Stocks had a boring day; I think the last three days add to the idea that last week’s rally was driven by options market positioning, and the declining market breadth supports that idea even further. What will only further validate things if we go from being stalled out to stopping and then dropping again, just like the other rallies we have seen since the start of 2022?

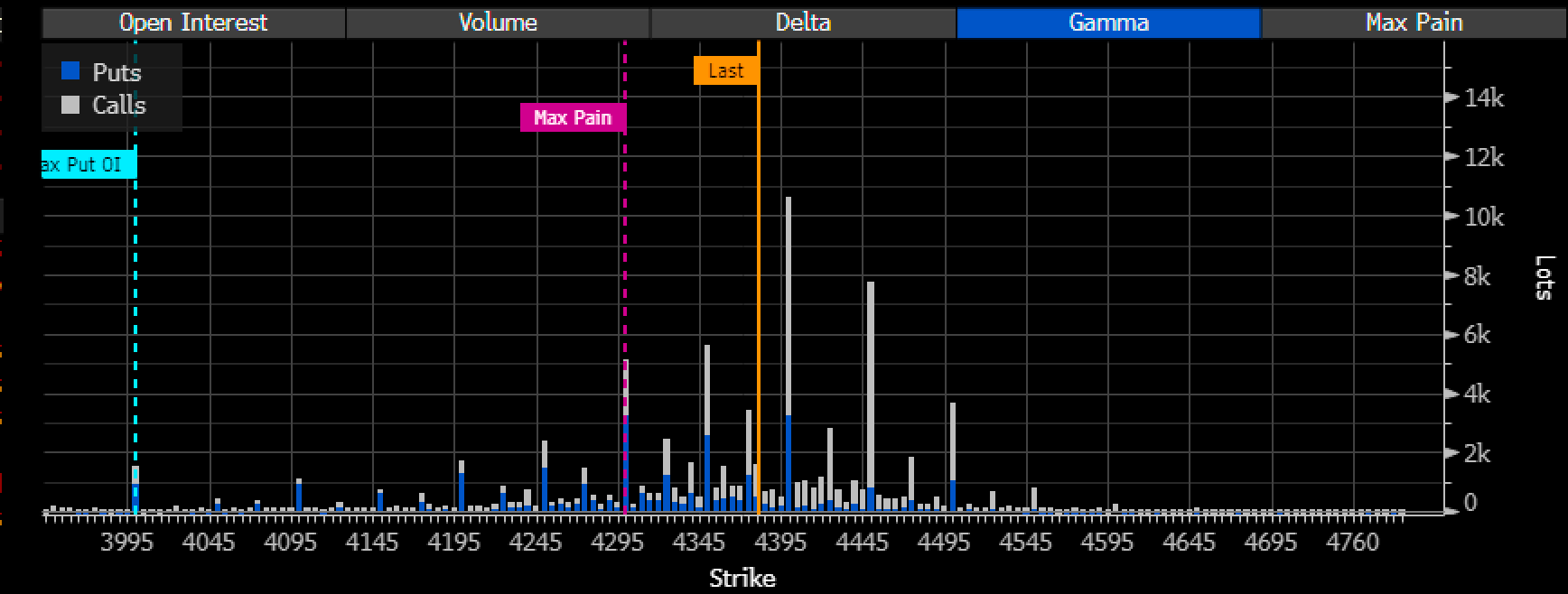

The S&P 500 has traded back to prior resistance around 4,400, the option call wall, and a resistance level from mid-October. Additionally, it marks the 61.8% retracement level from the drop that started on August 31.

This is an important level for the S&P 500 because what happens over the next few days will tell us a lot, not only about what happens over the next week, but potentially what leg we are in this market, and that could tell us where we go for some time to come.

I continue to think we will hold resistance here because we still have the call wall for November OPEX at 4,400. For the market to move higher, we need to see that call wall roll higher to 4,450 or 4,500. So far, that hasn’t happened, probably because we haven’t come close enough to it yet. Additionally, the Zero gamma levels appear to be creeping higher, and if the S&P 500 flips back into negative gamma, we will likely see implied volatility increase again, and prices fall.

10-Year Yields Fall Post Auction

The 10-year rate is now getting very close to or already has broken an uptrend and has closed below the 50-day moving average. This means that a drop below 4.45% or so could lead to a bigger drop in yields to around 4.35%, which would take us back to a big breakout level.

Yesterday’s Treasury auction for the 10-year was good enough not to be a concern, which helped to lower some rates. Today will be the 30-year note auction, and we will have Jay Powell speaking in a Q&A session.

The 10-year has fallen by around 40 bps since the Treasury refunding accountment last Wednesday morning. That, coupled with the S&P 500 rally, resulted in the Goldman Sachs (NYSE:GS) financial conditions index dropping sharply and erasing nearly a full month’s worth of gains in just a week.

You have to wonder what Powell thinks about this. It seems pretty clear that if you give the market an inch, it takes 10 yards, so it is almost as if Powell has to go back to being a bit more hawkish to avoid financial conditions easing even more.