10-year period is presented below for EBITDA. Trendline higher than the mentioned growth target

Customer Spending and AcquisitionAnother metric that raises concern is the 1% YoY customer growth in 2024. This is a decrease from the 6% achieved in 2023. This can mean the competition is getting ahead of the company and capturing new customers. However, another opportunity is presented here. Management has noted this and is now focusing on accelerating customer acquisition and increasing wallet share. With the last acquisitions adding products in new areas and the plan for geographical expansion, growth on those fronts can be achieved.

Also, given the company's strong balance sheet, it has the potential to initiate strategic acquisitions to expand product capabilities and market reach even further.

Balance SheetThe company has maintained a lean balance sheet with $241M in cash and cash equivalents, no long-term debt, healthy stockholders' equity of $854.7M, and total assets reaching $1031.2 in 2024.

This puts the company in a position to move quickly into areas of opportunity like acquisitions, customer expansion, developing new products, and market expansion. And, in case of economic downturns or increased competition pressure, there is more room to fight back.

Competitive Advantages

Some other points that provide a favorable outlook are- The network effect creates a defensible moat with 45,000+ recurring revenue customers. Also, the cost of changing to another supplier of these software services is high and prevents existing customers from migrating at the first problem with the software. Instead, there is an incentive to help the company improve the product.

- Relationships with 3,500 buying organizations and 2,000+ 3PLs (Purchase Lines)

- Integration with 400+ system partners (Microsoft (NASDAQ:MSFT), Intuit (NASDAQ:INTU), Oracle (NYSE:ORCL), SAP, etc.) enhances product features and makes it easy for companies that already use them to adopt these partners' services.

- The viral lead generation model through retailer change events creates efficient marketing.

- A high percentage of recurring revenue (94%) creates stability

Concerns

Integration risksWith the multiple acquisitions, the company may face difficulties integrating different teams, systems, processes, and cultures. If problems arise in this regard, product development and geographical expansion will be affected, and as a consequence, customer acquisition and wallet share expansion will slow down.Competitive EnvironmentDue to the nature of the software sector, the company is exposed to a highly competitive environment. With competitors like IBM (NYSE:IBM), Open Text Corp (NASDAQ:OTEX), E2Open, and more, any mistake the company makes can and will be used by the competitors. Also, the supply chain technology space is evolving as more workloads are moved to cloud-based operations.

Valuation ConsiderationsAnother common concern with software companies is their valuations. With premium multiples based on high growth expectations, failure to post continued growth can lead to devaluation. Macroeconomic factors can affect the whole industry.

Vulnerable marketRetail sectors might be at higher risk of being disrupted by economic factors like trade wars or recessions. This threat is a significant concern because a considerable portion of the company's customer base is small and medium-sized businesses.

Valuation

Using GuruFocus tools, investors can have an idea of the target price for the company's shares.With the following assumptions as input for a DCF model:

- A growth rate of 25% based on the company's plans going well, specifically regarding customer acquisition and wallet share expansion.

- Terminal stage growth rate of 4%, close to the US GDP growth of 3.1% (1947-2024)

- WACC of 9.69% as the discount rate

- Book Value of 22.69M (from company data)

The Free Cash Flow graph is shown below as context. The FCF growth rate for the DFCF model is 19.94%, while it has been 35.50% over the 10-year period shown on the graph. The tool also tells us that growth is achievable.

These numbers show that the company is considerably undervalued. Its potential upside is 29.13%, which can be realized quickly once other investors start looking into it.

Who is buying?

One of the gurus who is heavily investing in SPS Commerce is Ken Fisher (Trades, Portfolio), who has been consistently increasing his position, reaching 265,326 shares (0.710% of outstanding shares)If we look at the volume of guru trades, we see that almost all the trades done have been buys

About tariffs

One could argue that tariffs are a risk for the company, but I think they could actually boost adoption. Tariffs will impact supply chains worldwide; in that case, a tool like the one provided by SPS Commerce is of much help.If we look at the financials during another event disrupting supply chains, the 2019/2020 pandemic, we find no significant effects.

Moreover, this situation could raise awarness of companies like SPSC, potentially attracting investors.

Conclusion

SPS Commerce presents an attractive investment case for investors expecting high returns while being able to compromise on risk. The company has demonstrated the ability to grow revenue at ~19% while maintaining healthy profitability and strong cash flow. Based on the company's consistent financial performance, ample market opportunity, and strategy moving forward, it is well-positioned to continue growing.The primary growth concern is slowing customer acquisition, which is partially offset by the positive expansion in wallet share among existing customers. Given its multiple growth pathways and significant market opportunity, the company's expectation of ?15% revenue growth going forward appears reasonable.

The strong balance sheet with no debt and substantial cash reserves provides flexibility for strategic investments, acquisitions, and changes in direction. The company's high percentage of recurring revenue, paired with low churn, creates predictability, while the strong network effects build a defensible competitive position.

The key investment consideration would be valuation, as high-quality SaaS companies often trade at premium multiples. There might be companies with equal or more upside potential with less risk; I'm open to reading about them in the comments.

This content was originally published on Gurufocus.com