This week, the PPI, CPI, and Retail Sales data will be significant. This follows a strong December job report. The household survey was also robust, showing that nearly 478,000 people found jobs while the number of unemployed individuals decreased by 235,000.

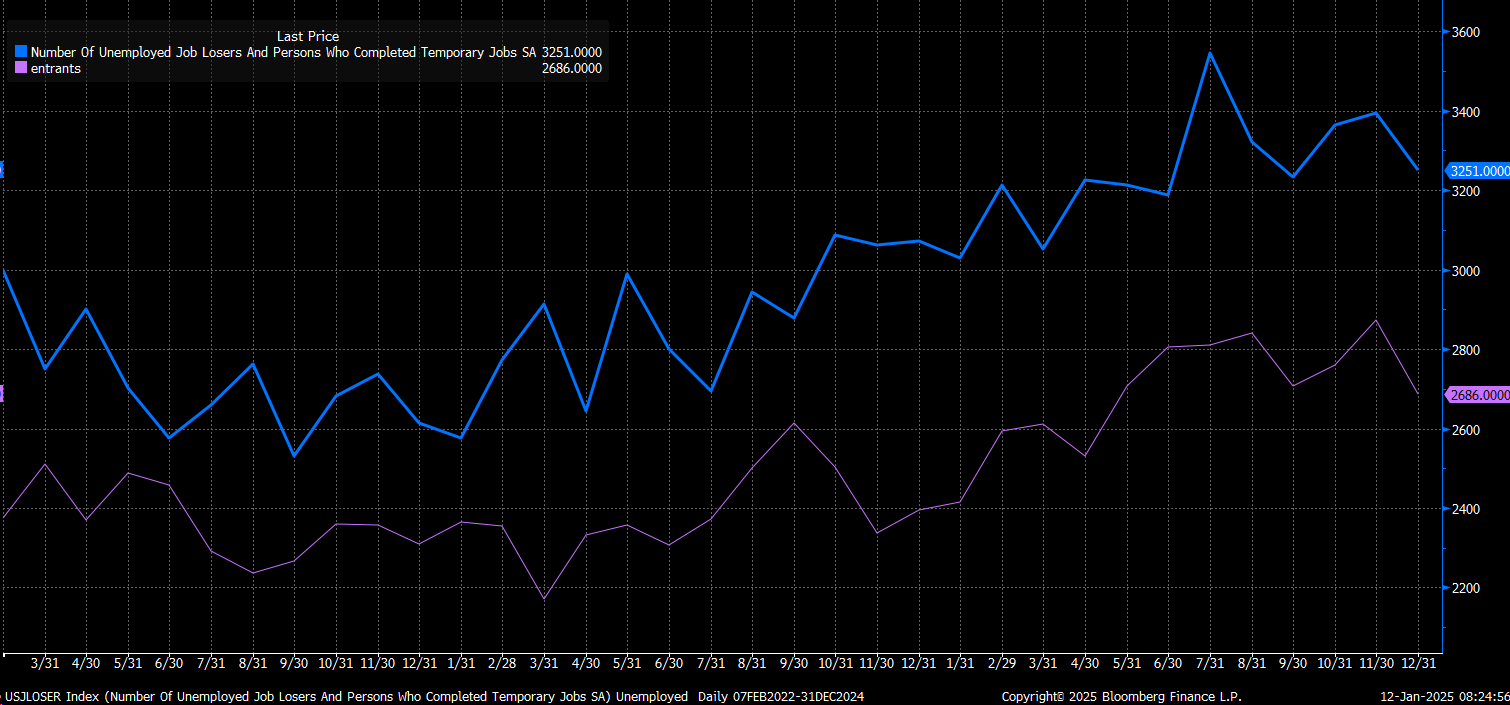

In context, there were 7.1 million unemployed individuals in November, compared to 6.88 million in December—a substantial drop. A closer look shows that the number of people who lost jobs declined from 3.394 million in November to 3.251 million in December. Additionally, new entrants to the labor force decreased from 2.87 million to 2.686 million, contributing to the unemployment rate’s decline.

The report also included notable revisions. For instance, the July unemployment rate was adjusted from 4.3% to 4.2%, while March saw an upward revision from 3.8% to 3.9%. These revisions are critical as they redefine the series’ high points. Significant revisions are expected in January, particularly for the household survey, which will make comparing previous reports difficult. Changes to the establishment survey are also planned for January, which may complicate future data interpretation.

