What is happening with rates and the dollar is pretty impressive, and the equity market, while down yesterday, has failed to keep up. The Fed meeting today, I think, will not be a surprise on the rate side, with the Fed hiking 75 bps. The WSJ has written a couple of pieces in the last few of days as if to send a message to the market regarding a 75 bps hike. Again, what I care about the most are the projections. Stocks will likely only focus on the rate hike because that is what they tend to do.

I think the market is set up for a post-FOMC rally no matter what the Fed says today; I hate to say it. Implied volatility for S&P 500 options is very high, with only the June meeting showing higher Implied Volatility. You can see how quickly it is expected to come down by Monday. That will likely give the market a mechanical bid and push stocks higher.

Could we rally back to 3920? Sure, we were practically there yesterday. But again, I only bring this up so that everyone knows ahead of time should this happen.

TIP Vs. QQQ

The TIP ETF made a new low yesterday, and the QQQ is still trading about 12 days behind the TIP ETF. The TIP suggests that the QQQ is also getting closer to a new low. So whether the market will rally today or not, I don’t think it will make much difference.

10-Year

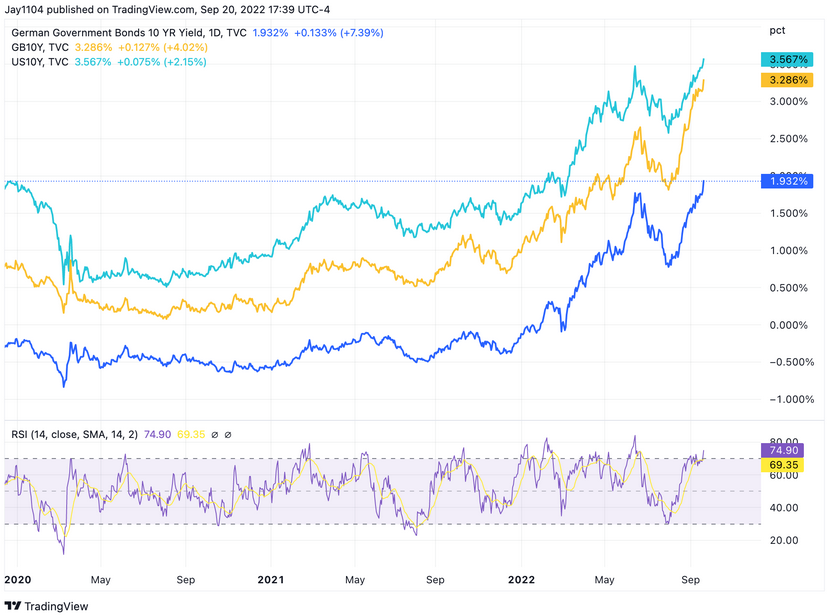

The 10-year yield made a new closing high yesterday, climbing to 3.57%. How high the 10-year goes is a good question and one I haven’t figured out yet. I have been more focused on the short end of the curve. But the break higher yesterday is an important one nonetheless.

Global

Rates aren’t just rising here; they are increasing worldwide. It is a significant fact because this will be a force that will help to drag rates up in the US. The 10-year rose by 13 bps in both Britain and Germany yesterday; both were new highs. Despite rates rising in the US quickly, they are rising even faster elsewhere.

Micron

Micron (NASDAQ:MU) finally broke support at $51.80 when it gapped below that level at the open yesterday. I think that sets up that drop to $49.70 and then probably to $46.

DoorDash

DoorDash (NYSE:DASH) is getting closer to breaking support; it needs to gap below support to get that next down leg started.