Stocks finished the day lower by roughly 20 bps, which is not a big deal, as rates fell somewhat and the dollar rallied. Today will be a full day of trading, but then the market will be closed on Thursday, and Friday will be only a half day.

The Fed minutes yesterday revealed nothing new and pretty much was as expected, with the Fed saying they will proceed carefully while watching the impacts on financial conditions due to the rise in rates on the back of the curve.

Very little new information. The one takeaway is that the Fed still signals that rates will stay sufficiently restrictive for some time. So, rate cuts aren’t in the equation at this point, and the market continues to get ahead of itself on this front, but that has been the case since July 2022.

It was an inside day for the S&P 500 trading within yesterday’s candle. This generally can be a sign of exhaustion for the buyers. Does it have to be? No, but generally, it would indicate that the market trades lower today.

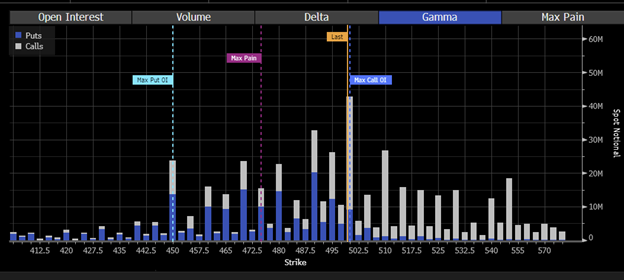

From what I have read, the CTAs are done buying, which means this drive higher in the stock market could be just about over. I base this on the fact that I know what triggered the rally was a very large negative gamma position built up in the S&P 500 into the last week of October.

The initial gamma squeeze pushed stocks higher, which triggered CTAs to flip from sellers to buyers. This buying pressure should abate now if CTAs are done, and we should now see the move higher stall out.

I still think the rally is a 3-wave retracement of the move down from the July highs. That answer won’t come until we see a pullback and if the pullback starts subdividing into a 5-wave impulse, similar to what was seen in July. That means the high of 4,550 can not be surpassed.

Nvidia Reports Better Than Expected Results

Also, after the close, Nvidia (NASDAQ:NVDA) reported strong results that came in much better than expected, with guidance that exceeded expectations.

Still, the stock traded lower, and I had noted over the weekend why that might happen, given the positioning in the options market.

The IV heading into the results was right around 100%, and that is likely going to fall today, which means calls above $500 could quickly begin to lose value and the stock trades lower as market makers find themselves over hedged, and that will bring plenty of stock for sale.

Additionally, I think the stock has stalled out from a fundamental standpoint since July around $500 because the market is trying to figure out just how long Nvidia can put up numbers like this. Anyone who invests in Biotech knows that the biggest part of growth comes before the launch of a new drug, and once that new drug hits the market, the clock is on for peak revenue and then, of course, the loss of exclusivity.

In 2015, I owned Gilead (NASDAQ:GILD); the growth in their Hepatitis drug was amazing, but even with the company posting better and better results, the stock never went up. The reason was that the market knew Gilead was first to market, but it also knew others were coming. I think some of that is happening with Nvidia presently.

Finally, the big hit in revenue from China will be a big concern going forward as well, which adds downward weight.