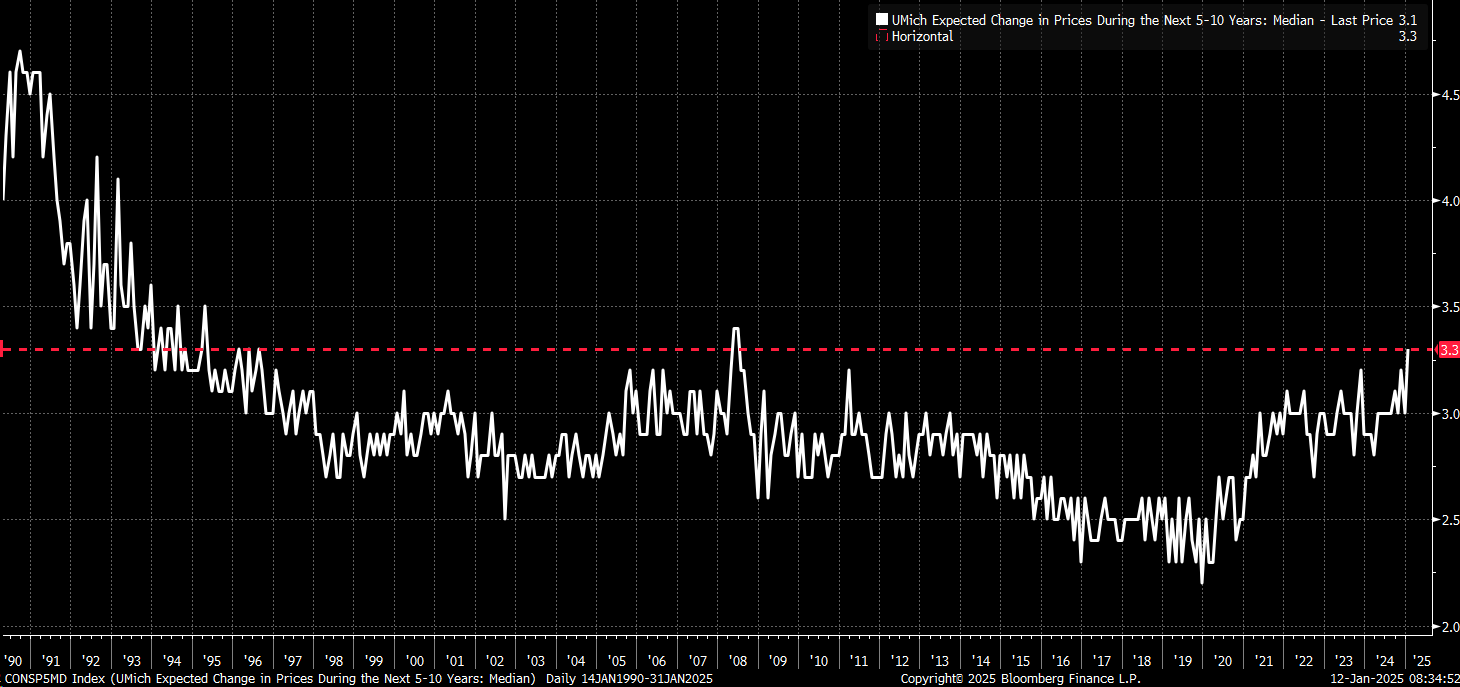

Friday’s University of Michigan inflation data shows year-ahead inflation expectations rose from 2.8% in November to 3.3% in December, and the five-to-ten-year outlook increased from 3.0% to 3.3%—a series high. This is the highest level since 2008, signaling persistent inflation concerns despite the Fed’s aggressive rate hikes. Preliminary data can be volatile, so revisions at the end of the month will be crucial.

