In terms of breadth, yesterday was a fairly-balanced down day, with about 270 stocks down in the S&P 500 and around 230 higher.

The index has traded chiefly sideways since it broke the smaller, inner-rising wedge pattern. However, it’s now on the verge of breaking the larger, outer rising wedge pattern, which also forms the lower trend line of the bump-and-run pattern. Regarding this rising wedge, it would only take a gap down at the open to confirm a break.

It is also present in the S&P 500 future, with a potential diamond top and a falling volume profile.

In the meantime, the 10-year Treasury rate rose by four basis points on the day, reaching 4.3%. This area is significant for rates, as a push above the 4.35% level could trigger a much larger upward move for the 10-year yield.

Additionally, the term premium for the 10-year rate continues to climb, closing at nearly 25 basis points on October 29. This indicates that some of the recent rise in U.S. rates is driven by investors seeking greater compensation.

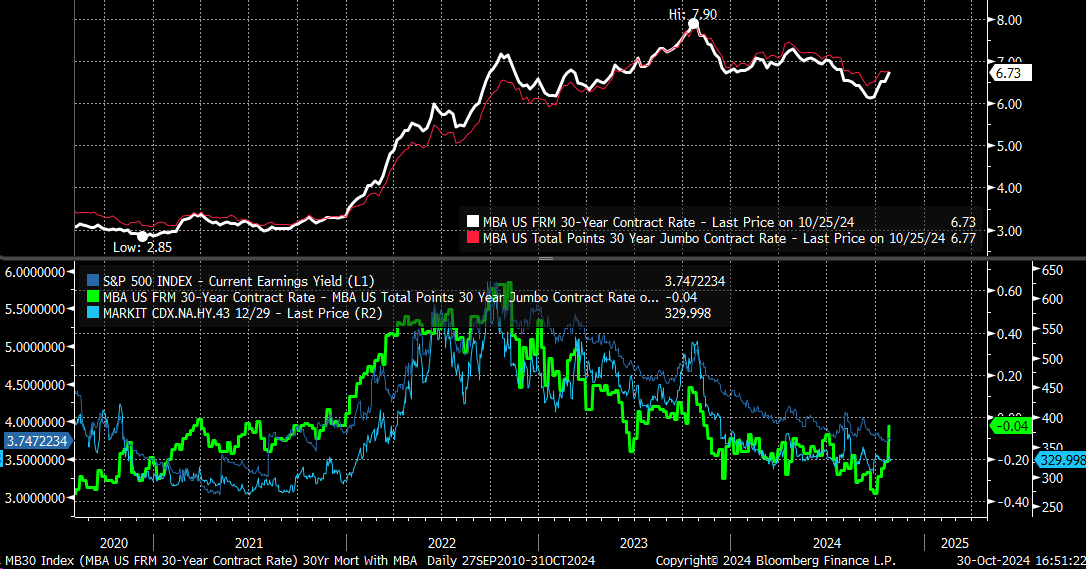

If rates continue to rise, this will impact financial conditions. Mortgage rates have been increasing, and the spread between conventional and jumbo rates has narrowed significantly over the past couple of weeks. Over the past few years, this spread has closely tracked the CDX high-yield credit spread index, which the S&P 500 earnings yield also closely follows.