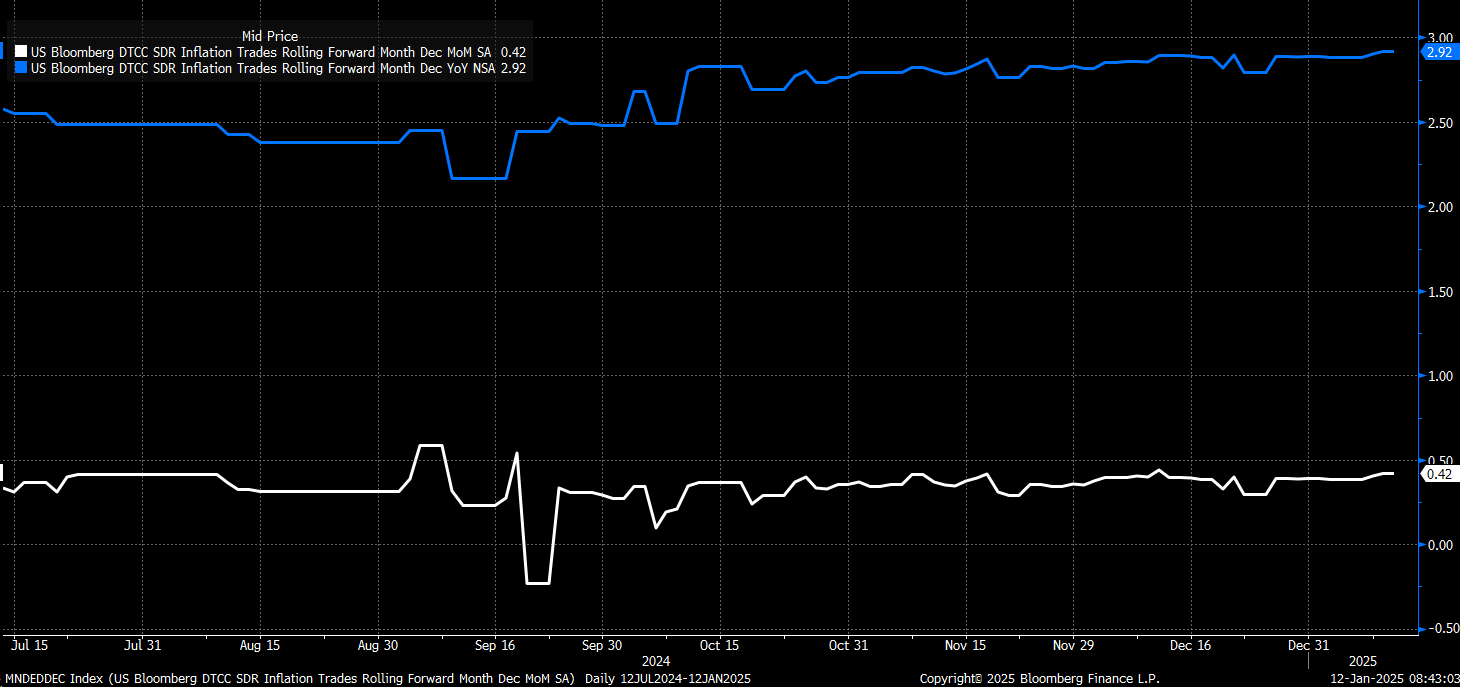

This week brings a wealth of key data. On January 14th, the NFIB survey will provide additional insights into inflation. On the same day, the PPI report is expected to show a 0.4% month-over-month increase, with core PPI rising 0.3% from 0.2%. On Wednesday, CPI is expected to rise 0.3% month-over-month, with year-over-year core CPI projected at 2.9%, up from 2.7%. CPI swaps suggest the headline figure may come in hotter than expected.

Retail sales are forecast to decline by 0.6% on January 16th, while the control group will remain flat at 0.4%. That day, import prices and initial jobless claims will also be released, followed by housing starts data on Friday.

Regarding Fed activity, notable speakers include Williams on January 14th and 15th, Kashkari and Barkin on the 15th, and Goolsbee, who will speak before the Fed enters its blackout period starting January 18th.

After the jobs report, markets are signaling fewer rate cuts in 2025, with the first expected around September or October. The odds of a second-rate cut are only about 13%. Forward rates suggest 3-month Treasury yields could rise by 15–20 basis points in the next 12–18 months, implying a potential rate hike if economic data remains strong and inflation persists.

The steepening yield curve supports this outlook, with the 10-year yield rising to 4.76% and the 30-year at 4.95%. The spread between the 10-year and 2-year Treasuries has widened to 40 basis points, while the 30-year minus 3-month spread reached 61 basis points. A further breakout could lead to significant steepening.

In currency markets, the dollar index (DXY) is nearing resistance at 109.60, with the potential to reach 111.

The euro is holding at 1.02–1.03, but a break below 1.02 could push it under parity.

The yen remains weak; barring unexpected action from the Bank of Japan, the USD/JPY could run to 165.

For the S&P 500, last week’s close around 5,825 broke key support at 5,875. If downside momentum continues, we could see the index drop to the mid-5600s. Options market dynamics will play a significant role, with the put wall at 5,800 and the negative gamma flip zone at 5,930. Expect elevated implied volatility heading into the CPI report, with the potential for a volatility crush afterward.

***

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.