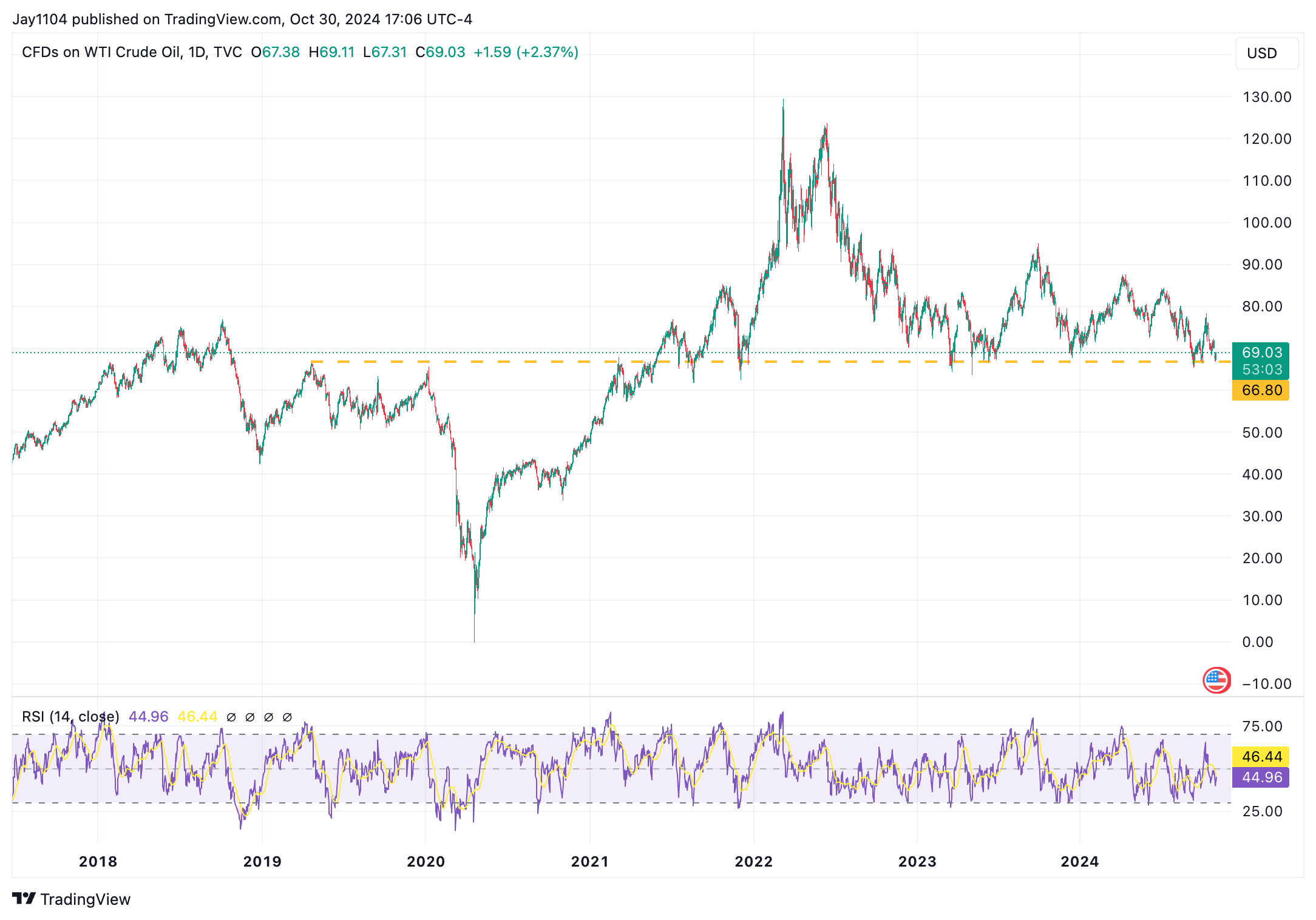

In the meantime, oil prices refuse to break below $66. Again, oil managed to bounce today after news of OPEC+ potentially delaying a December production increase. So, we continue to wait to see what happens here.

The XLE hasn’t fallen much, given where oil is trading. However, it’s nearing the bottom of its range, forming what appears to be a rising pennant originating back to November 2020. The key price level to watch on the chart is $83.50—if it falls below this level, it could lead to lower prices that reflect oil’s weakness.

Usually, when we think about rising interest rates, we expect utility stocks to decline. However, the AI boom and the anticipation of increased energy demand have likely pushed this sector higher than it might otherwise be. Interestingly, this reminds me somewhat of the EV bubble, where many new EVs were hitting the market, but questions remained about having enough energy to power them all.

In any case, the XLU’s uptrend has broken. There’s an argument for a secondary uptrend, where the XLU rests. However, the more critical level is the $78 support, which forms the potential double-top pattern.

We can see what tomorrow brings.